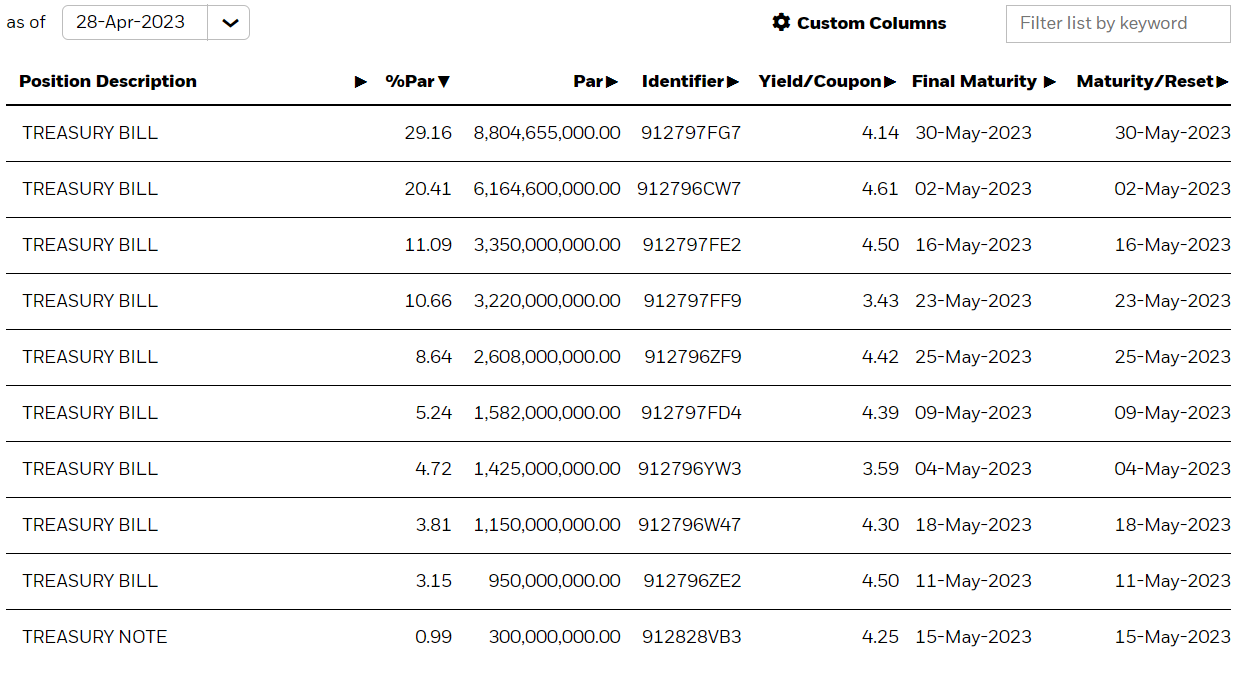

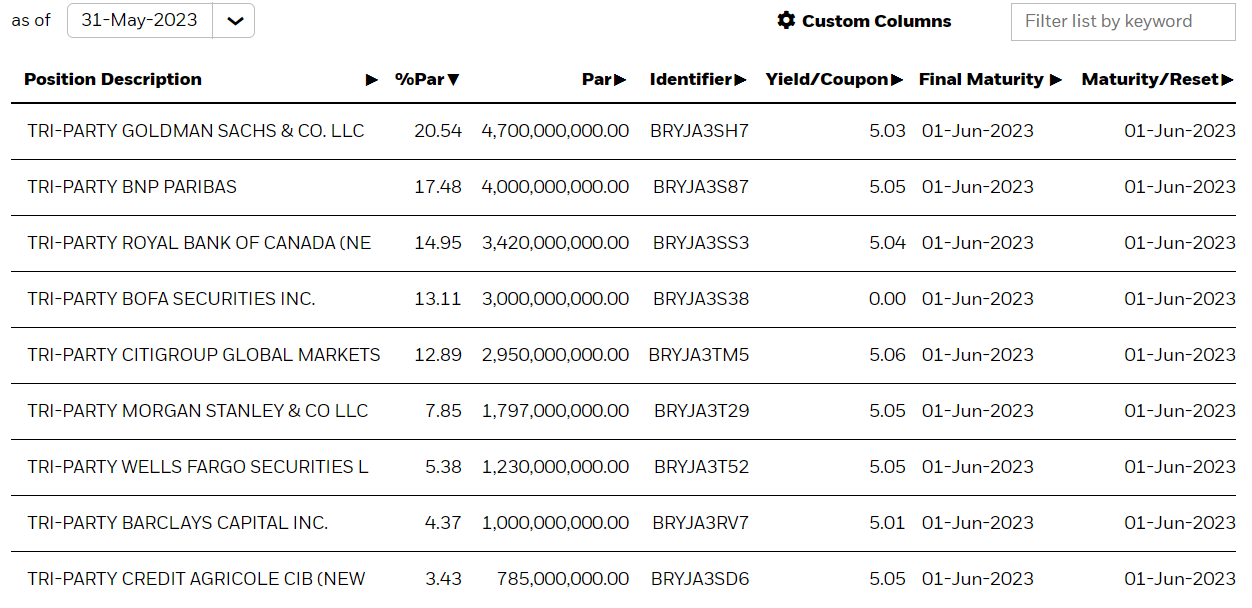

The end of May marked an interesting development in the stablecoin market – the reserves of the second largest stablecoin issuer that had been partially invested in U.S. Treasury bills (T-bills) and notes, were flipped to repurchase agreements with commercial banks.

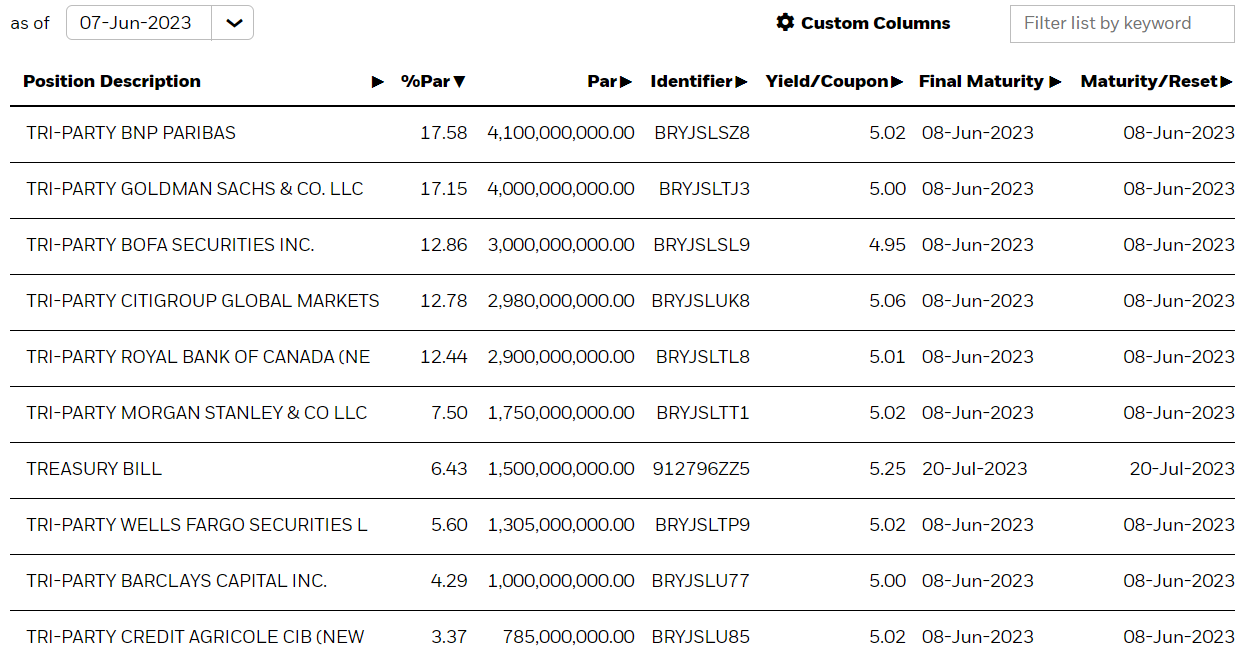

Tri-party positions with commercial banks represent overnight repurchase agreements where the fund basically borrows cash against its T-bill holdings, supposedly to weather a possible liquidity crunch. While normally U.S. Treasury bills and notes are easily converted to cash, the turbulence caused by the rumors of a U.S. default on its debt could undermine their liquidity.

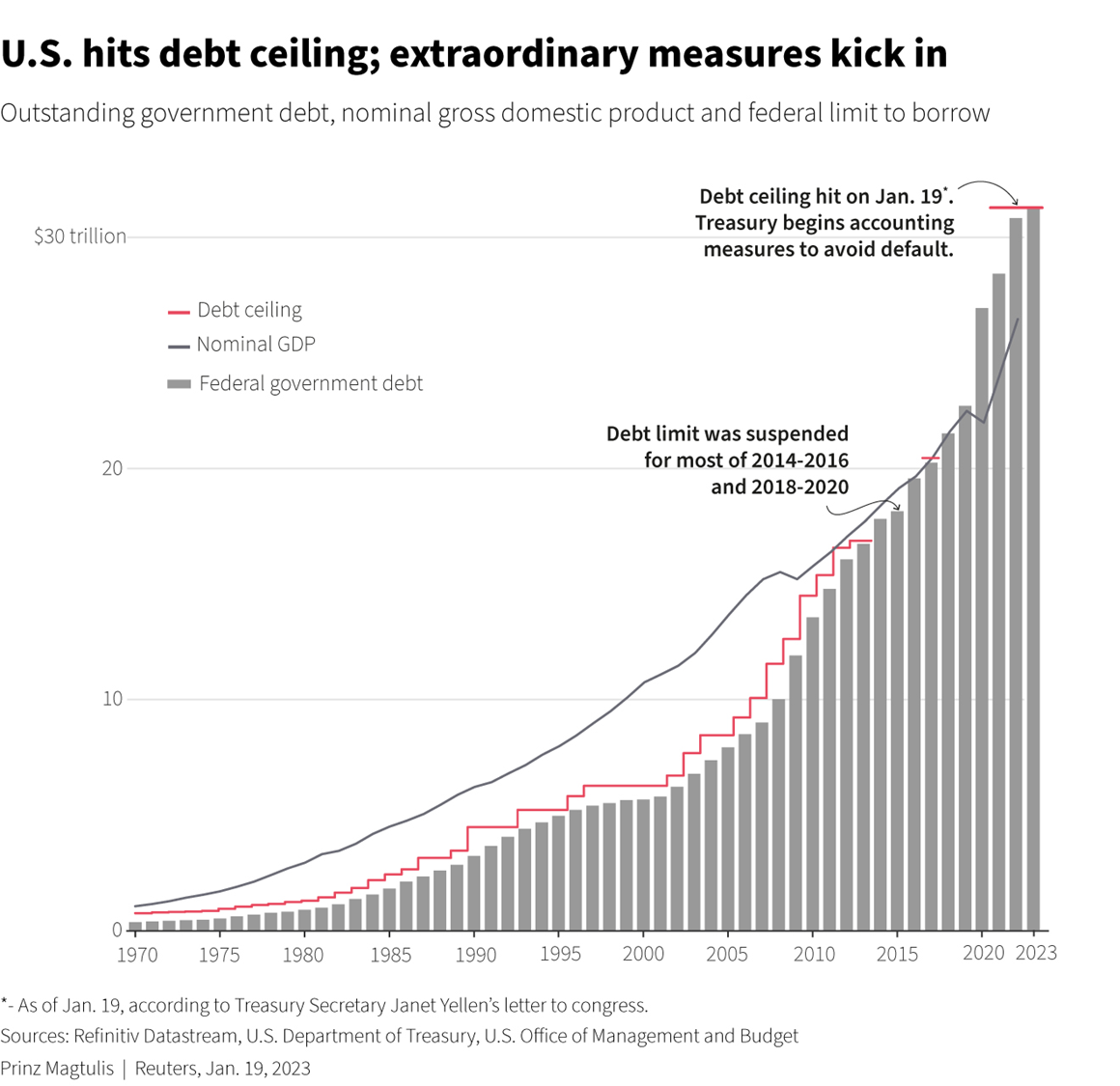

At the beginning of June the U.S. Government was on a brink of a technical default, whereby the government was running out of funds but could not borrow any more because of the 'debt ceiling'. The law allowing the government to borrow under a certain cap without Congressional approval was first introduced in 1917. Since the parabolic rise of U.S. debt started in the 1990s, there are regular debt ceiling debates regarding the over-indebtedness of the U.S. economy.

Despite all the political disputes, the U.S. debt ceiling had always been raised (or temporarily suspended) and this 2023 crisis was no different. The ceiling was suspended until January 1, 2025.

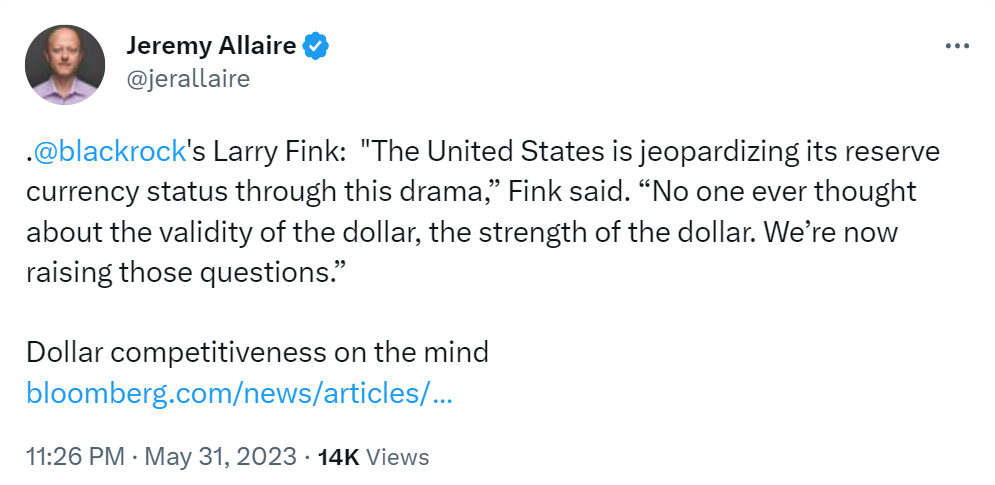

Blackrock's CEO Larry Fink and Circle's CEO Jeremy Allaire had publicly expressed their concerns about U.S. monetary policies.

Nevertheless, following the suspension, Blackrock has invested some of the Circle's reserves (6.43% at the time of writing) back into Treasury bills.

After the distress caused by the collapse of Silicon Valley Bank (SVB), where Circle was keeping most of its cash reserves, the company is now being extra cautious with its placements, yet it looks like the options for maneuver are limited.

According to the fund prospectus, 'Circle Reserve Fund invests at least 99.5% of its total assets in cash, U.S. Treasury bills, notes and other obligations issued or guaranteed as to principal and interest by the U.S. Treasury, and repurchase agreements secured by such obligations or cash.'

On May 10, prior to the hot phase of the U.S. debt ceiling debate, Jeremy Allaire told Politico that Circle would not keep Treasury bills to limit exposure to a potential U.S. default. It will be interesting to Observe where else a USD-denominated stablecoin issuer can invest its reserves.