FED is trying to stifle high inflation by rising interest rate and - surprisingly - by provoking unemployment as fears of recession escalate. The crisis could expand around the globe and lead to a contraction in the world’s economy.

The inflation rate in the US is currently around 8%, which is the highest level in four decades. The Fed has pursued a policy of aggressive rate hikes to stifle inflation but hasn’t reached the desired result (2-3%). Consumer-price index’s rise slowed slightly - 8.2% year on year compared to 8.5% in March - but the core index, which measures changes in the price of goods and services, excluding volatile food and energy categories, saw the most significant increases since 1982 in September this year (6.6% annually).

To combat inflation the Fed has hiked the federal funds rate five times this year to its highest level since 2008. According to the majority of economists polled by Reuters, we can expect another interest rate hike by 75 basis\ points to 3.75%-4.00% on Nov. 2. Also, the report shows that the majority of economists expect that by the end of 2022 the rate will have reached 4.25%-4.50%

The Fed Chair Jerome Powel declared that “reducing inflation is likely to require a sustained period of below-trend growth, and there will very likely be some softening of labour market conditions” adding that “higher interest rates, slower growth, and a softening labour market are all painful for the public that we serve. But they’re not as painful as failing to restore price stability”.

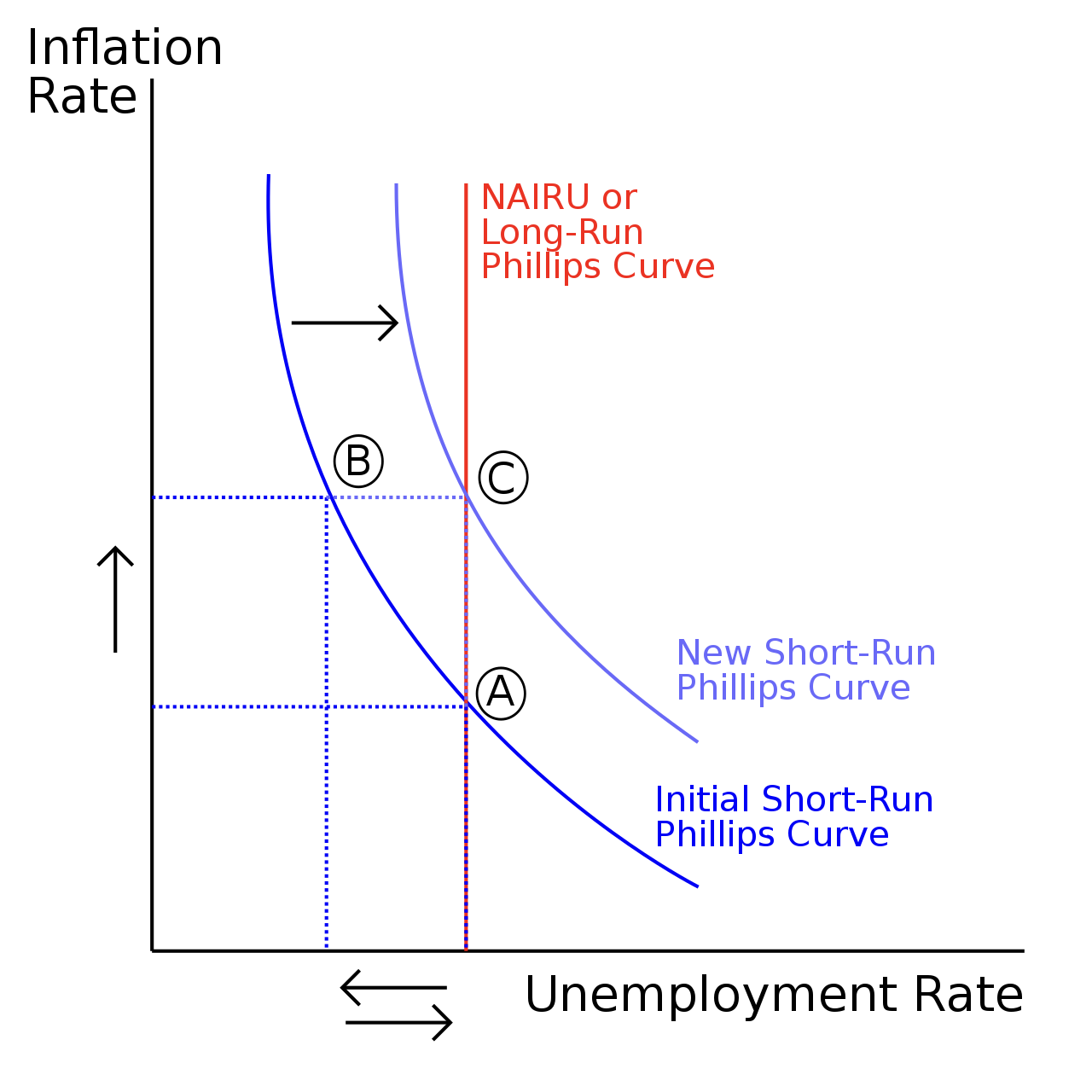

Indeed, according to the Phillips Curve, in the short run, there is a trade-off between unemployment and inflation. A weaker labour market and lower wages can help bring down inflation. However, this correlation has not been observed in the long run.

Former Treasury Secretary Larry Summers said that unemployment needs to reach 6% to tame inflation. This is a huge rise taking into account that currently the unemployment rate has been falling in recent months and now it is at 3.5%.

Not only is labour market in danger. When interest rates rise, the stock market tends to fall in value as companies and investors become less willing to borrow money at higher interest rates.

Fears of higher borrowing costs and the stock-market crash as well as of layoffs and a decline in wages cause concern among people and experts and trigger talks of an economic recession. The National Association for Business Economics recent report showed that U.S. economy has “a more-than-even likelihood” of entering a recession within a year or may already be in a recession. Slowing sales and shrinking profit margins indicate a continued slowing of the U.S. economy.

Although the U.S. economy grew at a 2.6% annual rate from July through September, the chronic weakening of consumer and business spending which is the result of the Fed policy, will definitely harm U.S. economy even if the country avoids recession.

Today, the U.S. dollar is an integral part of the world economy and its influence on other countries’ economies is incredibly strong. That’s why the Fed policy can also cause trouble around the globe. Higher interest rate and a strengthening dollar are weakening the currencies of developing nations, making their debt dangerously heavy. Not only third-world countries can suffer from this: experts say that a U.S. recession can hit Japanese exports and is the main risk for the whole Japanese economy as it hastens the yen's sharp decline. At the same time, developed countries face similar troubles as the U.S.: for example, U.K. inflation has soared to a 40-year high at 10.1%. The IMF expects global growth to fall from 6% in 2021 to 3.2% this year and 2.7% in 2023 and the World Bank warned that there is a “real danger” of a global contraction or even global recession next year.