Following the U.K. Treasury’s assignment of responsibility for regulating stablecoins last week, both the Financial Conduct Authority (FCA) and the Bank of England (BofE) have published documents adding further details to the proposed regulatory regime.

FCA takes main regulatory role

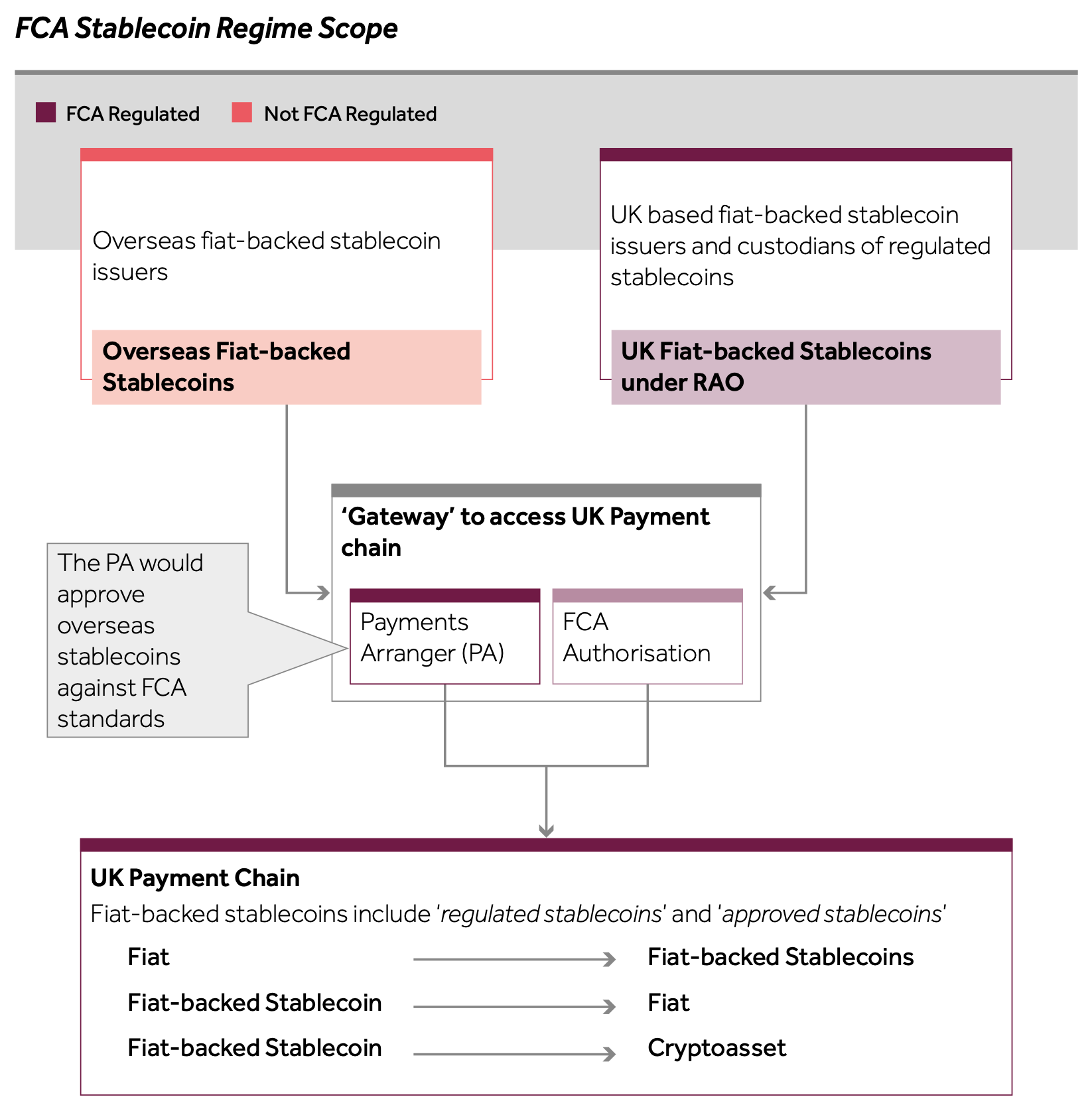

As the primary regulator, the FCA will be responsible for covering the issuance, custody, and payment use of fiat-backed stablecoins in the United Kingdom. On Monday it published a discussion paper outlining its current thinking in more detail, and asking for comments by 6 Feb, 2024.

The activities of issuance and custody will fall under the Regulated Activities Order (RAO), part of the Financial Services and Markets Act 2000, meaning that firms will need to be authorized by and adhere to FCA rules.

In contrast to the preliminary outline laid out by the Treasury, which stated that regulated stablecoins must be partially or fully backed, the FCA suggests that issuers must maintain a reserve of backing assets equivalent to the full value of the stablecoin in circulation.

This must consist of assets that are “low-risk, secure and sufficiently liquid,” and should be segregated from the firm's own assets, and potentially held in a statutory trust. Any excess or shortfall (due to fluctuations in the value of the underlying assets) should be rectified within one business day.

The proposed regulations also cover aspects such as the right to redemption (at par) on request, auditing and reporting. Regarding custody, the FCA proposes a similar structure to existing non-crypto custody asset services, with additional consideration of DLT-specific risks.

In the case of crypto exchanges that offer custody-like services as part of their overall product, strict rules would be implemented regarding what the exchange is allowed to do with client assets. This is with particular reference to the issues faced by customers of FTX, whose assets were freely used to support the ailing sister company Alameda Research.

The use of stablecoins within payment chains would be covered in an expanded version of the Payment Services Regulations 2017 (PSR). These would be modified to include both hybrid (stablecoin to fiat and vice versa) and pure stablecoin payment options.

“This would give consumers using stablecoins for payments the same rights as current users of regulated payment services, [including] how the consumer can communicate with the PSP if they have any questions about the service [and] where a transaction is executed defectively or is unauthorised… complaints-handling requirements.”

As mentioned in the Treasury’s communication last week, foreign-issued stablecoins would potentially be dealt with by having FCA approved payment facilitators, who would assume the responsibility of ensuring that these ‘overseas’ stablecoins met the FCA standards.

BofE is co-regulator for systemic stablecoins

The Bank of England’s discussion paper (also published on Monday) was focussed on GBP-denominated stablecoins used in systemic payment systems. These will not only be subject to FCA regulations, but potentially also to additional requirements imposed by the BofE.

The overarching aim of the BofE is to “maintain confidence in money and payments [as] this is core to preserving financial stability.”

Its discussion paper had significant overlap with the FCA proposals, including that stablecoins should be fully backed by suitable assets.

However, it also included additional suggestions, such as requirements for wallet providers, know your customer (KYC) and anti-money laundering (AML) processes, and stressed the importance of maintaining the difference between multiple forms of digital money, particularly by deposit-taking institutions.

The BofE timeline also expected responses in the first half of 2024, with a finalized proposal being put forward in the second half of 2024, and the eventual implementation of the new regime in 2025.