Ethereum’s ETH has spent the first two weeks of July firmly in the green, surging toward the $3,600 mark. The rally has renewed optimism among investors, hinting at a possible trend reversal after nearly three years of relatively subdued performance and sideways trading.

While Bitcoin and meme-driven tokens captured headlines with dramatic rallies in recent market cycles, ETH consistently lagged behind, unable to reclaim its previous all-time highs. The current rally, however, is accompanied by a notable shift in sentiment and positioning around Ethereum’s evolving role in the next phase of the crypto economy.

From 2021 to early 2024, Bitcoin captured most of the speculative spotlight—driven by institutional adoption, growing ETF narratives, and a favorable shift in U.S. leadership. Meanwhile, retail-fueled meme coins like DOGE, SHIB, and PEPE thrived, as did crypto initiatives linked to the same political circles. Notably, Trump family-backed meme coin projects gained traction, often launching on faster, retail-friendly chains like Solana—networks that may have benefited from behind-the-scenes alignment with those promoting the initiatives.

In contrast, Ethereum—with its rigorous roadmaps and focus on long-term scalability—seemed too “slow” or “academic” for a market obsessed with quick gains. Its leadership, particularly Vitalik Buterin and the Ethereum Foundation (EF), has consistently prioritized protocol robustness, decentralization, and research over price speculation. Unlike other L1s that aggressively market token performance, Ethereum’s development culture remains deeply academic and consensus-driven. While this has earned the respect of developers and technologists, it hasn’t always translated into short-term investor excitement.

Additionally, Ethereum’s transition to Proof-of-Stake (The Merge) and subsequent upgrades such as EIP-1559 and withdrawals created uncertainty around staking behavior and fee models, keeping some investors on the sidelines.

It's Ethereum Season

That dynamic has clearly shifted in recent months. A report titled “The Bull Case for ETH,” published by Ethereum-focused startup Etherealize, argued that ETH may be one of the most mispriced assets in the digital economy—referring to it as “digital oil.” The report emphasizes Ethereum’s role as the compute engine of Web3, drawing parallels to oil as the critical fuel of the industrial age.

Even Ethereum's typically reserved leadership circle has started to embrace more assertive, bullish narratives. In a recent post, EF contributor Josh Chaskin (@chaskin.eth) declared that “most alt-L1s will become L2s,” pointing to Celo’s transition as a model. He noted its reduced inflation, faster block times, streamlined codebase, and integration with Ethereum’s vast developer ecosystem.

Vitalik Buterin offered a more measured response to it. He encouraged developers to better utilize Ethereum’s L1 strengths—like security, censorship resistance, and data availability—while keeping L2s as minimal and efficient as possible, serving mainly as sequencers and provers. Still, the tone marks a notable shift from his earlier posture of neutrality; Buterin is now more openly framing Ethereum as the foundational layer others should build on.

Former BitMEX CEO Arthur Hayes recently stated that "It's $ETH szn" citing structural tailwinds for ETH over BTC. Hayes argues that Ethereum's modular scaling architecture, vibrant DeFi and NFT ecosystems, and maturing staking dynamics position it as the most exciting asset for the coming cycle. His endorsement echoed across crypto media and gave Ethereum bulls fresh ammunition.

Network fundamentals back the bullish case. Ethereum’s base fees are rising again, reflecting growing on-chain activity. The staking ratio has surpassed 27%, reducing liquid supply. Thanks to EIP-1559, ETH remains deflationary in periods of high usage. These elements combine to create structural upward pressure on price—especially during periods of app-layer resurgence.

On the trading screens, Ethereum is flashing bullish signals across the board. Open interest in futures markets is climbing, and a rising funding rate suggests traders are using leverage to bet on further gains. Options markets reinforce this sentiment. Data from Deribit shows that the largest open interest for ETH options expiring August 30 sits at the $4,000 strike price. The optimism doesn’t stop there: September expiries are piling up around $4,400, and December calls are clustered at $5,000 and beyond. This upward progression in strike prices indicates a growing market expectation that Ethereum’s rally still has significant room to run.

Spot volumes have also increased, while the ETH/BTC ratio has begun to rebound—an early sign of rotation out of Bitcoin and into Ethereum. Technical analysts point to a decisive breakout above multi-year resistance levels, supported by strong momentum on higher time frames.

Ethereum’s appeal is not just philosophical or technical—it’s also financial. In recent months, several corporates have added ETH to their balance sheets. Most notably, SharpLink Gaming has emerged as the world's largest corporate holder of Ethereum, holding over 307,000 ETH, valued at over $1 billion, as of mid-July.

Following a similar playbook, Bitmine Immersion Technologies has also pivoted toward an aggressive Ethereum-focused strategy. In June, the company announced a $250 million private placement to fund a dedicated ETH treasury, and as of July 17, 2025, Bitmine publicly announced it held over 300,657 ETH, valued at approximately $1 billion. This positions both companies as among the largest corporate holders of Ethereum to date.

The move gained even more attention when tech billionaire and Palantir co-founder Peter Thiel disclosed a 9.1% stake in Bitmine, becoming its largest shareholder. Thiel, historically a Bitcoin supporter, is now indirectly backing a company that has publicly committed to Ethereum as a core balance sheet asset. Bitmine also brought Fundstrat’s Thomas Lee onto its board, signaling a strategic institutional approach to ETH accumulation.

While not on the scale of Bitcoin’s corporate treasuries, this growing trend mirrors MicroStrategy’s Bitcoin playbook, but with Ethereum at the center.

Ethereum For Stablecoins

Beyond a shift in market sentiment and positioning, Ethereum’s resurgence is also supported by a powerful fundamental driver: the maturing role of stablecoins. Once pitched as crypto’s “killer app,” stablecoins have now received both utility validation and growing regulatory support. Former President Donald Trump’s executive order explicitly banned digital dollar development, and the recently passed “Genius Act” formalized stablecoins as the U.S. government's preferred path for regulated digital cash—cementing their central role in the evolving financial system.

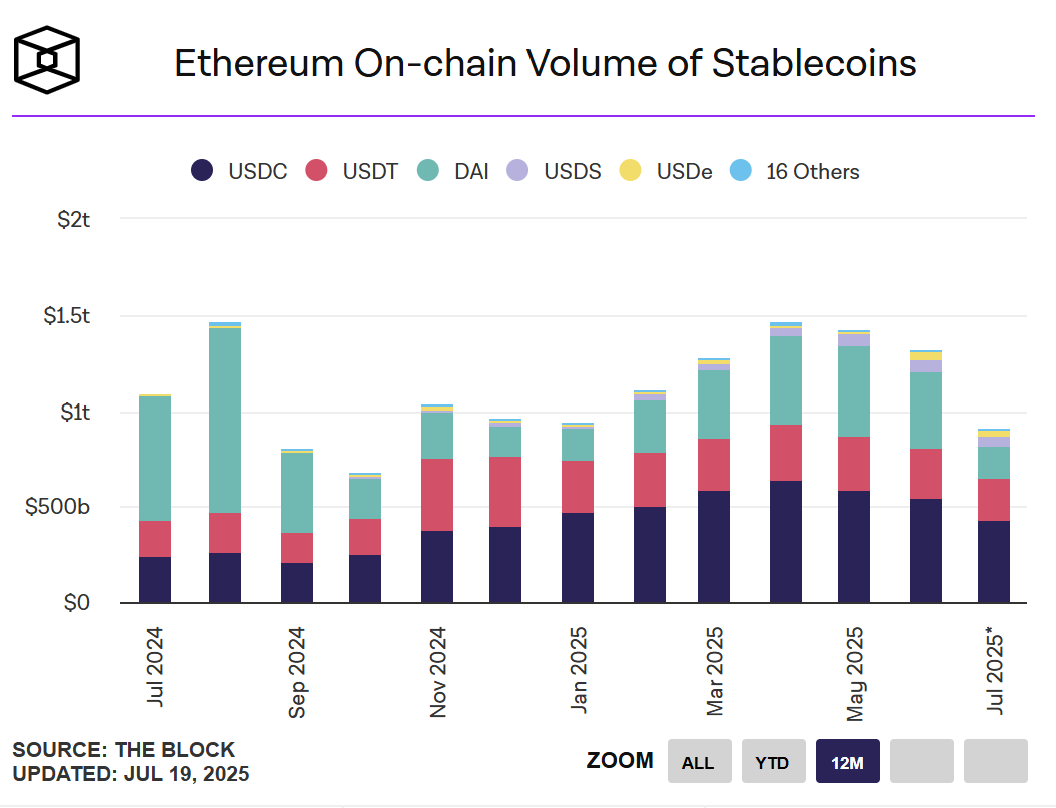

Ethereum, as the dominant smart contract platform, was the original home of stablecoins, supporting the early rise of USDT, USDC, and DAI. But during periods of high gas fees, stablecoin activity migrated to cheaper chains—Tron, for example, captured a significant share of USDT volume. As the true economic potential of stablecoins became clear, a new competition emerged: blockchains like TON, Base, BNB Chain, and Solana began fighting to attract stablecoin traffic through lower fees and targeted incentives.

Ethereum has started to win that battle back. After the implementation of EIP-4844, which drastically reduced transaction costs, stablecoins began returning to the network. Today, Ethereum is the #1 platform for USDC and almost equally large for USDT by volume. The third largest stablecoin by market cap and relatively new entrant to the space, Ethena stablecoin is virtually fully on Ethereum. The fourth-largest stablecoin by market cap and the only decentralized major one, DAI—remains over 60% deployed on Ethereum, anchoring the network’s position in decentralized finance.

Stablecoin monthly transaction volume on Ethereum currently reaches over $1.5 trillion, which is five times larger than native ETH transfers on Ethereum, and arguably accounts for over 75% of total monthly on-chain transaction volume when considering on-chain activity.

Analysts project that stablecoin adoption could grow by 5-10x in the coming years, driven by increasing institutional interest, cross-border payments, and DeFi integrations. This expansion is poised to potentially drive Ethereum's overall transaction volumes and fee revenue multiples higher in the coming cycle, solidifying its role as the dominant settlement layer for digital dollars.

Ethereum’s resurgence is no longer just a technical narrative—it’s starting to show up in price, positioning, and real-world adoption. Whether this wave will carry ETH into a new cycle of dominance remains to be seen. But the foundation is shifting, and the signals are getting stronger. As new developments unfold—from stablecoin infrastructure to corporate treasury moves—we’ll continue tracking what matters most. Expect more deep dives ahead as Ethereum’s next chapter takes shape.