The Ethereum Foundation (EF) is entering a period of meaningful change. After outlining internal restructuring and reaffirming its focus on building a more scalable Layer 1, the foundation has now introduced a new treasury policy that reflects its evolving role in the ecosystem.

EF has long been accused of sitting on its capital rather than using it to engage with the tools and protocols built on Ethereum. Despite promoting the promise of decentralized finance, the foundation rarely interacted with the DeFi ecosystem it helped to foster. That disconnect didn’t go unnoticed. Some critics went as far as to say EF existed mainly to sell ETH. But the latest announcements suggest a shift in thinking.

From Cypherpunk to Defipunk

Going forward, EF’s capital deployment will be shaped by what it calls “Defipunk” principles—a modern version of cypherpunk values. These include privacy, financial autonomy, open-source development, security, and the use of cryptography to defend civil liberties.

Projects that want EF’s support will need to reflect these ideals. Internally, these principles will guide how the foundation evaluates both existing protocols and new proposals.

EF also admits that the Ethereum space, once openly experimental and rebellious, has slowly moved toward more cautious and centralized models. As more traditional players get involved, they quietly start to restrict what is possible in the space. The foundation believes it’s time to push back. That means rejecting systems that include backdoors, admin keys, or other centralized levers, and advocating for tech that is truly permissionless.

Privacy is one of the areas EF sees as most neglected. It notes that while privacy tends to benefit from network effects, it still hasn’t seen the kind of investment or attention it deserves. The foundation plans to support younger DeFi protocols working on privacy features and will also encourage mature projects to move closer to Defipunk ideals. Research into decentralized front ends and user interfaces is also on the list.

Financial Strategy and Reporting

For the first time, EF has offered a clearer strategy for managing its sizable treasury, estimated at around $1 billion, mostly held in ETH.

Before, it largely relied on selling ETH when needed to fund operations, which often led to poor timing and unpredictable spending. In 2022, the EF treasury was worth about $1.6 billion. By late 2024, it had dropped to just under $1 billion—mainly due to declining ETH prices and over $240 million in ecosystem spending during those two years.

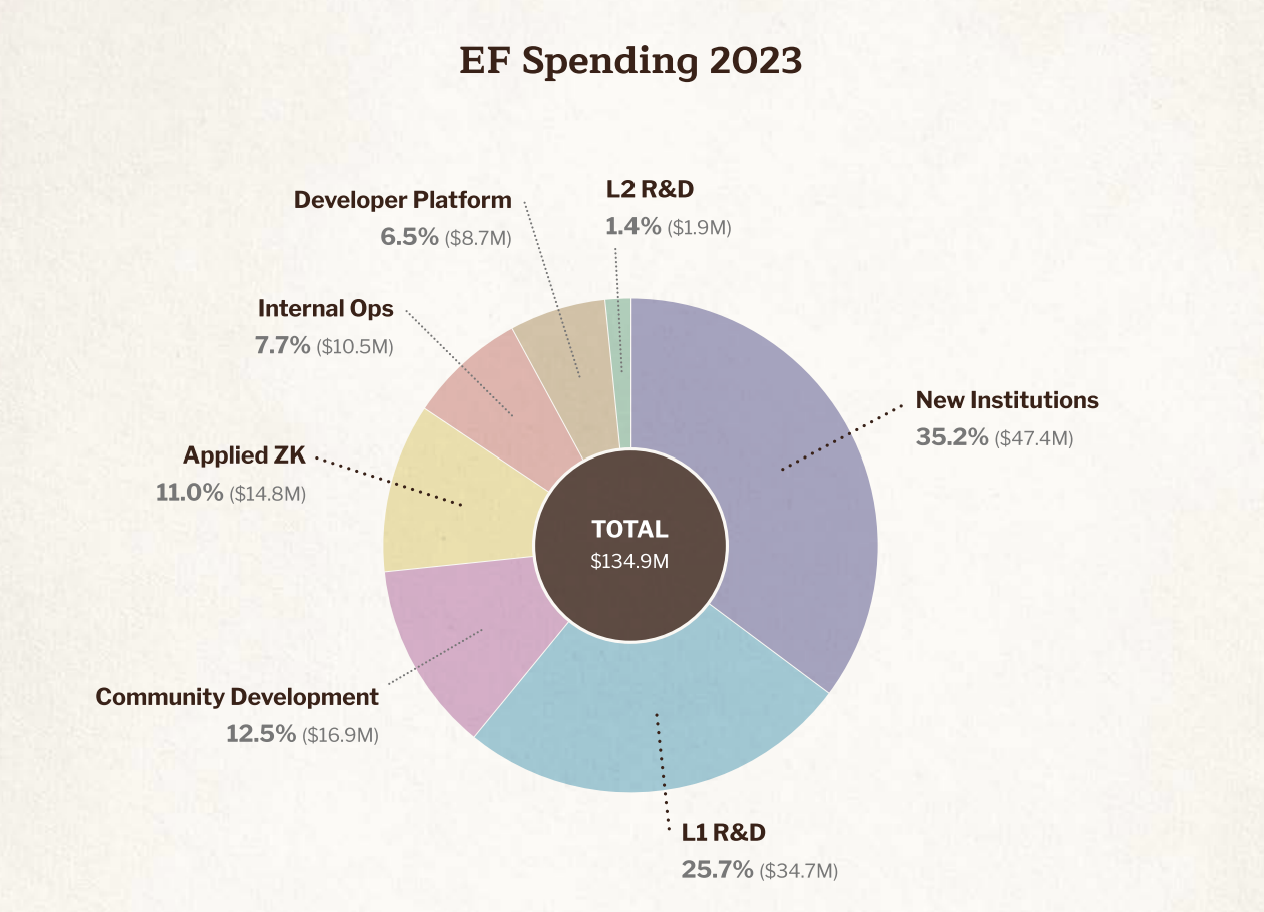

Much of this spending went toward Layer 1 research, zero-knowledge (ZK) projects, developer tools, and community initiatives. In 2023 alone, EF spent around $135 million, with the largest portion—about one-third—going to “New Institutions,” a category that includes organizations like 0xPARC and Nomic Labs.

Now, EF is introducing a more disciplined financial model. The new policy introduces a counter-cyclical approach: EF will increase support during bear markets and reduce it when markets are strong. It has identified 2025–2026 as a “pivotal” period for Ethereum, during which it expects to be more actively engaged and deploy additional resources.

As such, EF plans for annual operational expenses of 15% of the treasury’s total value, which—based on a treasury of about $970 million—currently translates to approximately $145 million per year.

To ensure stability, EF will maintain at least 2.5 years of operating runway in fiat or stable assets. With annual expenditures around $150 million, this translates to a target of roughly $375 million in liquid reserves. If the value of these reserves falls below that buffer, EF may sell ETH in the following quarter to restore it.

Over time, EF plans to reduce annual spending to 5% of the treasury, aligning EF’s budgeting with the approach of long-term endowments.

The Foundation also intends to earn modest returns on its on-chain and off-chain holdings. For the latter, it includes solo staking of ETH and lending wrapped ETH on established DeFi platforms.

EF has also committed to publishing quarterly reports that will detail treasury balances, earnings, and how funds are spent. This added transparency is likely to be welcomed by much of the Ethereum community.

Overall, this isn’t just a policy update—it feels more like a cultural pivot. EF seems to be rethinking its place in the ecosystem, not just as a technical steward, but as an active participant shaping the values Ethereum is built on.