As part of the investigation phase of the digital euro central bank digital currency (CBDC) project, the European Central Bank (ECB) has been undertaking a number of exercises in order to help it to decide whether to continue on to the next (preparation) phase in the Autumn.

Last Friday it published reports of the outcomes from two of these activities, a market research project and a prototyping exercise, which both finished back in February this year. Together these two reports fill over twenty pages of pdf, but the TL;DR version goes something like this:

Sure, the twenty pages actually go into a(n awful) lot more detail, but there isn’t much else which is of any consequence, and certainly no new information on how a potential digital euro may finally look.

Digital euro – Market research summary

First, let’s consider the market research, which a less generous Observer might suggest was entirely unnecessary, given that its stated aim was to “gain non-binding information on technical solutions,” and that a prototype of technical solutions was already underway.

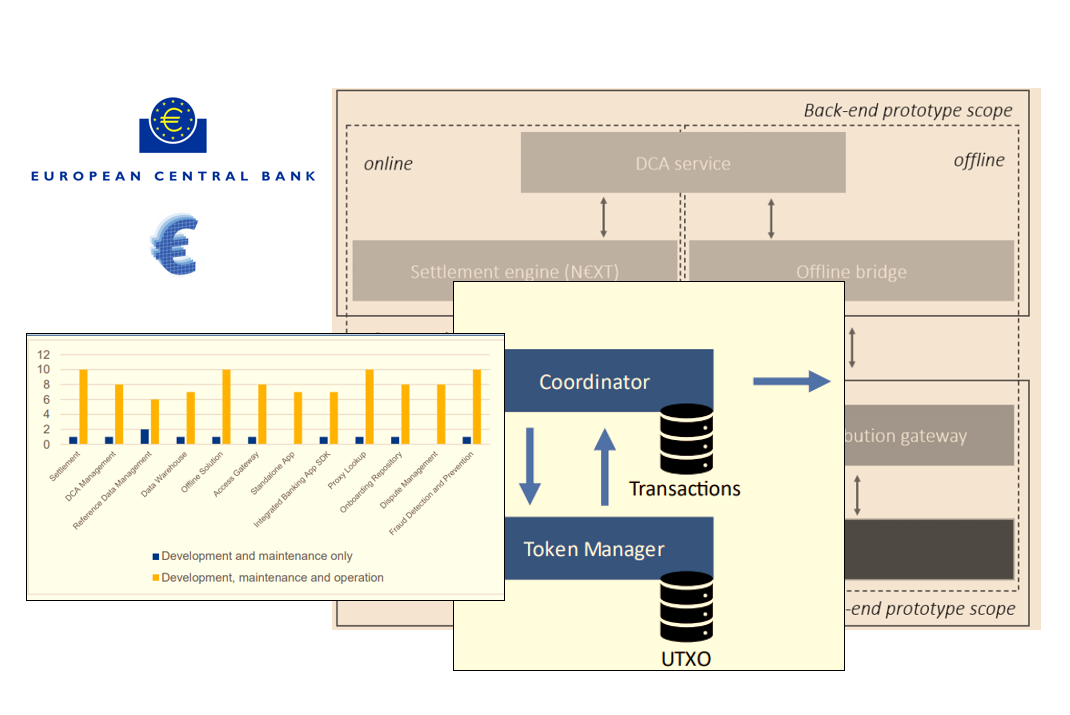

This ran from 13 Jan to 17 Feb 2023, with unspecified ‘market participants’ invited to take part and give feedback on 12 different components that may be needed to support a digital euro. These included settlement, data management and warehousing, standalone and banking app integration, dispute management and fraud prevention.

The ECB received 29 responses to the market research and summarized the conclusions as:

- “there is a sufficient pool of European providers able to tackle the challenge of developing digital euro solutions”

- “most functional and non-functional requirements can be addressed in multiple ways”

The report then goes on to list in great detail the “multiple ways” that were proposed for each of the 12 components covered in the market research. As one example: most respondents proposed unit-based solutions (i.e. UTXO and digital bills), although balance-based solutions were also considered feasible.

And that’s it. No greater insight than that, and a cop-out disclaimer than the report, “does not intend to imply that any of the solutions presented by the respondents are necessarily optimal or best-fit solutions for a digital euro.”

Digital euro - Prototype summary

On to the prototyping exercise, which Observers first covered back in September last year, when Amazon was chosen as the entity to develop the online payments prototype; the other four prototypes being online and offline peer-to-peer payments, and point-of-sale payments initiated by the payer and by the payee.

The exercise ran from July 2022 to Feb 2023 to “test how design choices for the digital euro could be technically implemented and integrated into the existing European payments landscape.”

The Eurosystem (the ECB and the Central Banks of the countries in the euro region) developed a centralized back-end settlement engine called N€XT, based on a UTXO model.

The developers also used sharding, another technology used in decentralized blockchains, to provide scalability of the backend.

For the front end, the five front-end prototypes delivered ranged from mobile phone apps through SmartPOS payment terminals to an online shopping interface, and all were successfully integrated with the Eurosystem back-end.

The only “innovative” findings falling outside of the existing digital euro outline published at the end of April, were the unexpected delivery of a self-custody wallet (because nobody previously considered the possibility that users wouldn’t want the banks controlling their private keys), and tiered due diligence checks for transactions with a lower risk profile.

In summary, the report concludes that ‘Yes, it is possible to integrate the preferred design choices for the digital euro into the current payment system’, although the ECB isn’t sure that offline functionality can be fully implemented in the short to medium-term (which it defines as five to seven years).

The prototyping activity was intended to be a learning exercise and there was no goal of developing the core of a later production solution. So, all of the developed prototypes will now be discarded, and the bank has identified further areas for exploration, including a second back-end prototype with a different technology stack to “validate current design choices.”

We should find out whether all this leads to a preparation phase in the autumn, although even that will not commit the ECB to actually launch a digital euro. In the meantime, we continue to Observe.