Sometime in mid-2019, Facebook's proposal for its Libra stablecoin project scared central banks around the world into finally sitting up and taking notice, as the idea of a private digital currency suddenly became a credible threat to their jurisdiction over monetary policy and forced them to prepare for a digital future.

In October 2021, a team from the European Central Bank (ECB) was tasked with developing a blueprint for a proposed digital euro. From the early stages, however, the commercial banks lobbied the investigation to maintain their position in any resulting financial system, limiting the scope of potential benefits that could be achieved.

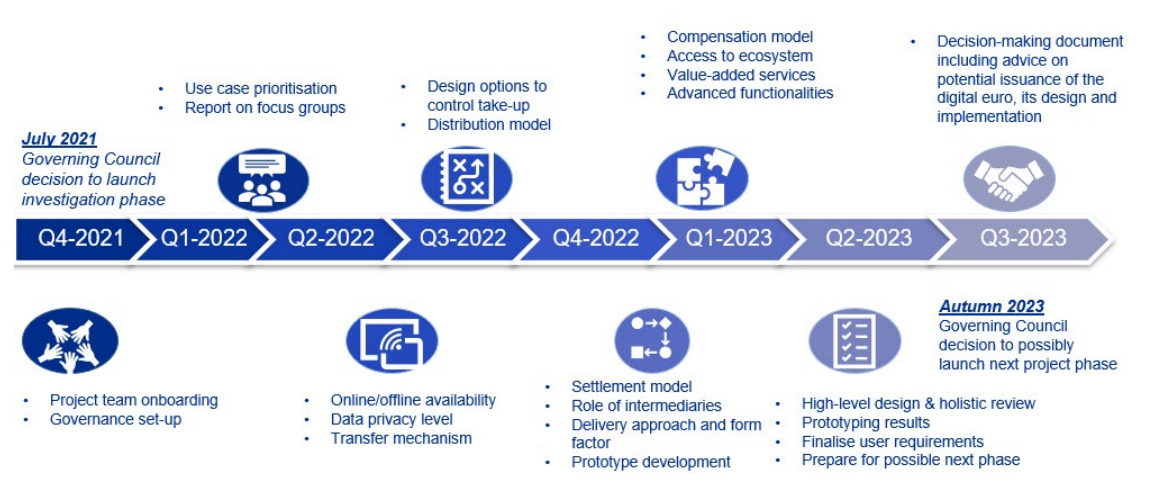

At the end of April this year, Fabio Panetta, Executive Board Member of the ECB, presented the third and final report of the team's investigations to the Committee on Economic and Monetary Affairs of the European Parliament.

Previous development updates

Before taking a closer dive into the design propositions that the last investigation report sets forward, it is important to look back at the key findings of the two reports that preceded it.

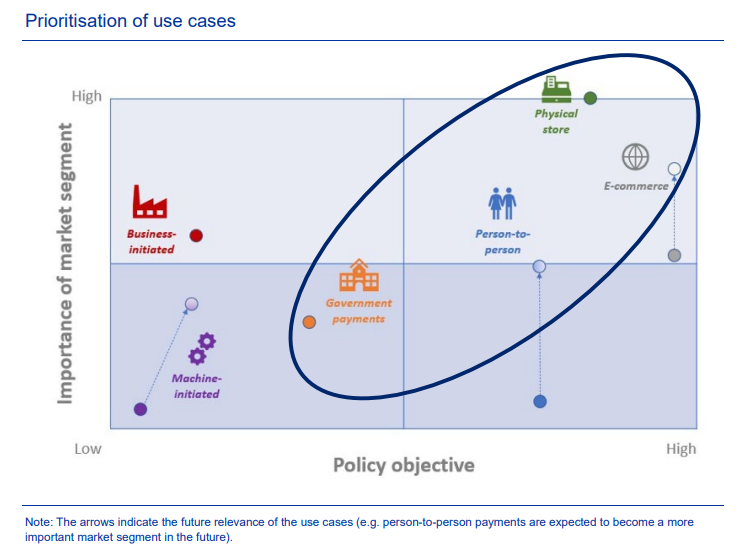

The first report was issued in September 2022, and asserted that e-commerce merchants and physical stores would be the primary beneficiaries of this proposed new version of the euro. Mention was also given to the potential of the digital euro for person-to-person payments.

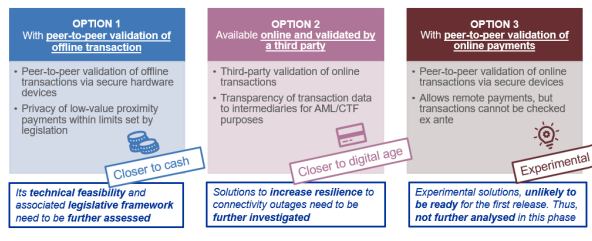

The report's preferred distribution mechanism involved third parties (such as banks) acting as intermediaries between citizens and the ECB, ruling out full anonymity as a viable option and limiting the potential privacy level of the system to that of current commercial banking solutions.

Finally, the first report assesses the feasibility of limiting the balance of private and business accounts and using remuneration tools that penalize excessive holdings of the digital euro, thus drawing a clear line between its use as a payment mechanism and a form of investment.

The second report, published in December 2022, further defines the potential roles of 'Supervised Intermediaries'. Banks and other financial institutions would be responsible for managing user accounts and providing customer support.

The ECB would then process settlements, establish a common framework for intermediaries, and implement the technical rules for a full payment service. With this approach, the central bank seeks to maintain equal availability and consistency across the euro area.

Key features laid out in the report are 24/7/365 availability (giving the option to fund or defund the account at any time), along with waterfall and reverse waterfall functionalities; linking digital euro accounts with commerical bank accounts to automatically convert to/from private money in case of holding limits being temporarily exceeded.

The latest shape of the digital euro

The third and latest report further details design features put forward in the earlier reports, making the final shape of a potential Eurozone CBDC clearer, yet leaves doubts as to whether there is demand for such product in the current market.

Initially the digital euro would be available for euro area citizens only. End users would access the digital euro through existing banking and payment applications or through a native application to be developed by ECB/Eurosystem; the latter seeking to provide “a harmonized entry point for basic payment functionalities.”

The amount in circulation would be controlled by limiting account holdings (to a previously suggested €3,000) for individuals, while merchants will not be allowed to hold any. Merchant payments/refunds will rely on waterfall functionality to perform automatic conversion to/from private money in standard accounts.

Payment processes could include both QR and NFC options, with QR as the preferred solution as this doesn't depend on the device manufacturer's implementation standard. NFC is envisaged for future offline functionality, which, despite the associated complexities, has been consistently championed through all three reports.

Onboarding, along with know your customer (KYC) and anti-money laundering (AML) checks would be performed by 'supervised' banks and payment system providers (PSPs), meaning that the digital euro isn't going to provide the increased privacy that end users have been crying out for since the start of the investigatory review.

While it should be possible (via banks and intermediaries) to use the digital euro for 'conditional payments' the ECB team's latest report gives a hard 'No' to programmable money using smart contracts either now or in the future. It is feared that this functionality could contradict one of the key facets of a digital euro, that it should be convertible at par with other forms of the currency.

One of the great promises of digital currencies, is to mitigate the high costs of international transfers. “The Eurosystem envisages supporting the provision of cross-currency functionalities,” although the priority is to ensure the timely delivery of a digital euro that serves the needs of euro area users. Therefore initial cross-currency use cases will focus on foreign exchange conversion on consumer transactions, such as for online purchases outside the euro zone.

What comes next?

Discussions between EU policymakers and stakeholders on the digital euro will start next month, and are predicted to last until Autumn when the Governing Council of the ECB will decide on whether or not to move forward to the project’s ‘trial phase’. Also, the European Commission intends to propose a regulation for the digital euro before the end of the second quarter of 2023.

Despite professing to desire technological progress and best serve its people, the ECB's primary commitment would appear to be maintaining the status quo. The necessity for commercial banks and other financial intermediaries is preserved, and the 'digital euro as replacement for cash' is undermined by limits on holdings and the requirement for linked accounts to facilitate waterfall functionality.

While the currency would be free to use for end users, Panetta's speech made sure to stress that intermediaries would be compensated for the services they provide. It is assumed this would largely be in the form of merchant fees, which are currently only slated to not exceed the fees of existing digital payment methods. So the initial principle of merchants being the primary beneficiaries seems to have also fallen by the wayside at some point.

The Italian economist Ignazio Angeloni, was asked to produce a study on the first two investigation reports, naming it: “When in doubt: abstain (but be prepared)”

Although he encourages the investigation phase, like many other experts, Angeloni doesn’t recognize that the ECB digital currency project has a strong enough value proposition to be implemented as yet.

Whether any stakeholders other than the commercial banks get their views heard during the next stage of discussions is debatable. The investigation thus far has progressed in a pretty much singular direction, and its momentum may at this stage be too much to deflect.

However, we shall continue to Observe.