The U.S. Securities and Exchange Commission has discovered a monthly withdrawal of $80 million from the company’s budget to various wallets. At the same time, Anchor Dev claims to have warned Do Kwon that Terra was not able to work with an interest rate of 20%, even before the project was launched.

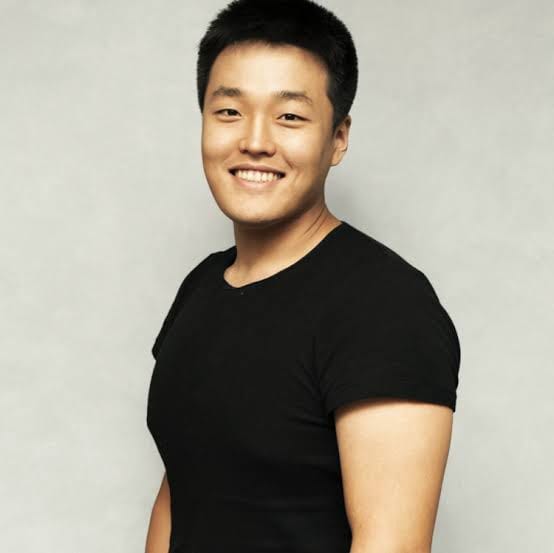

After the collapse of Terra, attention of not only investors and the crypto community, but also various government agencies has been focused on the stablecoin and its owner Do Kwon. As we wrote earlier, Do Kwon is already implicated in criminal cases, and is also accused of fraud. If Do Kwon was previously watched by the bailiffs in South Korea, today he is being watched by prosecutors in various countries.

The South Korean news agency probably reports:

“The US Securities and Exchange Commission recently conducted a remote video survey of some of Terra’s key designers and focused on inquiring about Terra’s poor design structure.”

Recently it became known that the US Securities and Exchange Commission discovered a monthly withdrawal of $80 million (100 billion won) from the company’s funds, which was made on several occasions a couple of months before the collapse of Terra. The funds were sent to different wallets to cover operating expenses. This fact may be used as proof of Do Kwon’s criminal activities of money laundering.

The Securities and Exchange Commission suggests that Do Kwon violated the Securities Law, and it is also assumed that the blockchain service that allowed the purchase of US stocks using Terra is a violation of the Securities Law. If the above is confirmed, then Do Kwon will receive a US lawsuit.

Thus, the collapse of Terra has not only forced governments around the world to think about the regulation of stablecoins, but also to examine in detail the work of Kwon and its legal ramifications. Perhaps soon we will see court cases involving Do Kwon, which will be organized by other countries around the world.

Courts and state supervisors call into question the integrity of Do Kwon and cast a shadow on the reputation of the company, but this is not the only reason that will destroy the credibility of the project.

The Anchor developer, who is now known under the pseudonym Mr. B, claims that he warned Do Kwon about an unacceptable interest rate of 20% back in April 2019.

“Just before the release, I suggested to CEO Kwon Do-Hyung that the interest rate should be lowered, but it was not accepted.” — says Mr. B.

This high interest rate was set by Kwon himself a week before the launch of Terra, according to Mr. B initially, initially the interest rate was 3.6%, for which there were good reasons for.

The platform was originally designed to offer an interest rate of 3.6%. This was a key component of maintaining the stability of the Terra ecosystem, as it took into account the available funds in the Anchor military chest.

It can be assumed that Do Kwon raised the interest rate in order to attract as many investors as possible. He decided to take a risk, despite the fact that the development team had warned him about the instability of the ecosystem at high interest rates.

Currently, the creator of Terra has multiple problems with the authorities around the world in regards to legal financial violations. It seems that Kwon, was initially ready to jeopardize the performance of the blockchain, despite the warnings from his team — for the sake of profit.

All this will have a detrimental effect on the reputation of not only Do Kwon himself, but also his project. We’ll see what happens next, but recent events do not bode well for the Terra mastermind.