PancakeSwap recently concluded one of its strongest months ever, hitting a massive $136 billion in trading volume for May. That gave it nearly 40% of the entire DEX market share—well ahead of Uniswap and Raydium, which recorded around $80 billion and $40 billion, respectively.

In annual terms, Uniswap still holds the lead with $768 billion trading volume, almost double that of PancakeSwap for the same period. However, PancakeSwap’s recent performance signals it is a rising contender.

This growth isn’t just about one big change—it is a mix of several positive trends. Activity on BNB Chain has been growing, and PancakeSwap has released some important updates. Plus, new integrations keep bringing in users. Now that PancakeSwap handles over 80% of the DEX volume on BNB Chain, it is really picking up speed with the network.

An important factor was how PancakeSwap positioned itself within Binance’s broader ecosystem. Binance has been steadily linking its centralized and decentralized products, and PancakeSwap is right in the middle of that. Weekly token launches (Token Generation Events, or TGEs) are now going live directly through Binance Wallet on PancakeSwap, which not only brings more users on-chain but also drives up trading activity for both platforms.

This lines up with what we have been seeing throughout the first half of 2025—BNB Chain is having a standout year, and the numbers back it up.

A big reason BNB Chain has picked up activity again is its recent dive into the memecoin scene. Platforms like four.meme, which took inspiration from Pump.fun, are seeing huge traffic, with over 1,000 new tokens being launched every day. That kind of volume naturally spills over into higher trading numbers on Binance Wallet, PancakeSwap and more on-chain action overall.

Infinity Upgrade

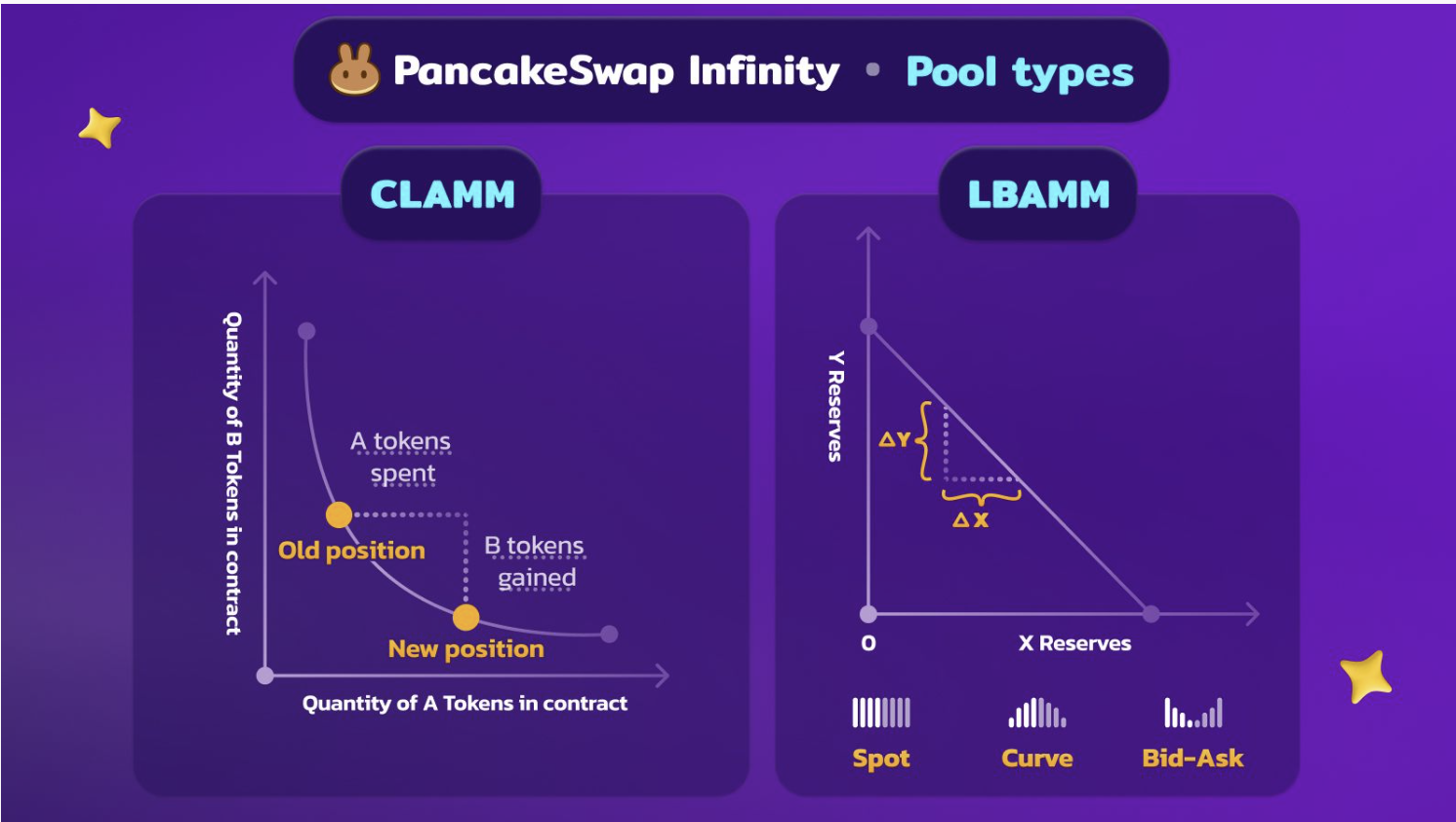

Another factor that helped fuel this momentum was PancakeSwap’s Infinity upgrade, which dropped in early May. It used to be called v4. This update brought in two new pool types with tailored AMMs that give liquidity providers more flexibility in how they manage their capital and risk.

The first, CLAMM (Concentrated Liquidity AMM), primarily benefits liquidity providers and lets them choose a specific price range where they want to provide their tokens. This means their funds are used more efficiently, earning more fees if the token trades stay within that range. It’s like putting your money where the action is, rather than spreading it too thin. However, it requires active management — LPs need to adjust their range if the market moves. This feature works similarly to Uniswap's latest V4 contract.

The second, LBAMM (Liquidity Book AMM), primarily benefits traders, especially in low-volatility pairs (like stablecoins). It divides liquidity into set price bins. Each bin holds liquidity for a fixed price, so trades that happen inside a bin don’t cause price slippage.

Whether someone wants to manage their positions more actively with CLAMM or prefers the simpler setup of LBAMM, the upgrade made trading smoother and more customizable.

The next major area of innovation in PancakeSwap’s Infinity upgrade focuses on gas efficiency. To reduce the cost of using the protocol, developers introduced multiple mechanisms for subsidized, discounted, and optimized gas usage.

For example, pool creators now benefit from discounted gas fees when launching new pools using optimized templates. The upgrade also introduces “hooks,” which are popular in modern DEXes. These are customizable smart contracts that allow protocols or developers to subsidize gas fees for users, such as by refunding part of a swap’s gas cost or offering incentives for frequent traders.

Additionally, PancakeSwap supports batching multiple actions into a single transaction to lower costs and reduce on-chain complexity. In some cases, users who help maintain the health of a pool—like rebalancing liquidity ranges—may even receive on-chain gas rebates.

CAKE Stable

Interestingly, all this activity hasn’t translated into a huge price spike for the CAKE token—the token has been hovering around the same mark for the last year.

CAKE is up around 20% over the past month, but the gains were likely held back by the recent controversial V3 tokenomics update that unlocked staked tokens. That triggered some selling, which might have canceled out the visibility boost from all the new volume.

Still, the new tokenomics include a stronger burn mechanism, and with trading volumes climbing, more CAKE is likely to be taken out of circulation. Currently, the protocol burns approximately $1 million worth of CAKE tokens each week. If the volume remains high, the consistent token burn might gradually increase its price, matching the recent growth in volume.