Latest Articles

157 Articles

Learn about DeFi (Decentralized Finance) and its impact on traditional financial systems. Discover the opportunities and challenges it presents.

Learn about DeFi (Decentralized Finance) and its impact on traditional financial systems. Discover the opportunities and challenges it presents.

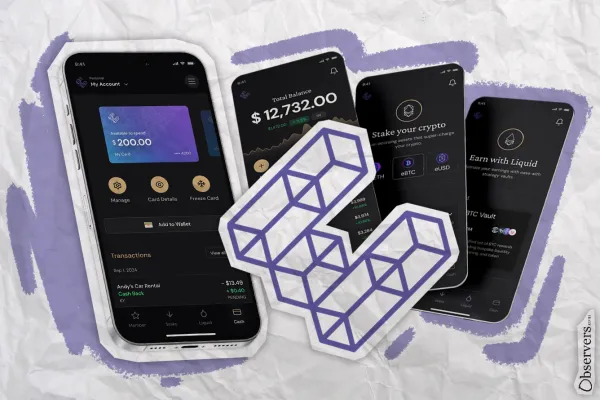

Evolving beyond a staking protocol, the project is transforming into a full-fledged fintech platform, featuring its own credit cards and a variety of DeFi integrations for its users.

Synthetix's main stablecoin, sUSD, has been trading significantly below its $1 peg for over a month after the implementation of the SIP-420 protocol upgrade. In an act of manual intervention within a decentralized system, the project’s founder has urged users to take action and help restore the peg

In 2024, flash loan transaction volume surpassed $2 trillion, establishing flash loans as a key mechanism for maintaining capital efficiency across DeFi markets.

Alexander Mardar

In 2024, flash loan transaction volume surpassed $2 trillion, establishing flash loans as a key mechanism for maintaining capital efficiency across DeFi markets.

Alexander Mardar

Evolving beyond a staking protocol, the project is transforming into a full-fledged fintech platform, featuring its own credit cards and a variety of DeFi integrations for its users.

Alexander Mardar

Synthetix's main stablecoin, sUSD, has been trading significantly below its $1 peg for over a month after the implementation of the SIP-420 protocol upgrade. In an act of manual intervention within a decentralized system, the project’s founder has urged users to take action and help restore the peg

Alexander Mardar

The project aims to disrupt the reinsurance industry by bringing reinsurance contracts on-chain and making them accessible to a broad range of Web3 investors.

Alexander Mardar

Superseed is an Ethereum Layer 2 with a built-in CDP lending platform. What sets it apart is that 100% of its on-chain profits are used to repay loans for users who provide its native token as collateral. The big question is: Will this bold bet on tokenomics pay off?

Alexander Mardar

The project’s team introduces a fundamentally new approach to decentralized trading and liquidity provision, addressing inefficiencies in existing protocols.

Alexander Mardar

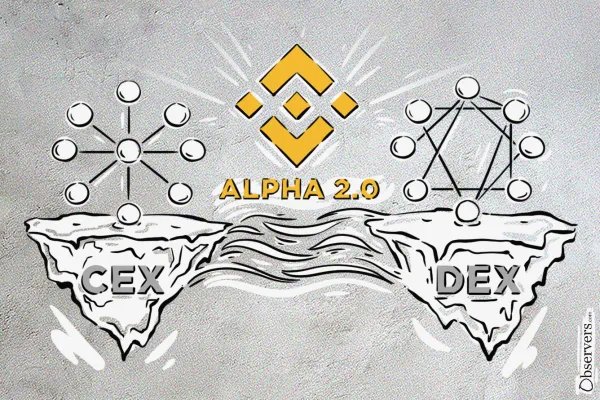

Binance has introduced a new product that brings decentralized exchange (DEX) functionality directly to users of its centralized platform. This move could mark the beginning of a more integrated trading experience across both models.

Alexander Mardar

A DeFi app named 'DeFi App' has quickly gained traction. With its unique technology and user-centric approach, it surpassed $1.8 billion in transaction volume and attracted over 20,000 weekly active users within just seven weeks of launch.

Alexander Mardar