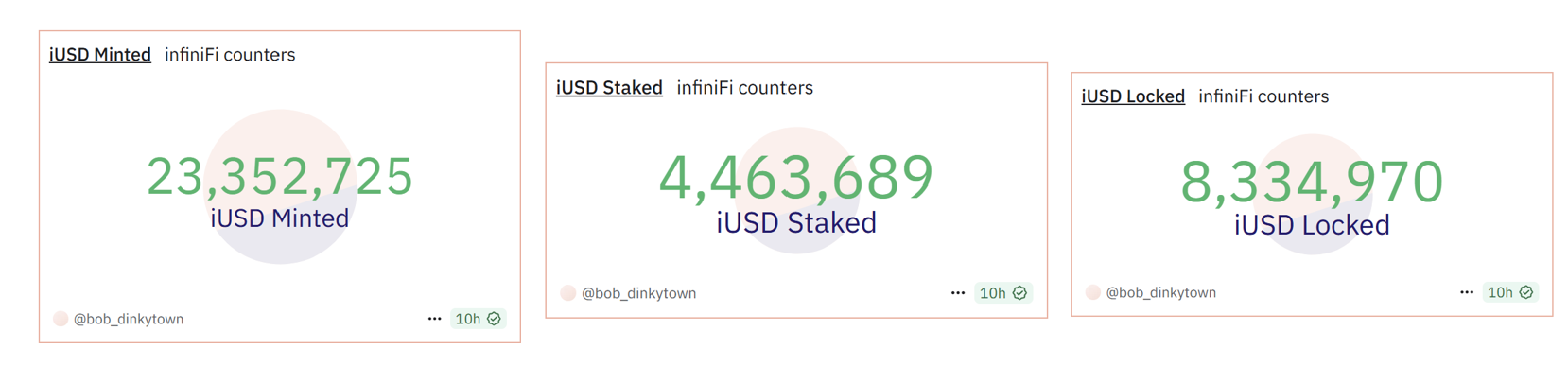

InfiniFi is a new DeFi protocol that has been gaining traction rapidly. Within just a few days of launch, it attracted over $23 million in deposits.

The concept is ambitious: increase yields by optimizing the allocation of deposited funds using blockchain mechanisms such as smart contracts and incentive structures.

On-Chain Fractional Reserve Protocol

The team describes its approach as an on-chain equivalent of the fractional reserve model used in traditional banking. In that system, banks keep only a portion of customer deposits as reserves and lend out the rest to generate returns. This works as long as the bank can meet withdrawal demands, but becomes risky when depositors withdraw en masse or when loans are long-term while deposits are short-term. Banks mitigate this through careful liquidity planning and risk management.

InfiniFi seeks to replicate this balance using smart contracts. When users deposit funds, the protocol splits them into different “buckets” based on how long the users are willing to lock up their capital. The longer the lock-up period, the higher the yield.

This structure aligns returns with users’ time preferences. But since similar outcomes can be achieved in many DeFi platforms, InfiniFi’s added value lies in reinvesting a portion of liquid funds into higher-yield, illiquid assets.

By blending liquid and locked capital into duration assets, infiniFi increases capital efficiency. Duration assets yield more, and joint deployment drives better system-wide returns.

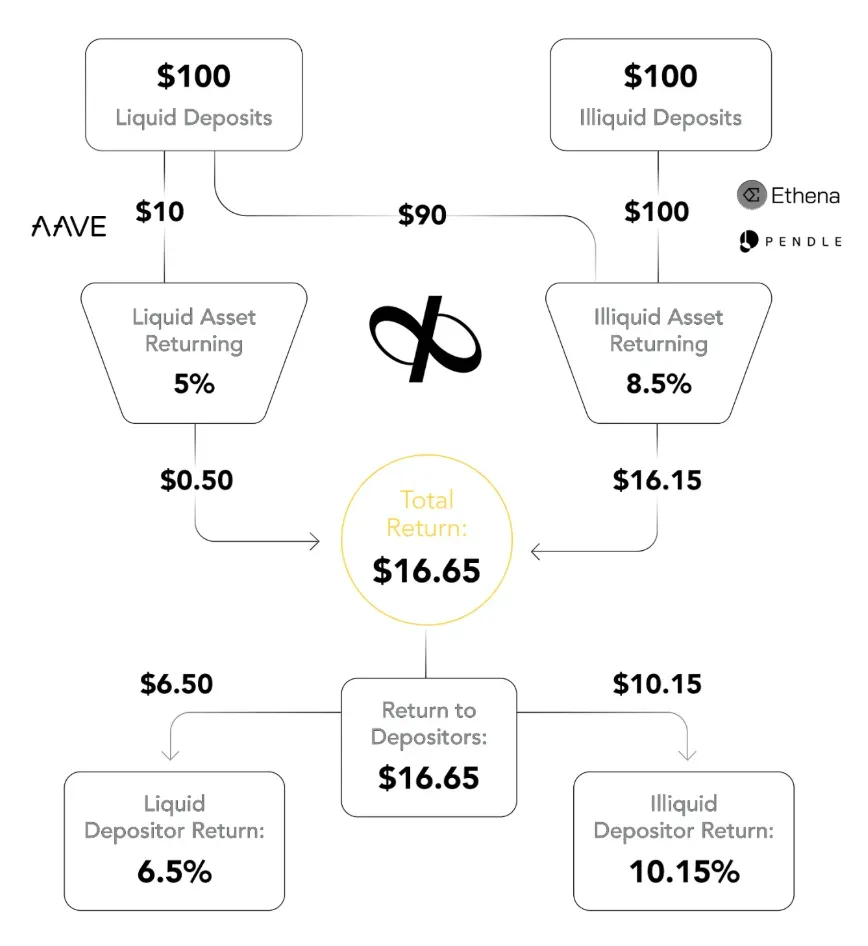

In one example presented in the whitepaper, up to 90% of a user's liquid deposit is allocated to higher-yield, illiquid positions such as Ethena and Pendle. The return from this investment—referred to as “duration assets” in the document—is then distributed between both liquid and illiquid depositors, boosting returns for all.

This mechanism allows InfiniFi to offer up to 8.5% APY on fully liquid positions, compared to around 4% on Aave. Locking funds for just four weeks can push that yield to 16.4%, well above the ~12% typically seen on Pendle.

Of course, such a system depends on strict liquidity management. Without it, liquid user withdrawals could jeopardize the entire structure. Here’s how the protocol handles that.

Token System: iUSD, siUSD, liUSD

When users deposit into InfiniFi, they receive one of three tokens depending on how they intend to use their funds:

- iUSD – the default token, which earns no yield.

- siUSD – earned by staking iUSD; yields passive returns and remains liquid.

- liUSD – issued when funds are locked; yields are higher and depend on the lock-up duration selected by the user.

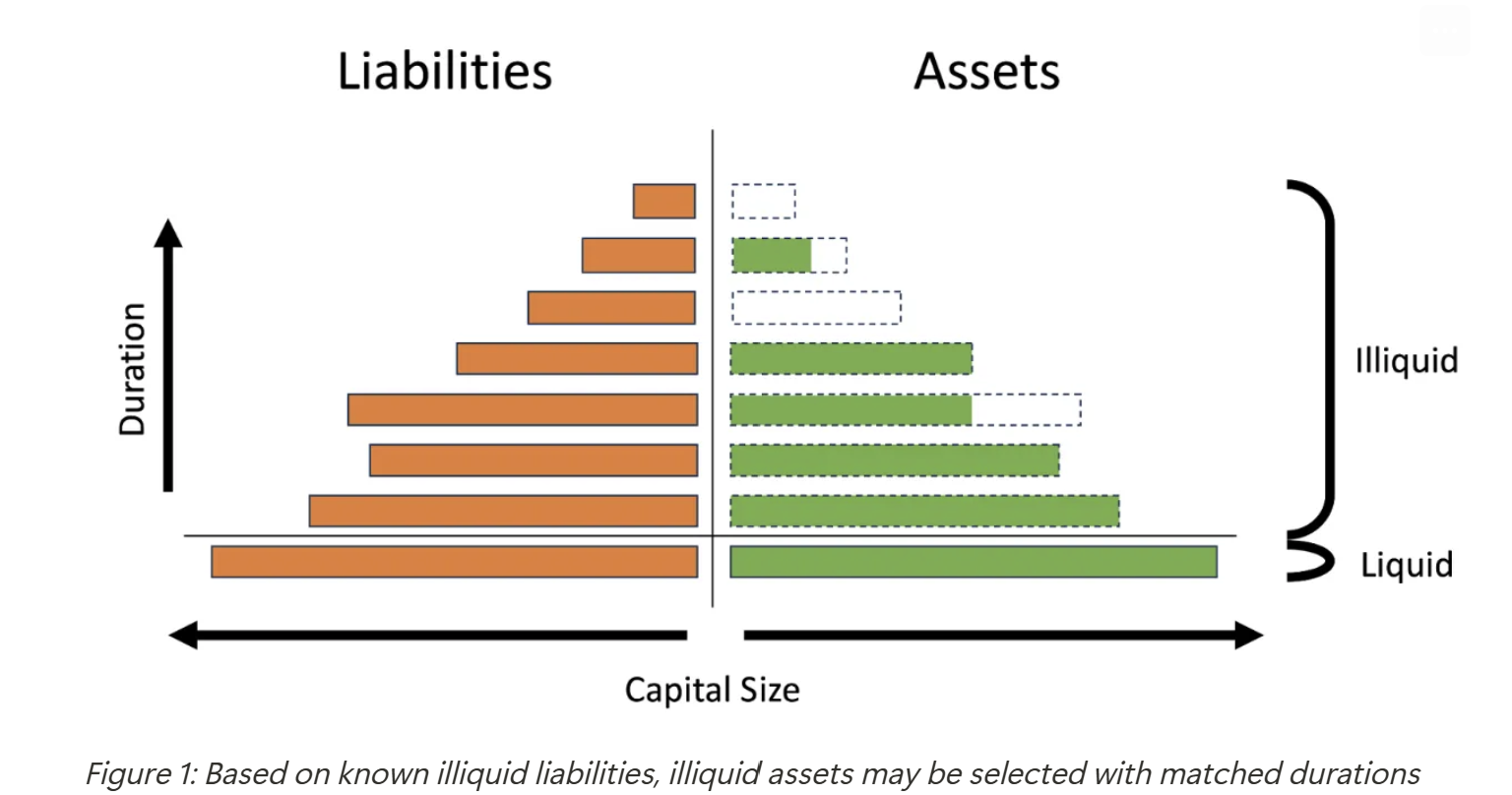

The authors claim that such maturity laddering gives the protocol visibility into its cash flow schedule and enables more efficient investment planning.

Since laddering only works with committed (illiquid) funds, InfiniFi further incentivizes users to lock up capital.

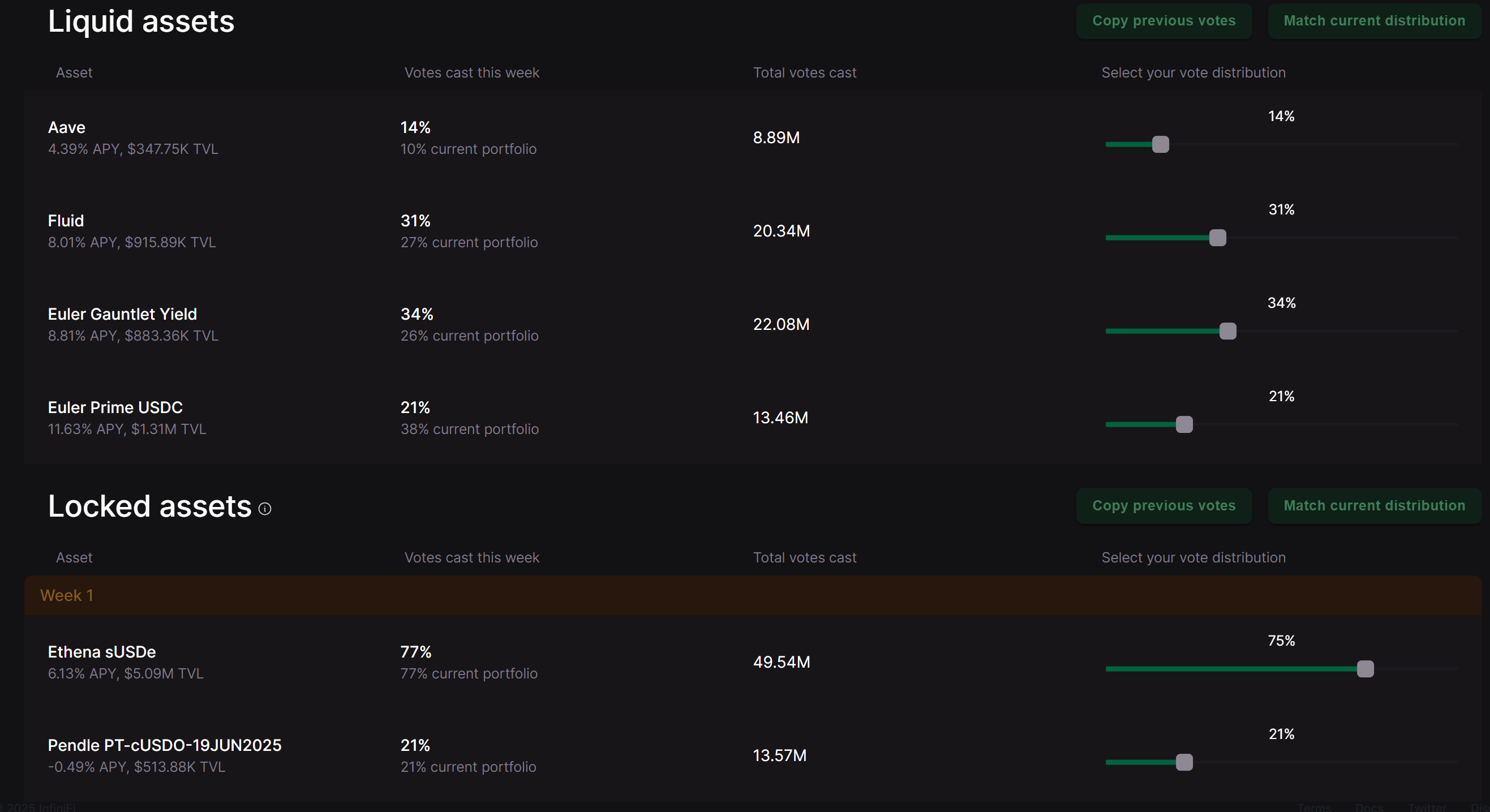

Illiquid depositors are given voting privileges. Further, liUSD holders get voting power based on how much they have deposited and how long they have locked it. These votes help decide how the protocol allocates capital, whether to more liquid strategies like Aave, Fluid, or Euler, or to longer-term options like Ethena and Pendle.

To align responsibility with risk, liUSD holders are first in line to absorb any losses in underlying investments. siUSD holders are next, while iUSD holders are only affected if losses exceed both prior layers. The system is designed to reward long-term participants while shielding those who choose to stay liquid.

As of writing, out of the 23 million iUSD minted, 4.4 million are staked and 8.3 million are locked.

The whitepaper acknowledges unresolved governance issues. The following placeholder is currently used:

To fully address governance is a whitepaper unto itself. This whitepaper is currently being written, and prior to it being merged into this paper, the outline describing governance functionality shall suffice.

InfiniFi is the second project we’ve observed recently that has attracted substantial investor interest despite publishing an incomplete whitepaper. Whether this is the beginning of a new trend or simply a coincidence remains to be seen.