Latest Articles

47 Articles

Explore the world of decentralized exchanges, where crypto trading occurs without intermediaries, ensuring greater transparency and efficiency.

Explore the world of decentralized exchanges, where crypto trading occurs without intermediaries, ensuring greater transparency and efficiency.

The DEX suffered a substantial loss of over $50 million last week due to a cyber attack. The hacker has now announced they will announce a potential deal on a bounty at the end of November.

The major derivatives DEX and the Yearn.finance token were hit by apparent market manipulation, according to the exchange's founder.

The thief's on-chain "treaty" requests complete authority over Kyber, temporary authority over KyberDAO, as well as all assets owned by the company.

Mathilde Adam

The thief's on-chain "treaty" requests complete authority over Kyber, temporary authority over KyberDAO, as well as all assets owned by the company.

Mathilde Adam

The DEX suffered a substantial loss of over $50 million last week due to a cyber attack. The hacker has now announced they will announce a potential deal on a bounty at the end of November.

Mathilde Adam

The major derivatives DEX and the Yearn.finance token were hit by apparent market manipulation, according to the exchange's founder.

Sasha Markevich

The DEX’s V4 has migrated to a new blockchain for greater scalability and decentralization in derivatives trading. This evolution includes novel staking opportunities and fee earnings for token holders.

Alexander Mardar

Thorchain distinguishes itself with the capability for cross-chain swaps of native assets, a feature not seen in other DEXs. This innovation, coupled with a surge in liquidity and trading volume, underpins its rapid rise in the decentralized exchange market.

Alexander Mardar

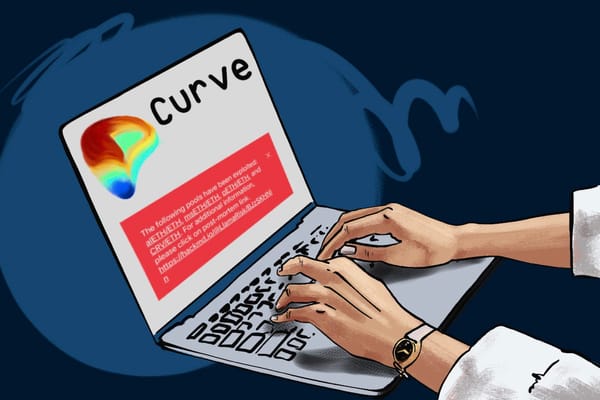

Automatic crypto exchange Curve was hacked and $50 million stolen. DeFi markets are experiencing massive volatility.

Alex Harutunian

DEX giant Uniswap teases Uniswap v4, introducing an array of changes set to improve user experience and efficiency while also allowing for feature expandability through the introduction of "hooks."

Observers

SushiSwap users lost about 1800 ETH, or more than $3 million, as a result of a smart contract vulnerability. Fortunately, most of the funds were recovered.

Alex Harutunian