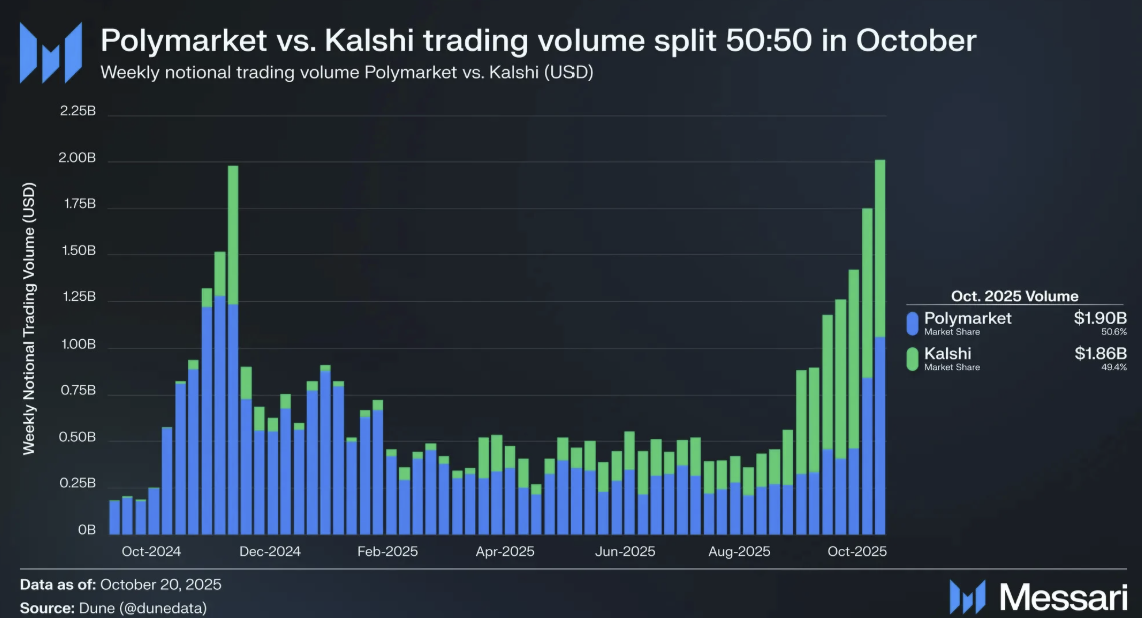

Prediction markets have broken out of their niche. Monthly volumes exceed $4 billion led by Polymarket and Kalshi platforms.

Kalshi’s latest $300 million round lifted its valuation to about $5 billion, while Polymarket is rumored to be raising at $12–15 billion, with lifetime trading over $18 billion.

Total event trade volumes in the industry have become measurable in billions — and are drawing institutional attention. Even Intercontinental Exchange (ICE), the NYSE parent, has stepped in to package and distribute event-derived data.

Blockchain-based betting has quietly become the largest crowd-sourced information experiment in history — a global system where collective belief turns into tradable data.

Betting has existed for centuries, but what the crypto industry has built is fundamentally different.

Why Blockchains Became the Laboratory for Crowd-Sourced Truth

Blockchains offered the perfect testing ground for betting-based information markets — not only because they enable programmable, immutable settlement and tokenized trading, but because information feed is one of the core challenges of blockchain development.

Blockchains are blind to the real world; whoever feeds them data effectively controls their truth.

This need for verifiable external input gave rise to oracles — protocols that connect on-chain logic with off-chain reality. Yet, these systems still lag behind in scale and decentralization. While in any distributed network, the system’s total trust is only as strong as its weakest link — the chain or its oracle.

For example, a simple voting app built on Ethereum-secure rails asserts the immutability of its records, backed by the hundreds of billions of dollars in economic security that protect the Ethereum network.

However, if the oracle supplying vote results can be manipulated for as little as $10,000, the entire system’s integrity collapses. Once the biased data is fed into the smart contract, the ledger records the wrong outcome — immutably and irreversibly — despite the vast economic guarantees underpinning the chain.

When Gambling and Greed Align to Bring Truth

Projects like Polymarket turn speculation itself into a defense mechanism. By creating outcome markets with deep liquidity, they make it economically irrational to corrupt results.

Take the New York City Mayor Election 2025 market, which has accumulated roughly $240 million in traded volume at the time of writing. A 1 % price swing in such a market implies about $2.4 million in capital. To meaningfully shift the odds, an actor would need several million dollars of trades — far exceeding the typical cost of manipulating an oracle.

By turning collective belief into tradable stakes, Polymarket transforms greed into security, raising the financial barrier against manipulation.

This market liquidity also funds the sourcing of truth itself. Polymarket’s trading fees are used to pay decentralized oracles, such as Chainlink, for verified resolution data — ensuring that the final outcome is anchored to credible external feeds.

Further, Polymarket also supports markets that can resolve without relying on any oracle feed at all. This is especially important for subjective or qualitative questions — where no single “official” data source exists, such as Which technology trend defined 2025? or Did this startup deliver on its roadmap?

In such cases, the system incentivizes designated resolvers (known as proposers) to submit outcomes by posting a bond in USDC, effectively staking both reputation and capital. The proposed result then enters a dispute window (typically a few hours), during which anyone can challenge it by posting a matching dispute bond.

If no challenge occurs, the result becomes final. If a challenge is raised, governance via UMA’s Data Verification Mechanism (DVM) or tokenholder vote determines the true resolution.

In practice, the truth is financed by the disputers — those most confident in their version of reality are the ones willing to risk capital for it.

This final feature embodies the wisdom of crowds: instead of relying solely on specialists, Polymarket channels collective conviction through transparent, economically aligned rules. In this system, truth is not merely sourced — it is produced by the market itself.

From Gnosis to Polymarket and Kalshi

Gnosis

Launched in 2015, Gnosis was among the first projects to tackle the oracle problem head-on. It built fully on-chain markets through the Conditional Token Framework and Omen, with Reality.eth and Kleros providing arbitration layers.

The architecture was technically elegant — every dispute could be resolved on-chain — but also slow, costly, and complex. Traders didn’t want to navigate nested smart contracts; they wanted instant results, not philosophical purity.

By 2022, Gnosis had pivoted toward infrastructure — Gnosis Chain, Safe, and Gnosis Pay — effectively leaving pure prediction markets behind. The market, in turn, voted for usability over theory.

Polymarket

Polymarket emerged as the opposite of that complexity. It stripped prediction markets down to their essence — a clean interface, binary outcomes, and fast settlement.

The platform concentrated on sports, crypto, and politics, where outcomes are frequent, verifiable, and emotionally charged — ideal material for high-volume, betting-style engagement.

Its defining moment came during the 2024 U.S. election cycle, when millions of users treated Polymarket as an alternative poll tracker.

The “Will Donald Trump win?” market alone drew unprecedented liquidity, often updating faster — and more accurately — than traditional media forecasts.

To strengthen credibility, Polymarket standardized its rulebooks: each market clearly specifies its resolution source (e.g., the Associated Press or official results) and dispute window before trading begins. The simplicity was its breakthrough.

Behind the retail surge lay a major investment story. Polymarket raised an initial $4 million seed round in 2020, followed by several subsequent series rounds that brought total funding to roughly $300 million by mid-2025.

In a landmark deal in October 2025, the Intercontinental Exchange (ICE) — parent of the New York Stock Exchange — announced a strategic investment of up to $2 billion, valuing Polymarket at around $8–9 billion.

Following ICE’s entry, reports surfaced of a new funding round that could push the valuation to $12–15 billion, cementing Polymarket’s position as the industry’s flagship.

Its success proved a point Gnosis never could: information trading works when the experience feels like betting, not arbitration.

Kalshi

That success inevitably attracted competition. Kalshi positioned itself as a centralized alternative, listing event contracts as a legitimate financial instrument. This turned prediction markets into a regulated asset class, effectively bridging Wall Street and Main Street.

Kalshi’s model mirrors Polymarket’s “yes/no” simplicity but operates inside the regulated perimeter: every contract is centrally cleared, subject to margin rules, and capped in notional exposure. While compromising on decentralization, this structure appeals to regulation-savvy hedge funds and data-driven traders who can now use event contracts as macro hedges rather than pure speculative bets.

The platform recently surpassed $1 billion in weekly event volume, rivaling Polymarket’s global activity, while focusing on a strictly U.S.-compliant audience.

Robinhood now integrates Kalshi event contracts directly into its app, giving prediction markets mass-market distribution for the first time.

Funding-wise, Kalshi’s total capital raised is broadly comparable with Polymarket’s. Recent reports suggest that its valuation has approached the same $10–15 billion range, signaling investor confidence that regulated prediction markets can scale alongside their on-chain counterparts.

Where Polymarket’s innovation lies in decentralization, liquidity, and user incentives, Kalshi’s breakthrough is regulatory architecture — engineering legality rather than code.

Outlook and Challenges

The outlook for prediction markets remains explosive.

Rising volumes are broadly positive — they increase liquidity, improve price discovery, and raise the cost of manipulation. As more capital flows in, markets become sharper, and their aggregated probabilities more informative to analysts, traders, and policymakers.

Most importantly, this growing depth of crowd-priced truth could also help solve blockchain’s long-standing blindness problem. By turning human judgment and market incentives into verifiable data feeds, prediction markets may evolve from speculative venues into a decentralized truth layer for the broader blockchain economy.

But tying “truth” to monetary rails also introduces ethical and regulatory tension. Platforms have faced backlash for listing contracts on deaths, plane crashes, or geopolitical conflicts, and for creating potential “legalized-bribery” scenarios — where someone might profit from influencing an outcome.

The challenge ahead is simple yet profound: to keep the oracle layer — the feed of truth itself — as trustworthy, decentralized, and tamper-resistant as the blockchains that record it.