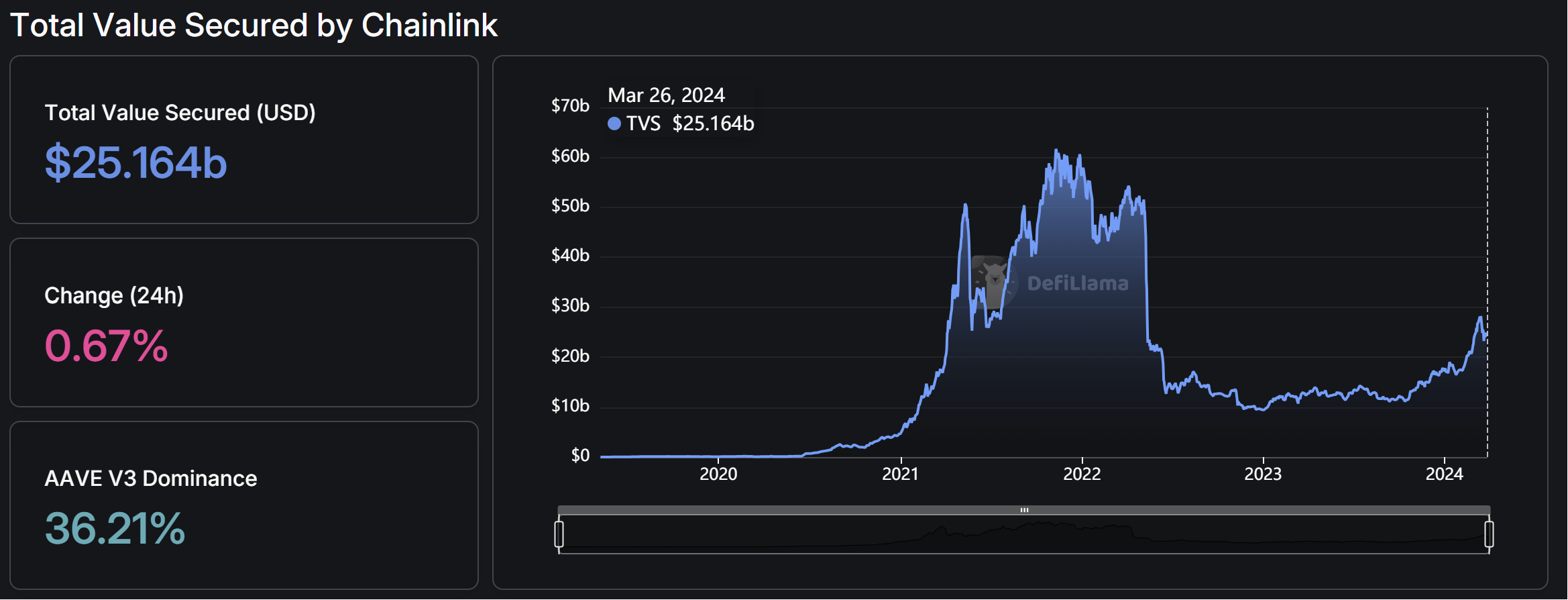

As the market trends upward, Chainlink’s Total Value Secured (TVS) has seen significant growth, currently estimated at around $25 billion. Although the TVS indicator is still well below its all-time high of $60 billion, the recent rise reflects the ongoing developments across the decentralized finance (DeFi) landscape on various blockchains.

The concept of Total Value Secured represents the cumulative amount of Total Value Locked (TVL) across all protocols and platforms that rely on the operation of an oracle network to safeguard user funds. Typically, a protocol or platform’s entire TVL depends on the efficient function of its integrated oracles for fund security, thus contributing to the oracle’s collective TVS.

Nonetheless, certain exceptions must be considered when calculating TVS. For instance, some DeFi protocols provide a spectrum of financial services, not all of which depend on oracles. In these cases, only the services within a DeFi application that rely on oracles for fund security are included in the TVS for that particular oracle network.

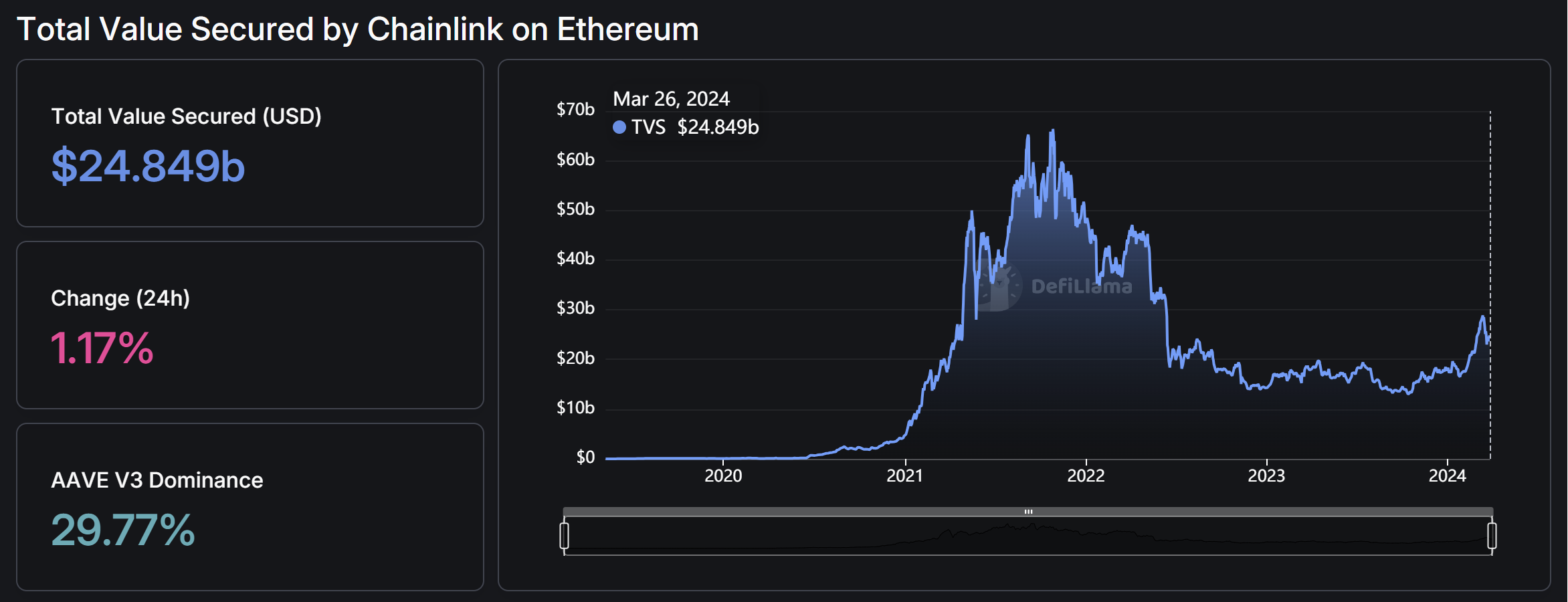

A closer examination of Chainlink's TVS, broken down by blockchain, reveals that Ethereum has predominantly fueled recent growth. This underscores Ethereum’s continued dominance as a leading DeFi blockchain, despite its high transaction fees and sometimes clunky user experience. Looking at the steep rise in the last two months, we can infer some of the growth is attributed to the rise in prices of the underlying assets.

Not included in Ethereum's figures is the TVS related to the data feed on MakerDAO, which is provided by its native Chronicle oracle.

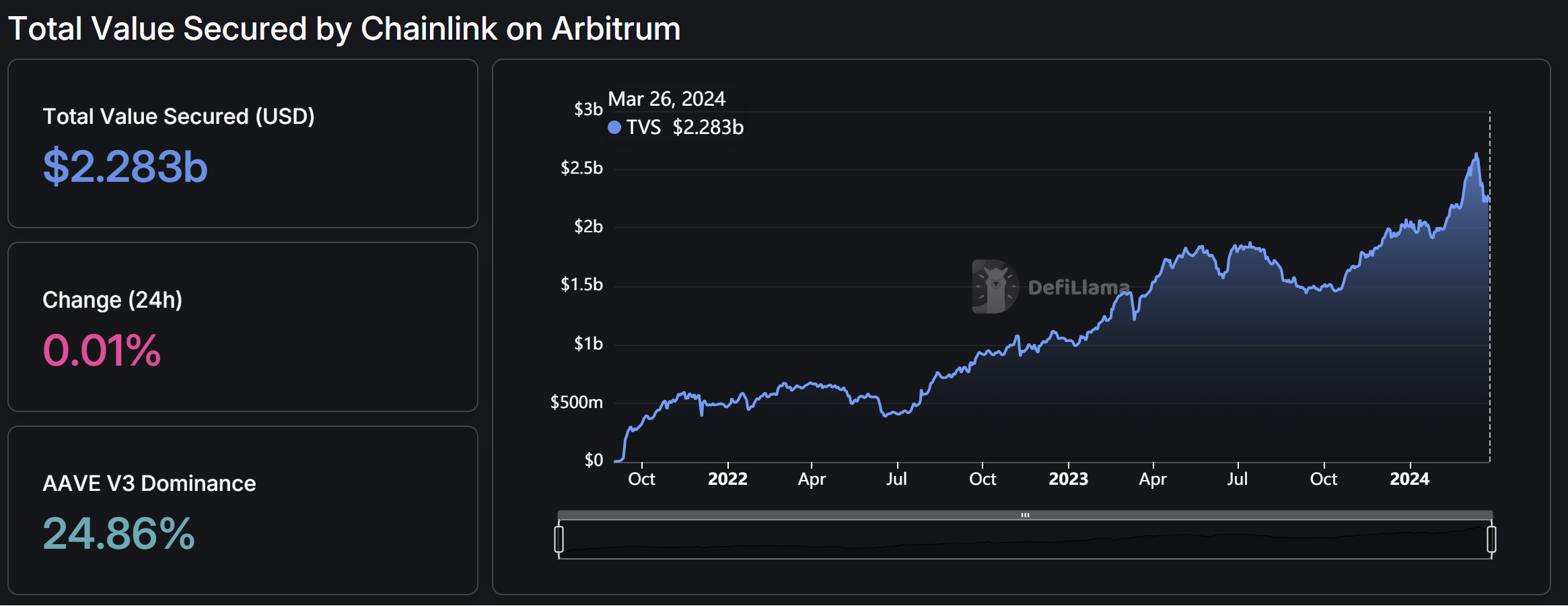

Arbitrum has experienced a steadier rise in Chainlink oracle use, with its TVS increasing from zero in 2021 to nearly $2.5 billion in 2024. Given Arbitrum’s status as one of the most rapidly evolving Layer 2 solutions on Ethereum, noted for being the largest by TVL, it continues to draw considerable interest from developers, investors, and DeFi teams.

In the lower league, Base and Gnosis added significant work for the Chainlink oracles. TVS on Coinbase's new platform stands at an all-time-high of around $200 million, while the veteran chain Gnosis reached $90 million TVS with Chainlink, mainly due to the Maker DAO Spark protocol, launched in the last quarter of 2023.

The scenario differs with other blockchains such as BSC, Polygon, Avalanche, and Optimism. Their TVS growth since the beginning of 2024 has been relatively modest. This indicates that the DeFi sector’s expansion is not as pronounced across these chains. Notably, there has been virtually no growth on chains like Fantom.

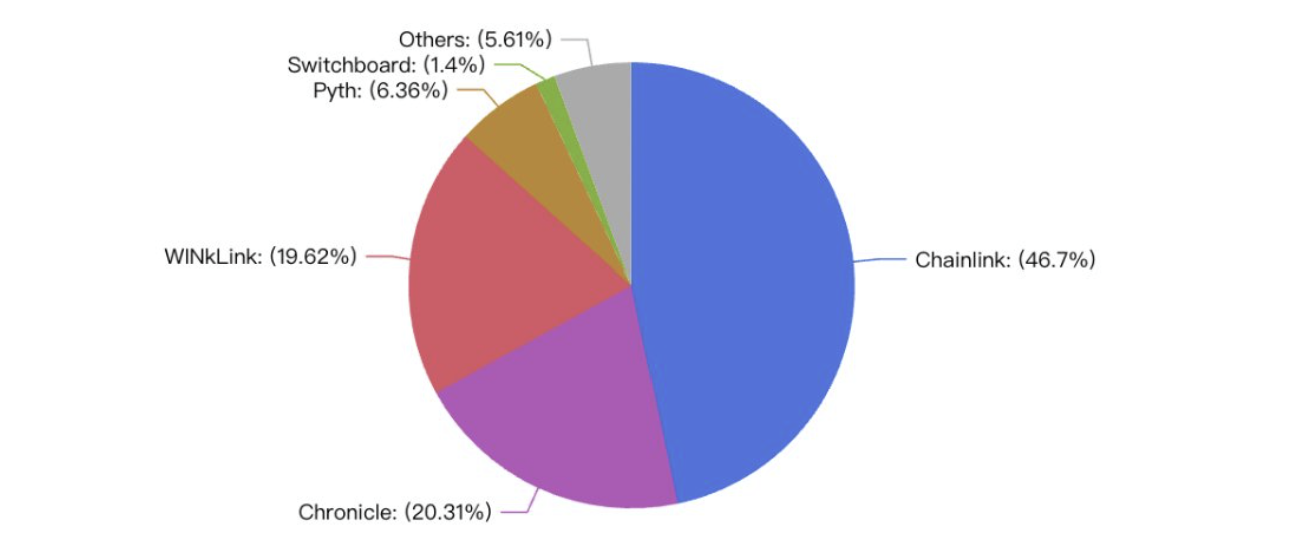

The second largest EVM-compatible blockchain, Tron, is also off Chainlink's radars, however, this is due to the domination of the WinkLink oracle on that chain.

Interestingly, Solana's TVS with Chainlink is soft during this cycle. It stands at 200 thousand, at a level not typical of Solana. Chainlink is supposed to be a blockchain system agnostic tool, yet still, its expansion to non-EVM chains is slow. Pyth, Switchboard, and Dia dominate Solana's oracle landscape yet their combined volume is less than 10% of TVS of all oracles.

Low Chainlink TVS values do not necessarily imply that there is no activity on blockchains. Some chains may have other oracles, such as in the case of Tron. Nevertheless, given Chainlink's dominance in the field, its TVS distribution is a valuable metric for Observing the pulse of the DeFi sector.