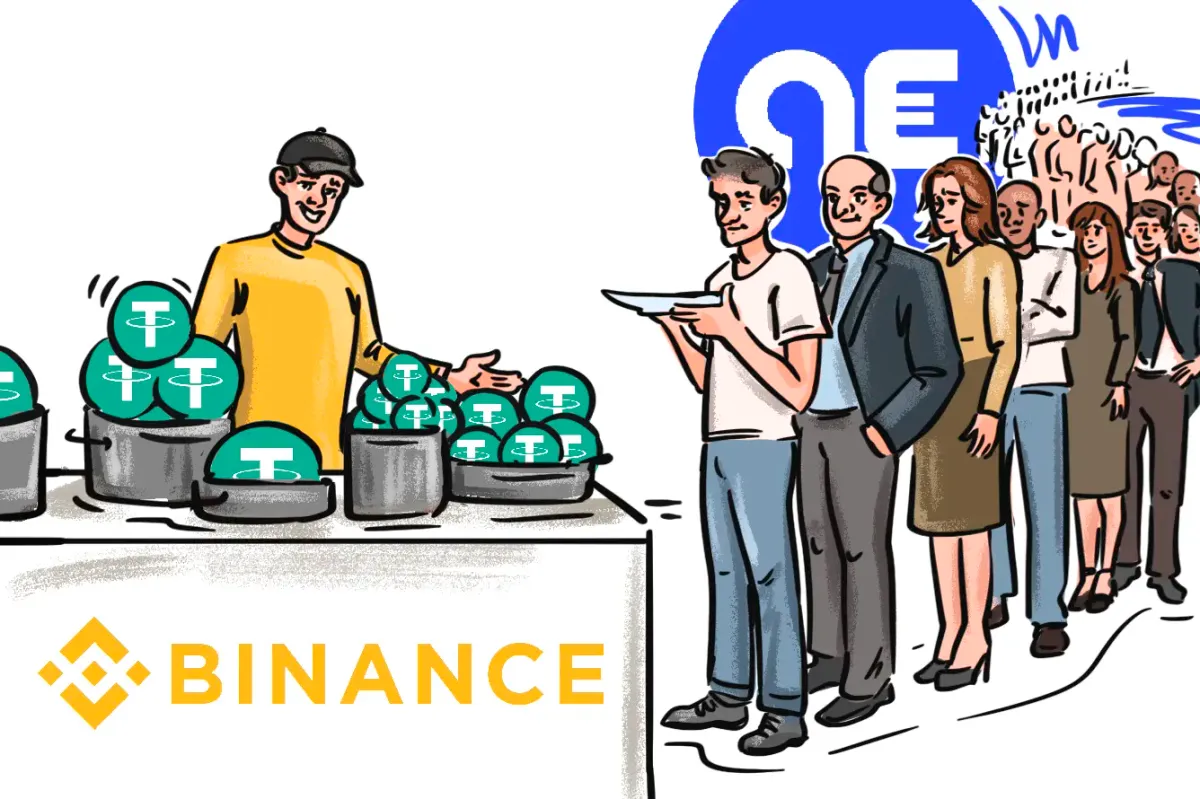

AEUR, a new Euro-backed stablecoin, somewhat surprisingly surged by 200% right after its listing on the Binance spot market on Tuesday. The AEUR-USDT trading pair hit a $3.25 high, while its expected value was around $1.08. The exchange explained that the surge was mainly down to users’ lack of awareness of the stablecoin’s nature:

“As AEUR has been well received by the community, including users who might not have realized its standing as a stablecoin, there was a strong demand for AEUR, which resulted in its price deviation.”

The exchange promptly suspended trading for the AEUR/USDT, BTC/AEUR, ETH/AEUR and EUR/AEUR spot trading pairs and promised to assist the affected users in getting compensation.

“We will assist the AEUR project team to provide reasonable compensation to affected users within 72 hours.”

Users who purchased AEUR within the “Compensation Period” of around 50 minutes on December 5 and did not successfully sell it will be eligible for compensation in the form of USDT token vouchers within the next few days. The compensation will be calculated based on the following formula:

Compensation = (Total amount of AEUR purchased - Total amount of AEUR sold during the Period) * (User’s average AEUR purchasing price - 1.07999 USDT)

Anchored Coins EUR is issued natively on the Ethereum and BNB Chain and has plans to expand support to more blockchains. The company behind it, Anchored Coins AG, is a Swiss issuer founded in 2022. The coin is claimed to be 1:1 backed with reserves held exclusively with Swiss FINMA-licensed banks. At the time of writing, AEUR was available for trading only on the Pancakeswap V3 exchange, according to CoinGecko. Another of the company's products, ACHF, a stablecoin backed on a 1:1 basis by Swiss Francs, is currently unavailable for trading.

The issuer stated that it is “not able to confirm when trading will resume on any of the venues.” However, the team acknowledged that it had seen “tremendous demand and [is] working to increase the supply.”

It is not completely clear if the project team or the exchange will provide compensation funds. Binance only mentioned that it would “facilitate and implement the AEUR project team’s compensation plan” but didn’t specify where the funds would come from. Taking into account that the issuer is not a well-established company (at least compared to Binance), it is possible that Binance is trying to rectify the situation without scandal and to avoid user discontent.

Some may be unhappy that the exchange didn’t provide an appropriate mechanism to prevent stablecoin speculation, or at least clearly indicate that AEUR was a stablecoin. Others may complain the trading was not suspended earlier or even that Binance eventually did suspended trading and thus didn't let them sell the coins.

It is also possible that after recent significant and dramatic corporate changes, Binance aimed to demonstrate its new “user-first mentality,” reliability and loyalty to its users. Obviously, the announcement of compensation was warmly welcomed by the community.

However, the situation does raise a lot of questions. Generally, neither exchanges nor coin issuers compensate users for their bad decisions. And trying to speculate on a stablecoin without D'ing-YOR and realizing its core nature is clearly a very bad decision.