For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, stablecoins and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

A senior Indian regulator has admitted that the traditional finance sector needs to compete with the crypto world. Madhabi Puri Buch, who chairs the Securities and Exchange Board of India, said investors will vote with their feet unless tokenization and immediate settlement are offered.

"Everybody wants instant everything," she told reporters.

India currently offers T+1, meaning trades settle a day later. But from March 28, T+0 will become optional - meaning funds could clear the same day.

Over in Europe, the ECB is also considering a shift to T+0. Piero Cipollone, who sits on the bank's executive board, believes distributed ledger technology could play a key role. In particular, two directions are explored concurrently: the first one based on a unified ledger, and the other based on interoperability solutions such as Trigger, TIPS Hash-Link or DL3S. ECB published a proposal with learning objectives and KPIs for the exploratory work.

During a recent speech, Piero Cipollone warned that innovation shouldn't be at the expense of stability - and interoperability is crucial to prevent fragmentation in the market.

Mr Cipollone, a digital euro expert, has also offered hints on when the EU's central bank digital currency could launch. He believes the asset - which would offer person-to-person, e-commerce and point-of-sale payments - could start being rolled out to retail users in November 2025.

Across the Atlantic, there is nowhere near as much enthusiasm for a digital dollar.

"Nothing like that is remotely close to happening any time soon [in the U.S.]," said U.S. Federal Reserve Chair Jerome Powell answering a question about CBDCs during the semiannual Congressional hearing this week.

The digital dollar fell into a political trap in the United States. While President Joe Biden ordered government agencies to look into a digital dollar in 2022, his Republican rival Donald Trump recently vowed not to allow CBDC in the U.S - describing it as a "dangerous threat to freedom".

China has been streets ahead of the competition in the race to launch a CBDC - but there have been few updates on the digital yuan's progress in recent months.

According to local media outlets, the city of Jinan is now offering loans to entrepreneurs in digital yuan - capped at the U.S. equivalent of $28,000. Key benefits include cutting the time it takes for small businesses to receive their funds, and traceability over how they're spent.

Over in Israel, and the country's central bank (BOI) has offered a detailed update on how its CBDC - the digital shekel - would operate. The BOI has been actively exploring it since 2017 and is now working on the final aspects of it, such as the distribution model, interoperability with the existing systems, and the roles of each participant in the system. The paper details the bank's choices on those aspects as well as discusses the pros and cons of various ledger types.

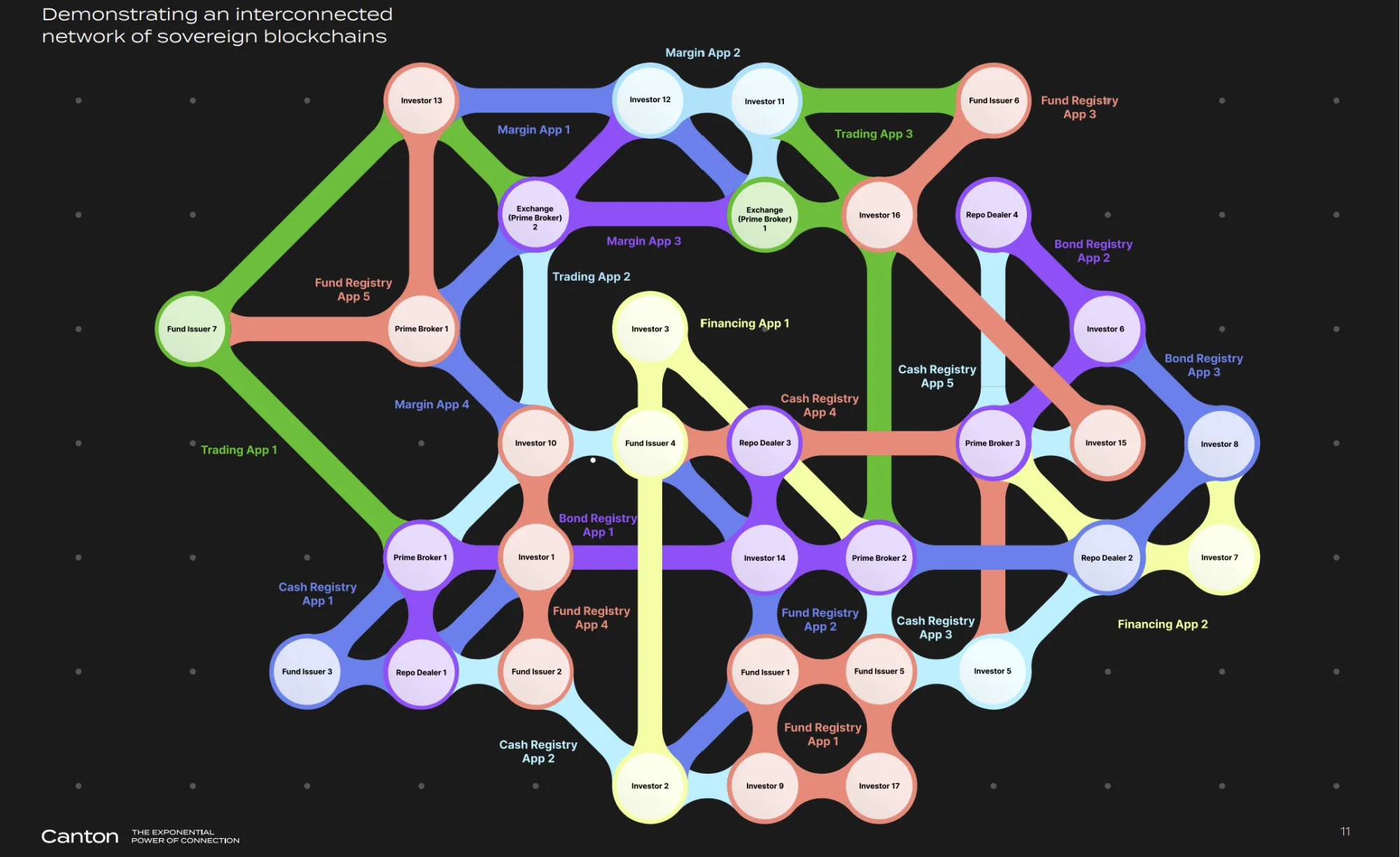

Elsewhere, the fintech company Digital Asset has announced that the Canton Network has undergone a four-day pilot. Big names including BNY Mellon, Goldman Sachs, Paxos, abrdn, BNP Paribas, Cboe Global Markets, Commerzbank, Nomura, Standard Chartered and Visa were involved. The participants were invited to transact tokenized securities and deposits across 22 dApps - including fund and bond registries, trading and financing solutions.

Digital Asset co-founder Yuval Rooz described the pilot as an "important milestone" because it allows "previously siloed financial systems to connect and synchronize in previously impossible ways while abiding by the current regulatory guardrails".

Further tests are set to take place in the coming months.