For all the key details of blockchain projects in the banking world, real-world asset (RWA) tokenization, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

The week began with international banking giant Standard Chartered indicating that its Chinese arm would be giving customers access to China's CBDC interconnection platform in order to recharge and redeem their e-CNY. This was swiftly followed by reports that three more 'foreign' banks, Hong Kong's HSBC and Hang Seng, and Taiwan's Fubon Bank had also added integration to the country's digital renminbi platform.

It has also been revealed that the Indian Central Bank is in discussions with the U.S. Federal Reserve, the Hong Kong Monetary Authority and Swift regarding the potential to use of its CBDC for cross-border payments.

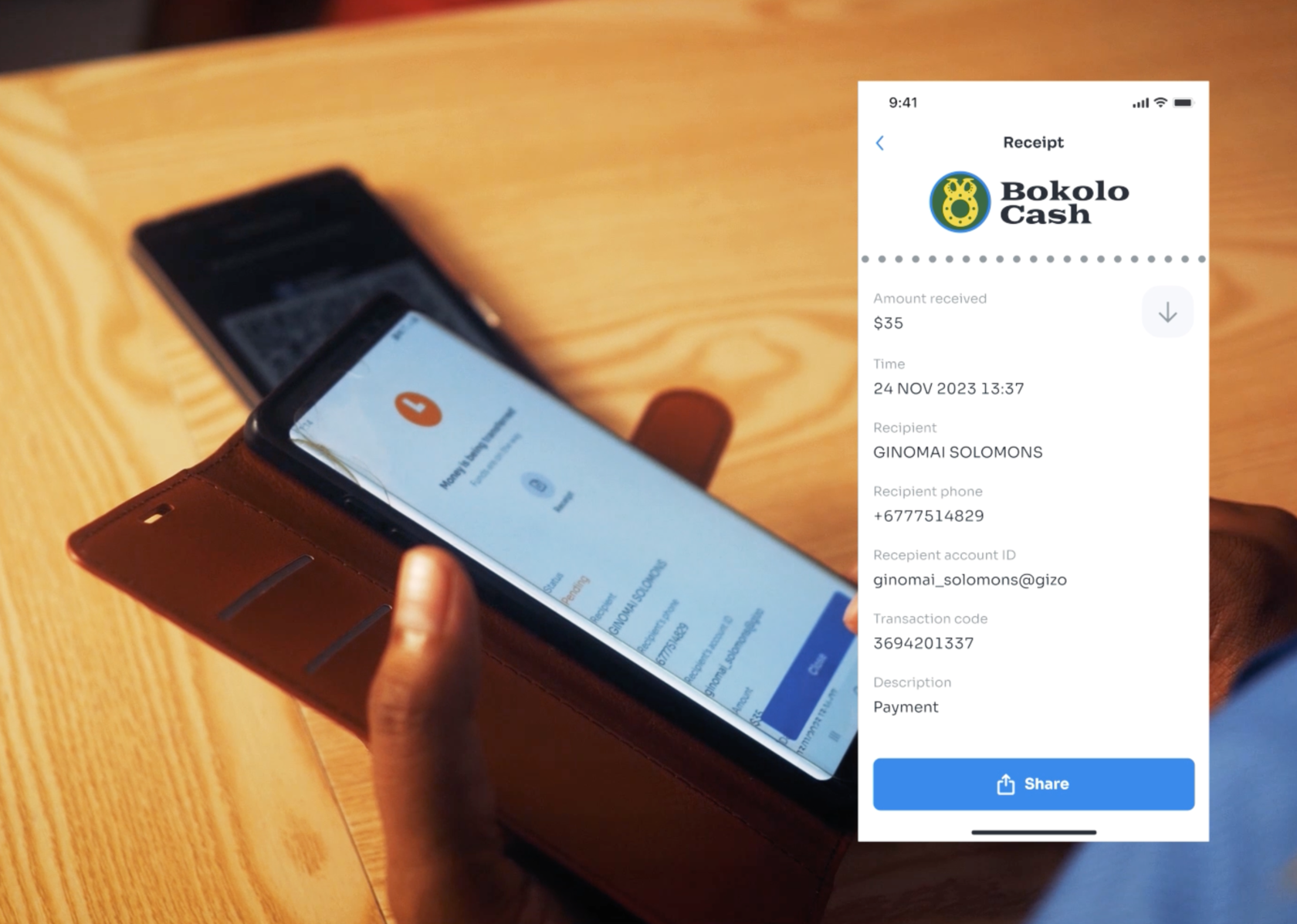

Later in the week, the Solomon Islands announced a proof-of-concept for its own CBDC project, called Bokolo Cash, which will see merchants in the capital Honiara accepting payments in Bokolo Cash from pilot project participants.

The European Parliament invited several experts to discuss the ECB's proposal for a digital euro, this week, with the only point of agreement being that it currently doesn't look particularly appealing from any angle: an Italian economist said there was no need for a CBDC, and the demise of cash was a myth; the former governor of the Bank of Spain said that a digital euro could potentially end the cycle of bank crises; and nobody could agree whether the limit on holdings should eventually be phased out or not.

The Bank of International Settlements has also been particularly vocal about CBDCs this week. On Tuesday, a BIS official claimed that central banks are not interested in citizens' personal data, attempting to quell a common concern with CBDCs. This was followed up on Wednesday by the publication of a report on Project Tourbillon, an exploration by the BIS into the possibility of payer anonymity in CBDC systems.

The BIS also this week published another document, regarding CBDCs' operational and information security risks to central banks, concluding that most central banks were not sufficiently prepared for such risks.

And finally, last week's roundup included news that Santander Private Bank was to offer high-net-worth clients in Switzerland the facility for BTC and ETH trading. Since then it has been reported that crypto safekeeping technology firm Taurus will provide a self-custody model for customers wishing to use this service.