The digital gold tokens will allow those holding small amounts of Zimbabwe dollars to exchange their money for tokens in order to store value and hedge against exchange rate volatility.

The development comes as the central bank of Zimbabwe (RBZ) is also mulling over releasing more Mosi-oa-Tunya gold coins onto the market to tame the recent depreciation of the Zimbabwe dollar on the parallel market.

The digital gold tokens, which will be backed by physical gold held by issuing authority, are designed to complement the Mosi-oa-Tunya gold coins by adding better granulation and by facilitating transactions.

RBZ Governor Dr John Mangudya confirmed the intention of monetary authority to continue the "golden standard" experiment started in 2022 and the objectives of the digital coin:

"We are addressing this demand for store of value by increasing the number of gold coins in the market so that we manage that demand.

"We shall also soon be introducing digital gold tokens to ensure that those with low amounts of local currency are able to purchase the gold units so that we leave no one and no place behind."

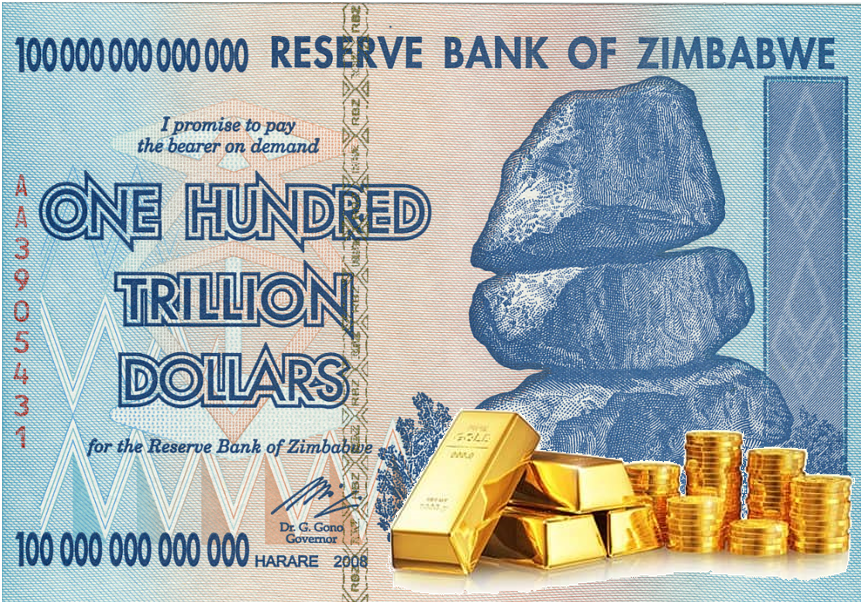

Zimbabwe has been struggling with currency depreciations and a high inflation rate for several decades. Zimbabwe's currency troubles date back to the early 2000s when the country experienced a severe economic crisis that led to hyperinflation. At its peak in 2008, the inflation rate reached a staggering 231 million percent, leading the government to abandon the Zimbabwean dollar and adopt foreign currencies, primarily the US dollar and the South African rand.

In 2016, the government introduced a new currency, the "bond note," trying to ease the country's dependence on foreign currencies. However, within months, the bond note began to depreciate rapidly against other currencies, leading to skyrocketing inflation rates. The government responded by introducing new denominations and attempting to limit currency exchange, but these measures did little to slow the depreciation.

In 2019, the government introduced a new currency, the Zimbabwean dollar, which it hoped would stabilize the economy and control inflation. However, the currency's value has continued to plummet, and inflation rates have remained high.

In August 2022 RBZ has even announced the completion of the roadmap for Zimbabwe CBDC development. Yet, the only thing that worked so far was the natural gold.

The strong internal demand for the golden coins made it a success in the eyes of the central bank. Started in 2022, this experiment has already seen multiple iterations with the introduction of digital representation of the gold currency being the latest. We will Observe how it develops.