It seems that with the awards for Ethereum staking after “The Merge” everything will not be as well as the community expected. Or does it just look that way? And what awaits us after the update?

A few days have passed since my last review of the situation around “The Merge”, as the update has already been postponed yet again. If this is the first time you’ve heard of “The Merge”, then, I invite you here. You can read all about the postponement of “The Merge” here, and now I will tell you about the possible future consequences that we will face once the update finally happens.

In the last article about “The Merge”, I touched a little on the topic of Ethereum staking. Staking is an alternative to mining, in which the user simply needs to store their assets in a wallet. Also, staking is one of the most anticipated features of the Ethereum network after the update. According to experts, thanks to this feature, users will be able to invest their cryptocurrency and receive from 12% to 15% APY. But, such were the estimates before the news about the postponement of “The Merge”.

Now, the situation is a little different. More than 11.5 million ETH is stacked and closed in the Beacon Chain, which is about 9.5% of Ether’s circulating supply. The number of staked ETH continues to grow, because users expect to receive a reward not at the rate that is now (5–7%), but at the expected higher rate of 12–15%.

But, IntoTheBlock in their analysis came to the conclusion that the delay of the update will increase the amount of staked ETH, which will cause a decrease of APY. IntoTheBlock experts suggest that the final rate after “The Merge” will be in the range of 6–8%.

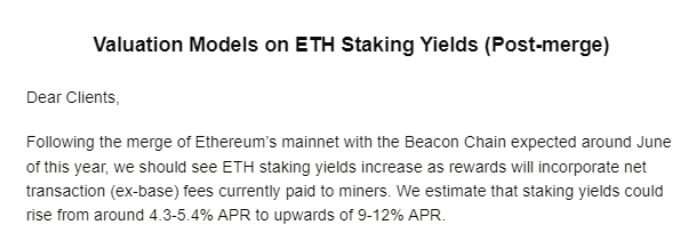

Coinbase (cryptocurrency trading and investing platform) adheres to more optimistic predictions. Recently, they told their clients that the staking rewards after “The Merge” will rise from the current 4.3–5.4% to 9–12%.

Coinbase’s Appeal to Customers

Alex Kruger, a trader and analyst, also shared his opinion about staking. “I am very bullish on ether for the summer as ether staking would offer returns better than real or inflation-adjusted yields in traditional markets after the merge,” Kruger told to CoinDesk. He consider that ether staking yields are likely to be in the range of 10% to 15%.

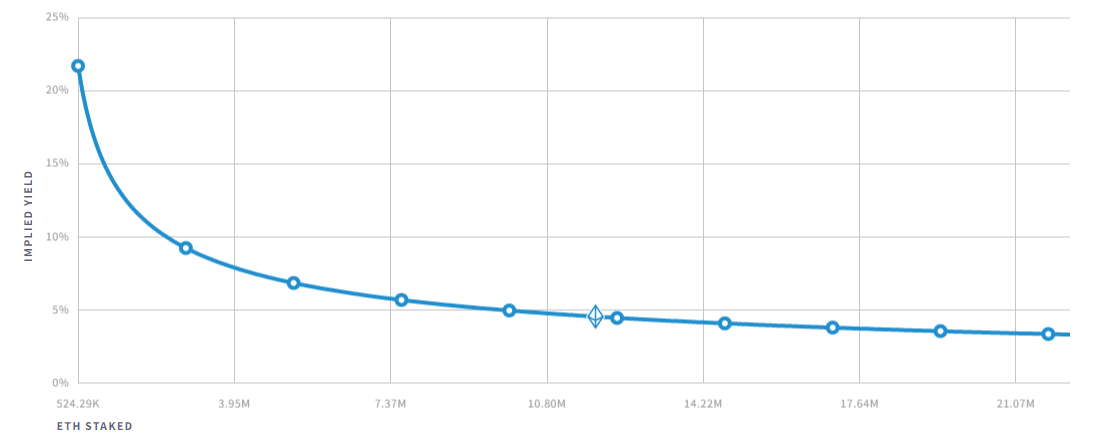

Expectations are different, and it’s confusing. The main problem with high expectations is that they attract more attention and, as a result, investment. And the ETH staking process is developed in such a way that an increase of the amount of staked ETH reduces the reward received by the user. Unfortunately, the amount of staked ETH is inversely proportional to the reward for it. The abovementioned is well demonstrated by the graph from staked.us:

Estimation of APY as staked ETH increases

Perhaps it was high expectations that motivated users to stake their ETH, which led to a decrease of the expected reward. But, staking is not the only thing that awaits us after “The Merge”. According to the developers, the network will become more secure and stable, and the detrimental impact of Ethereum on the environment will be zero after staking replaces mining. Also, the developers are going to increase the protection of the blockchain from potential attacks and expect a growth of investments in the Ethereum network.

“The Merge” is an extremely risky and large-scale update. But it seems to be worth it, because it will be followed by mostly positive changes. Only miners will face problems, but if we take into account the continuous postponements of updates, they have time to change the blockchain or sell gear and switch to staking. Well, to draw a more accurate conclusion — we need to wait for ‘The Merge’. I hope it will happen someday. Well friends, until the next delay!