Card payments behemoth Visa has announced that it will expand a pilot scheme in which cross-border transaction settlement is carried out using stablecoins. In a press release on Tuesday, it noted that international settlements with merchant acquirers Worldpay and Nuvei would now be made using USDC on the Solana blockchain.

The initial pilot has been running since 2021, and involved card issuer Crypto.com fulfilling international payments made on its Australian-issued Visa card via USDC on the Ethereum network. Visa says that this scheme has already moved millions of dollars worth of USDC to settle fiat-denominated payments made through VisaNet.

The expansion of the scheme will enable the stablecoin to be used for the settlement of another element of the Visa payment process; that of Visa itself making payments to the merchant acquirers.

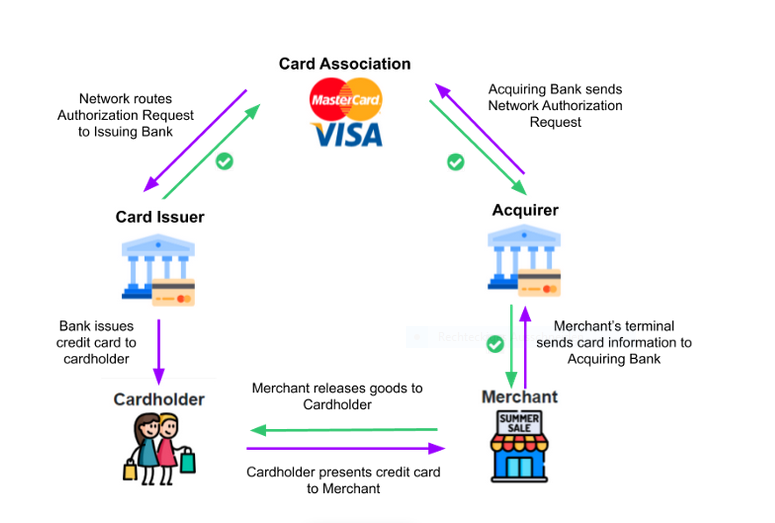

But what is all this talk of issuers and acquirers? Doesn’t Visa just take the payments from cardholders and pay the retailers? Unfortunately, as in a great many legacy payment systems, the reality is not quite that simple.

While cardholders can make seemingly instant payments for goods and services at any merchant connected to the worldwide Visa network, the actual funds take much longer to arrive with the merchant. This involves multiple additional parties and processes, especially in the case of cross-border transactions.

On one side of the equation is the bank or other financial institution which issues the card to the cardholder. This is known as the issuer, and in the case of Visa’s earlier USDC pilot scheme this would be Crypto.com.

On the other, there is the merchant acquirer, which in the expanded scheme will include Worldpay and Nuvei. The acquirer deals with the merchants, collating the retail transactions which have been accepted for goods and services and presenting these to Visa.

Visa collects payment from the card issuer and transfers this to the merchant acquirer, which then distributes this to the retailer. The whole process can take two or three days, and involve multiple international bank transfers and foreign exchange transactions. This goes some way to justifying Visa’s sky-high fees for merchants to accept transactions via their network.

However, now that the pilot scheme has been extended, two branches of this process are now being enabled via USDC on the significantly faster and cheaper Solana blockchain. So once this process is proven and rolled out more widely, surely the savings could be passed on to merchants in the form of reduced fees?

Or perhaps Visa will just absorb the extra funds into its quarterly profit figures, with very little benefit seen by retailers. Do we really need to wait and Observe?