Latest Articles

89 Articles

Tether issues the world's largest stablecoin by market capitalisation, USDT. It is referencing (pegged to) the U.S. dollar. USDT is classified as a centralized stablecoin, backed by U.S. dollar deposits, short-term U.S. Treasuries, cash equivalents and other Tether's reserves. The company also issues EURT, XAUT and other stablecoins.

Tether issues the world's largest stablecoin by market capitalisation, USDT. It is referencing (pegged to) the U.S. dollar. USDT is classified as a centralized stablecoin, backed by U.S. dollar deposits, short-term U.S. Treasuries, cash equivalents and other Tether's reserves. The company also issues EURT, XAUT and other stablecoins.

Tether’s omnichannel USDT0 rapidly expands across multiple chains. Built on LayerZero’s Omnichain Fungible Token standard and supported by Legacy Mesh, USDT0 unifies liquidity across blockchains. Unlike Circle’s Bridged USDC, it offers decentralized, flexible, and incentivized cross-chain support.

Stablecoins remain one of the top use cases in crypto, with the market showing tremendous growth year over year. USDC market share climbs to 25% taking 4% from USDT. The velocity measure for USDT of Tron and USDC is almost equal, while USDT on Ethereum moves two times slower.

Twenty One Capital, backed by Tether, Bitfinex, and SoftBank, is going public with over $3.9B in Bitcoin reserves. Structured by Cantor Fitzgerald via SPAC, the firm aims to dominate institutional BTC finance

Sasha Markevich

Twenty One Capital, backed by Tether, Bitfinex, and SoftBank, is going public with over $3.9B in Bitcoin reserves. Structured by Cantor Fitzgerald via SPAC, the firm aims to dominate institutional BTC finance

Sasha Markevich

Tether’s omnichannel USDT0 rapidly expands across multiple chains. Built on LayerZero’s Omnichain Fungible Token standard and supported by Legacy Mesh, USDT0 unifies liquidity across blockchains. Unlike Circle’s Bridged USDC, it offers decentralized, flexible, and incentivized cross-chain support.

Alexander Mardar

Stablecoins remain one of the top use cases in crypto, with the market showing tremendous growth year over year. USDC market share climbs to 25% taking 4% from USDT. The velocity measure for USDT of Tron and USDC is almost equal, while USDT on Ethereum moves two times slower.

Alexander Mardar

Thailand’s SEC adds the two major dollar-backed stablecoins to its approved crypto list.

Rebecca Denton

From football and agribusiness to cloud infrastructure, AI, and global blockchain education, Tether continues its aggressive diversification, expanding its portfolio and strengthening ties with governments worldwide.

Rebecca Denton

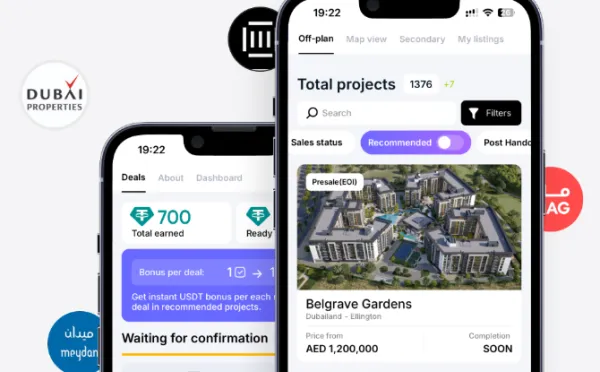

Tether has partnered with Reelly Tech, a real estate platform based in the United Arab Emirates, to integrate USDT into transactions.

Rebecca Denton

Tether is relocating its headquarters from the British Virgin Islands to El Salvador, having secured a digital asset service provider license. "This move to El Salvador will be the first time we're going to have a physical headquarters," CEO Paolo Ardoino told Reuters, adding that the

Rebecca Denton

Tether should be on the verge of delisting due to new regulations, but major exchanges are still not communicating clearly with users.

Rebecca Denton