The problems of USDD, like many others, were provoked by the collapse of FTX. Following the crypto exchange insolvency, on November 10, the stablecoin price fell below the one dollar. The situation stabilized in a few weeks.

Now, we observe its second serious deviation since June. On December 12, the price of the stablecoin fell to $0.9715 and has not yet recovered since then.

In November Justin Sun explained the USDD stablecoin depeg by the selling pressure from the liquidation of FTX holdings. However, if after a record fall to 0.9514 in June, the USDD managed to return the peg to the dollar after a while, then after the fall in November, the peg could not be restored.

This time Justin Sun again reassured users that there is no internal problem to the stablecoin and pointed to the USDD's record collateral ratio of 200%.

In case anyone ask about #USDD, it is 200% collateralized ratio on https://t.co/bQwdLAEw0B. You can check all live data on blockchain 24*7. 😎 pic.twitter.com/whbJrKpMoh

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) December 12, 2022

At the time of writing, USDD's Market capitalization is $711,658,269 and it ranks 8th among all stablecoins by market capitalization.

Of course, analysts from Twitter did not ignore the long deviation of the stablecoin from $ 1, once again pointing out that the algorithmic USDD is a clone of the collapsed Terra, as well as highlighting the shrinking Curve pool and problems with reserves as weaknesses.

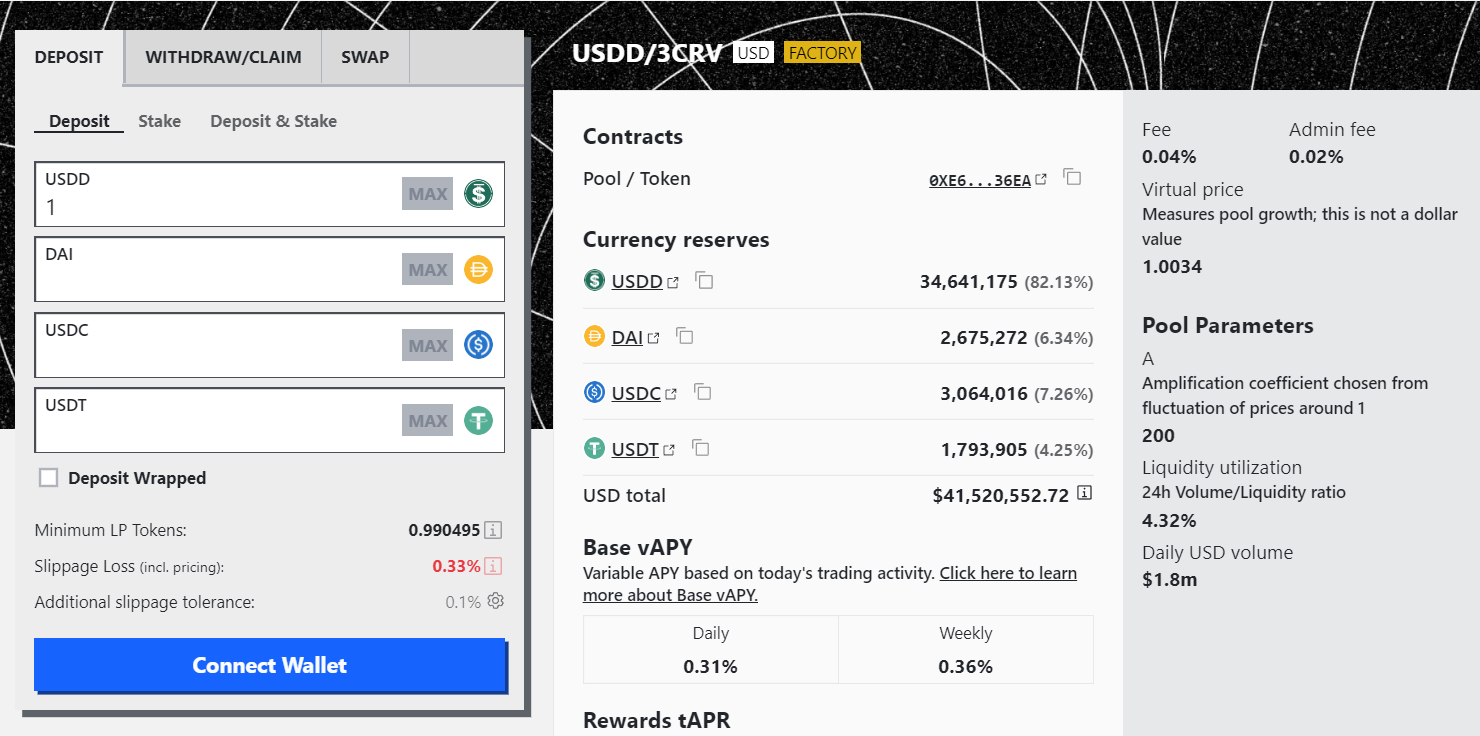

The panic affected the balance of liquidity on major stablecoin markets. USDD/3CRV liquidity pool on the Curve platform are drained of other stablecoins, with 82.13% of the liquidity in the entire pool filled with USDD. The second largest position in this pool, USDC, has only 7%.

Let's hope that comparisons of USDD with the algorithmic stablecoin Terra will be in vain and the binding will be restored in the near future. But a drop in the level of user confidence in stablecoin can greatly complicate this process or even lead to a complete drop in USDD. We will continue our observations and share the news with you.

USDD (Decentralized USD) is an algorithmic stablecoin introduced by Justin Sun in April 2022. At its inception, USDD had an algorithmic design, similar to Terra UST. Following the collapse of Terra's UST in May 2022, the team adjusted USDD's model and transitioned to an over-collateralized model. The collateral reserve of USDD includes cryptocurrencies, such as Bitcoin TRON's native token TRX, and stablecoins like USDT and USDC. USDD is reporting the highest collateralization ratio among similar products, exceeding 200%.