Circle’s first earnings report since its June IPO was more than a set of quarterly numbers — it was a signal that the company’s stablecoin strategy is working at scale.

The most striking figure wasn’t on the income statement, but on-chain: the amount of USDC in circulation has nearly doubled year-over-year, reaching $61.3 billion by the end of June and rising further to $65.2 billion by August 10.

While still far from Tether’s USDT market cap of $165 billion, USDC’s market share in the quarter strengthened slightly, edging up from 24% to 26%.

Financial Highlights

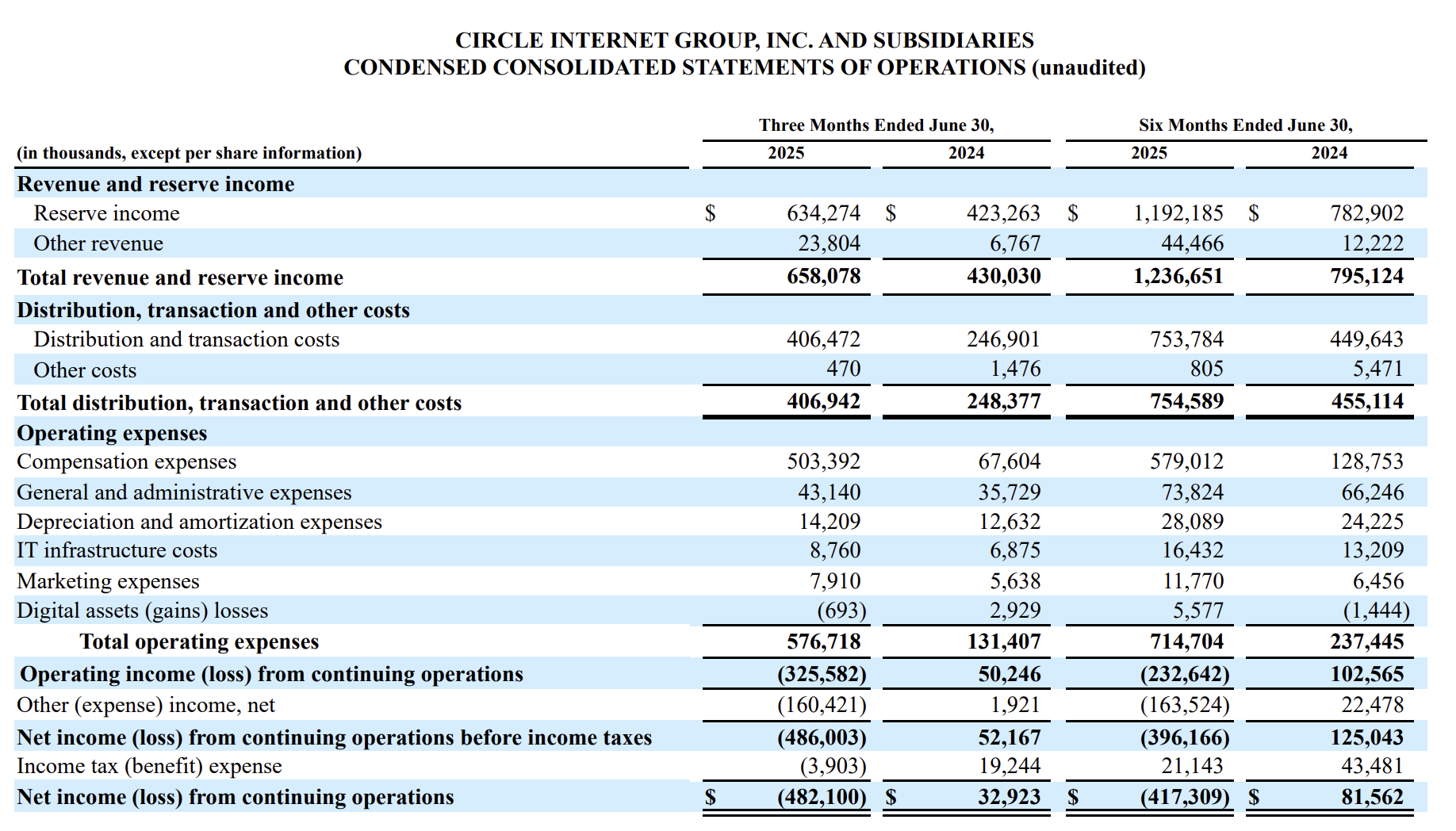

Financially, Circle delivered on the growth story. Revenue and reserve income jumped 53% year-over-year to $658 million, while adjusted EBITDA rose 52% to $126 million, underscoring operational strength.

In Q2 2025, Circle earned $634 million in reserve income against $61.1 billion in deposits from stablecoin holders, translating into an annualized yield of about 4.15%. In Q2 2024, reserve revenue was $423 million on $43.7 billion in deposits, an annualized yield of roughly 3.87%. This shows that not only did Circle’s revenue grow sharply year-over-year, but its effective return on customer deposits also improved.

While the extra cash was retained, the company still reported a quarterly loss, driven almost entirely by $591 million in stock-based compensation, less $65.6 million capitalized for internally developed software.

Much of this expense was triggered by the June IPO, which unlocked and sharply increased the value of long-held equity awards. Most of the benefit went to founders, early executives, and long-tenured staff who held large blocks of vested options, which surged in value once Circle’s shares began trading publicly.

Circle’s IPO

Circle's IPO – which raised $1.2 billion, twice the originally planned amount — marked a defining moment in the company’s corporate trajectory.

Beyond providing a direct infusion of capital, the offering transformed Circle’s capital structure by converting all $1.14 billion of redeemable convertible preferred stock into common equity.

The influx of cash boosted total stockholders’ equity from $570 million at year-end 2024 to $2.37 billion by June 30, 2025, providing ample reserves to meet regulatory compliance.

Under the EU’s MiCA framework, stablecoin issuers face explicit own-funds requirements — typically at least 2% of reserve assets, rising to 3% for “significant” tokens. Circle’s strengthened equity position means it can comfortably meet these thresholds if it issues in MiCA jurisdictions. In the U.S., the GENIUS Act does not yet define numeric capital ratios, but forthcoming rules are expected to impose prudential capital standards, making Circle’s post-IPO equity a valuable buffer and competitive advantage.

Circle Payments Network

In May, Circle launched the Circle Payments Network (CPN), marking its expansion beyond its traditional dominance in DeFi and programmable finance into broader industry verticals. Until now, Tether had held the lead in real-world payment flows, but CPN aims to close that gap by providing a secure, interoperable layer for vetted financial institutions to move value across borders using stablecoins.

A key feature of CPN is its institutional-grade Request for Quote (RFQ) system for price discovery and on-chain settlement within its built-in FX engine. This allows participating financial institutions to obtain competitive FX quotes and settle transactions in near real time using stablecoins like USDC.

With four payment corridors already active and more than 100 institutions in the onboarding pipeline, CPN could quickly position Circle as a serious player in enterprise payments — and help diversify revenue away from its heavy reliance on interest income from reserves.

Arc: Circle’s Own Layer-1 Blockchain

The other major reveal was Arc, a purpose-built Layer-1 blockchain that Circle describes as “internet-native financial infrastructure.” EVM-compatible and tuned for sub-second settlement, Arc promises native stablecoin foreign exchange, opt-in privacy features, and seamless interoperability with other blockchains. The public testnet is expected to launch this fall.

While the concept of a stablecoin-optimized blockchain is not new — projects like Plasma have pursued similar goals with low fees and low latency to attract issuers — Arc offers Circle more than just technical advantages. It gives the company control over settlement, adds utility for USDC as a fee currency, and integrates its currency, payment network, and blockchain into a single ecosystem, effectively locking in both liquidity and developer mindshare.

All of these developments arrived against a favorable policy backdrop: the passage of the GENIUS Act, creating the first federal framework for stablecoins. For Circle, long positioned as the regulated, transparent counterpoint to offshore competitors, that framework offers both legal clarity and a competitive edge. Whether this positioning will allow Circle to overtake Tether — despite Gresham’s principle that “bad money drives out good” — remains to be seen.