Uniswap continues solidifying its position as the leading decentralized exchange (DEX) within the Ethereum blockchain ecosystem. Unlike traditional, centralized exchanges controlled by a single entity, Uniswap operates through a network of automated smart contracts, facilitating peer-to-peer cryptocurrency swaps transparently and permissionless.

Last week, Uniswap announced the integration of Blast, a Layer-2 scaling solution for Ethereum, launched back in February 2024.

The Ethereum mainnet faces two primary challenges that Uniswap and other DEXs are trying to address through L2 solutions like Blast: Scalability and gas fees. Blast has faster transaction speeds and lower fees than the Ethereum mainnet, allowing users to conduct swaps and provide liquidity more efficiently.

Due to limitations in Ethereum's current architecture, the network can only process a limited number of transactions per second. This can lead to congestion, especially during periods of high activity. Transactions take longer to complete when the network is congested, and gas fees surge significantly. As a result, even simple actions like swapping tokens become cost-prohibitive for some users.

Blast focuses on offering native yield for ETH and stablecoins held in wallets on their platform. Users can potentially earn interest on their holdings without actively participating in DeFi protocols. The Blast integration allows users to access faster and more cost-effective swaps and liquidity provisions while introducing native yield for Ethereum (ETH) and the USDB stablecoin.

Uniswap supports both Uniswap v2 and v3 for liquidity provision on Blast. On v2, liquidity providers (LP) earn native yield for pools where one of the tokens is USDB or wrapped ETH (wETH), similar to holding these tokens in a Blast wallet.

While Uniswap v3 offers flexibility for LP2, due to the technical complexities of concentrated liquidity, v3 pools on Blast do not currently earn native yield.

As part of the Blast launch, Uniswap and Layer3 collaborated on a "quest" to reward users and released a commemorative NFT minted on Zora to celebrate.

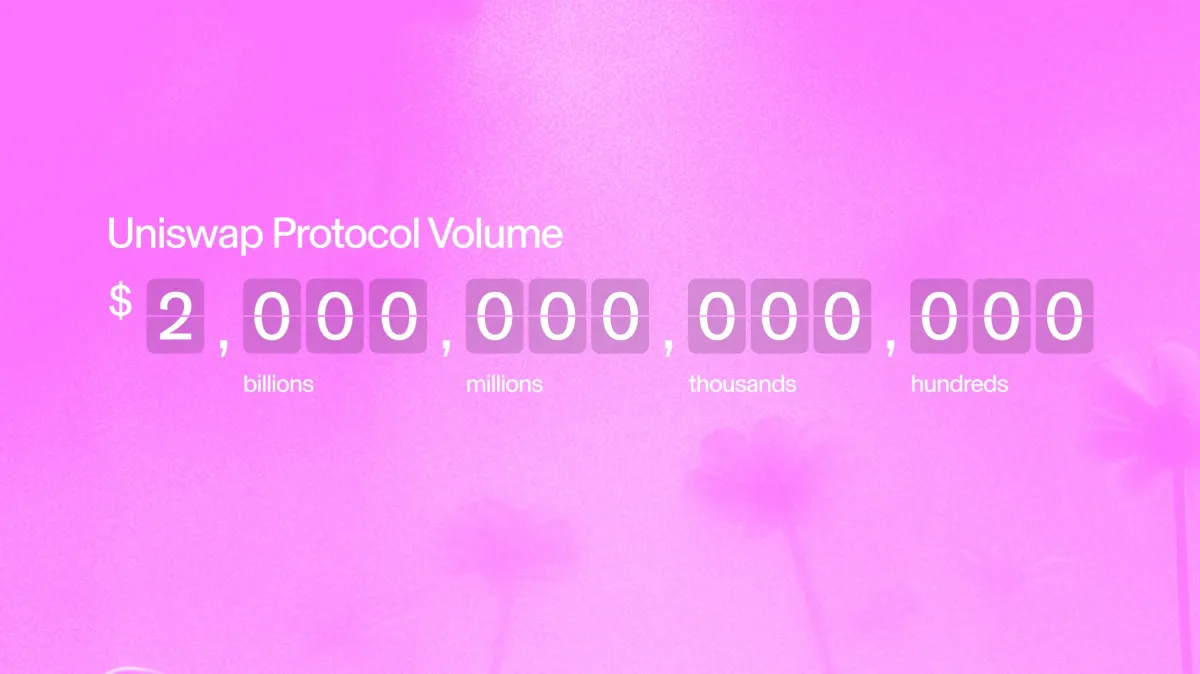

On April 5, Uniswap surpassed $2 trillion in all-time protocol volume across all the blockchains it supports, including Ethereum, Polygon, Optimism, Arbitrum, Celo, BNB Chain, Base, Blast, and the Avalanche Network. Launched in November 2018, the DEX has achieved a major milestone, less than two years after reaching the $1 trillion mark in May 2022. To mark the occasion, Uniswap offered a small USDC reward for the user who showed the historic moment first on the Dune countdown.

Things you love to see: pic.twitter.com/yfy6Ns258f

— Uniswap Labs 🦄 (@Uniswap) April 5, 2024