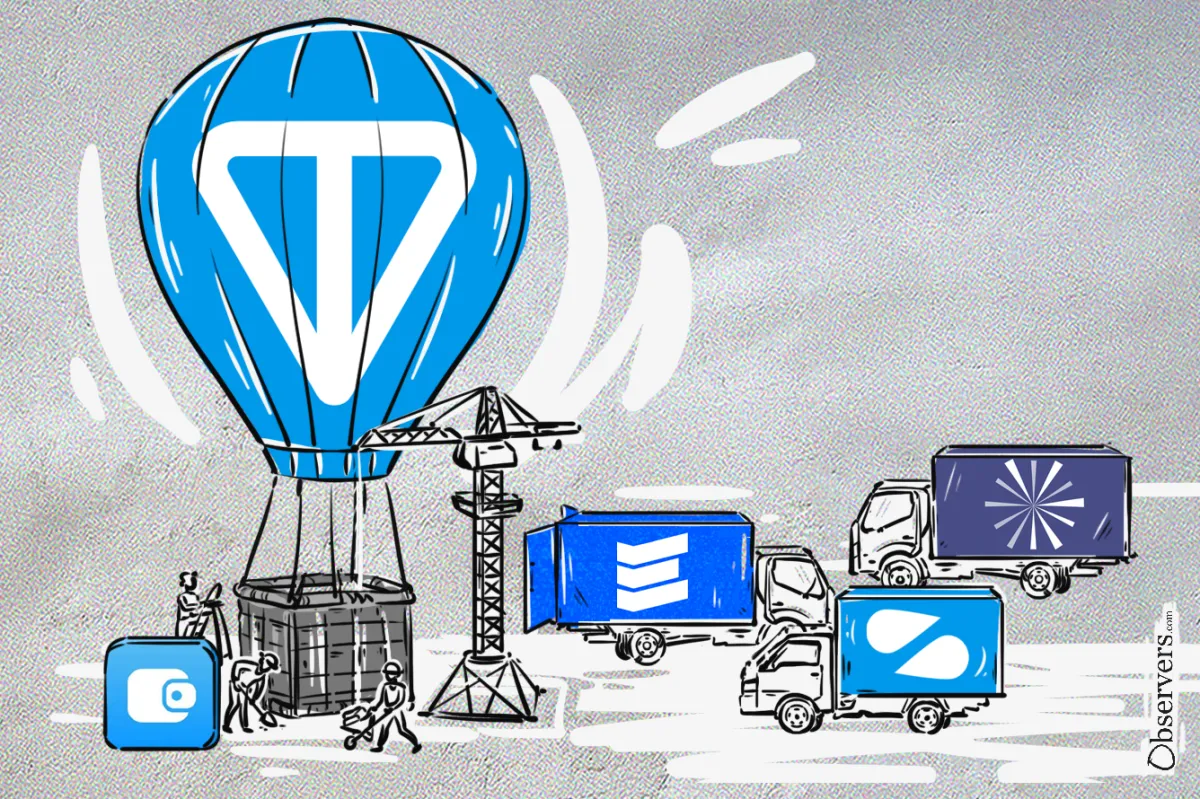

In January 2025, the TON Foundation and Telegram announced an exclusive partnership, naming TON the unified blockchain infrastructure for all Web3 solutions within the Telegram platform.

What was behind this move—and how have the past six months shaped the network?

The preceding year was groundbreaking for TON. In 2024, the network shifted from quiet buildup to high-stakes acceleration, driven largely by integration with Telegram and the viral success of mini-games like Hamster Kombat.

Also in 2024, TON inked a native USDT integration with Tether, embedding stablecoin support directly into the network and laying the groundwork for broader DeFi adoption.

However, the surprise arrest of Telegram CEO Pavel Durov in France in August 2024—over alleged platform misuse—shook the market. Toncoin fell by 20–35%, ecosystem momentum stalled, and investor sentiment temporarily soured.

Yet in the first half of 2025, TON rebounded. In May, the TON Foundation launched a tiered support framework through the revamped TON Builders Portal. This initiative focused on five strategic verticals—Payments, Simplified DeFi, GameFi, Telegram’s In‑App Economy, and AI—offering mentoring, funding access, and Telegram-native promotion across project development stages: Launch, Grow, and Scale. This was followed by the Champion Grants initiative, delivering targeted funding, audits, user incentives, and promotional campaigns for top-tier projects in those same high-growth areas. The combined effect catalyzed a wave of ecosystem growth, with increased innovation and user engagement.

Among standout projects:

- STON.fi, the largest DEX on TON, launched Omniston, a cross-chain liquidity aggregator to address fragmentation.

- TONSWAP is a new DEX and launchpad, created by the Soramitsu team, designed to enhance user experience, liquidity within the TON DeFi, and special features for the TON tap-to-earn coins (or Jettons as they’re known in the TON ecosystem).

- EVAA, the first native lending protocol on TON, partnered with FIVA to bring yield tokenization and fixed-income strategies to Telegram users.

On the stablecoin front, USDT adoption deepened, with TON joining Ethereum, Arbitrum, BNB Chain, and Avalanche as an official network supported by LayerZero’s cross-chain USDT transfers. Ethena Labs also launched USDe and tsUSDe, yield-bearing synthetic dollars accessible through STON.fi—offering up to 18% APY. As a result, TON’s stablecoin market cap surpassed $650 million by mid-2025, with USDT accounting for over 80%.

TON’s core infrastructure also saw substantial upgrades:

- The Accelerator Mainnet Upgrade, part of TON Core’s strategic roadmap, introduced optimizations for validator performance, smarter network load distribution, and improved transaction throughput. These enhancements aim to ensure the network can support both high-frequency transactions and growing application demands.

- In July, the TON team released TOLK 1.0, the network’s native smart contract language, offering expanded IDE support and a more intuitive development experience. This milestone significantly lowered the barrier for building complex dApps on TON, streamlining everything from contract deployment to debugging.

- Cross-chain interoperability also progressed with the launch of the TON-BTC bridging mechanism, developed by RSquad. This new solution enables fast, low-cost transfers of Bitcoin into TON, replacing older, less secure bridges and aligning with the network’s broader cross-chain strategy.

- To handle the increasing load from DEXs and blockchain-based games, TON Factory was unveiled by Broxus. Designed to support ultra-high-throughput applications, the platform targets up to 35,000 transactions per second with near-second finality. It includes the Tycho Protocol, engineered specifically for performance-intensive use cases, pushing TON closer to enterprise-grade scalability.

Wallet infrastructure kept pace. Telegram’s native TON wallet became available for U.S. users, while Tonkeeper Pro and MyTonWallet added advanced features like multisig, 2FA, USDe staking, and improved bulk transfer support—enhancing the ecosystem's DeFi readiness.

Despite the broader NFT market downturn, TON’s NFT segment showed resilience, largely driven by Telegram Mini Game assets. Projects like Tonnel and MRKT recorded significant growth, while Telegram Collectible Gifts, launched in January, generated $43.6 million in trading volume by May. Telegram usernames and DNS domains also remained high-volume NFT categories, reflecting a unique blend of utility and tradability.

TON in Numbers: An Extended Network of Low-Value Assets

Thanks to its strategy of migrating Telegram mini-app users to on-chain wallets, TON saw explosive growth in user activity: a 30x increase in wallet count and a 13x rise in daily transactions throughout 2024. This trend continued into early 2025, with between 170,000 and 590,000 daily active wallets and 3.1 million new wallets created in just two months. Monthly active users reached up to 5 million, and weekly transactions soared to 20–30 million—placing TON among the top blockchains by transaction volume.

However, this surge has not been matched by capital inflow. As of mid-2025, DeFi TVL on TON hovered around $200–275 million, mostly concentrated in liquid staking protocols like TONstakers. By contrast, Solana—with similar transaction throughput and comparable daily wallet numbers—hosts over $10 billion in DeFi TVL.

This sharp divergence supports the assumption that TON’s onboarding strategy generates massive volume but low-value interactions per user. While TON is gaining momentum in NFTs and tooling, its economic density remains thin—suggesting a network still transitioning from engagement-heavy to value-rich.

Nevertheless, TON now ranks among the 20 largest crypto projects with a market capitalization of $7.7 billion, underscoring investor confidence in its long-term potential. As the unique collaboration between a messenger and a blockchain deepens, TON’s next challenge is to convert its vast reach into real economic weight. We'll be watching closely to see how this bold fusion of scale and infrastructure continues to evolve.