Since the end of October, Thorchain has experienced remarkable growth, with its token value nearly tripling. In the past week alone, the project has witnessed over $1.3 billion in trading volume, positioning it as the third-largest decentralized exchange, trailing only behind Uniswap V3 and PancakeSwap.

Source: defillama.com

But what makes Thorchain so special, and why are its price and volume surging?

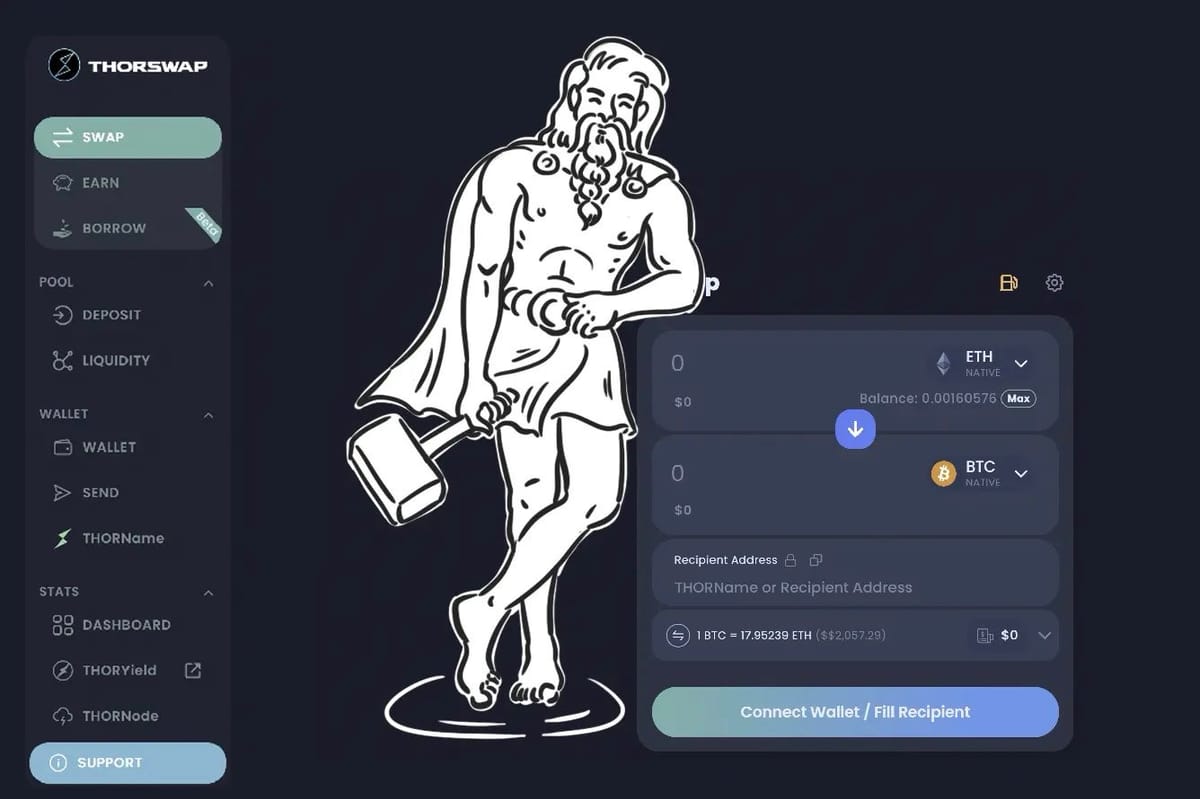

Thorchain stands out as the first and largest exchange for cross-chain swaps. It uniquely enables users to swap native assets across different blockchains in a decentralized manner, a functionality not offered by any other DEX on the market.

For instance, on Uniswap V3, the current largest DEX by volume, you are limited to trading ETH and Ethereum tokens (ERC-20). In contrast, Thorchain allows direct swaps of native assets between blockchains, like swapping native BTC on the Bitcoin blockchain for native ETH on the Ethereum blockchain.

The exchange is rapidly gaining popularity with Bitcoin traders who prefer decentralized trading. Yesterday, it accounted for over $200 million in Bitcoin trading volume, roughly 2% of the global total.

The surge in trading volume has attracted significant liquidity to the protocol, with its Total Value Locked (TVL) more than doubling since October. Notably, the trading fees generated by the protocol are distributed to liquidity providers, further encouraging an influx of liquidity.

However, Thorchain goes beyond being just a decentralized trading hub. It also facilitates cross-chain lending and borrowing, allowing users to lend or borrow native Bitcoin and other cryptocurrencies directly. This bypasses the need for centralized exchanges, banks, and eliminates the requirement for KYC and other verification processes.

Currently, the available Annual Percentage Rate (APR) on Bitcoin is around 6.63%, with the APR on stablecoins at around 20%.

Source: thorswap.finance

While crypto users are accustomed to DeFi swaps, liquidity pools, and lending/borrowing on Ethereum, many other blockchains simply lack DeFi. With its cross-chain functionality, Thorchain can bring DeFi to Bitcoin and other ecosystems.

Although Thorchain offers some unique services for traders, hackers have also exploited these to hide their actions and move stolen cryptocurrency between blockchains. A notable example is an incident reported by on-chain analyst ZachBTC, where a hacker moved about $27 million via Thorchain. In reality, hacks are frequent in the crypto world, and Thorchain is a common tool used in these illicit activities. Whether this could lead to regulatory consequences is something that only time will reveal.

So far, the protocol has offered valuable functionality for DEX traders, and it is likely to gain even more adoption as the bull market unfolds.