In Q2 2025, blockchain games attracted about 4.8M daily unique active wallets (dUAW)—still a sizable share of Web3 activity despite a soft quarter. The “gaming token” universe sits around $14.1 billion in market cap, though that headline bundles infrastructure, metaverse, and x-to-earn tokens with actual games.

Beneath those inflated caps is the question that matters: has the industry delivered on its original promise—true asset ownership (players hold items, not servers), controlled inflation (assets don’t crater overnight), and transferability (items that move across versions and, ideally, across games)?

We reviewed top names in blockchain gaming, including flagship games, publishers, and major platforms, to observe:

- What they delivered toward the promise (ownership, inflation, transferability, UX) and,

- Where they misstepped.

We excluded meme-coin “games,” metaverse-only social sandboxes, pure x-to-earn wrappers, and agent sims without real gameplay.

Sky Mavis / Ronin / Axie

Sky Mavis took a vertical path: it built Ronin, a game-tuned, EVM-compatible blockchain; launched its flagship game Axie Infinity; and wrapped it with first-party rails—wallet, DEX, and marketplace—for full end-to-end UX control.

Technically, Ronin was designed as an Ethereum sidechain, enabling asset transfers between the two chains. In practice, however, most activity remained confined within this self-contained Ronin stack, creating a local “island.”

Axie had problems of its own, with its main earnable token, SLP, flooding cash-out markets while facing little demand inside the game economy.

In March 2022, the Ronin Bridge was exploited for more than $600 million, one of the largest hacks in crypto history. The incident severely undermined trust in the blockchain, triggering a sharp drop in both total value locked (TVL) and user activity, and accelerating the collapse of Axie-related tokens.

Ronin enjoyed a brief resurgence in 2024 when Pixels migrated from Polygon, but overall user interest never fully recovered.

In August 2025, Sky Mavis announced that Ronin would transition back to an Ethereum L2, citing Ethereum’s improved throughput and the gravitational pull of its investor ecosystem.

Immutable / Immutable X / Gods Unchained, Guild of Guardians

Immutable emerged during the NFT boom with the launch of Immutable X, an Ethereum Layer-2 tailored for NFT trading and gaming assets. By offering gas-free minting and carbon-neutral transactions, it positioned itself as infrastructure for the coming wave of digital ownership.

Rather than betting on a single flagship game, Immutable spread across multiple titles. Gods Unchained, its card-battler, remains the strongest performer, generating over $25 million in secondary sales and cultivating a large base of active traders. The mobile RPG Guild of Guardians also showed strong early traction, with unusually high retention rates during demo testing. These successes contrasted with other partnered games that struggled to scale, underscoring the challenge of sustaining engagement even with seamless asset rails. Immutable’s experiments spanned trading cards, RPGs, and MMO-style experiences, but the common thread was the idea that NFTs could embed real ownership into gameplay.

In 2024, Immutable rolled out Passport, its wallet-plus-identity system that stripped out crypto friction. With one-click social logins and automatic wallet creation, Passport became the primary gateway to its ecosystem, surpassing 4 million sign-ups in its first year. Most users came through Google login — a signal that players don’t really care about on-chain ownership or key management, so long as the experience is smooth.

Immutable’s bet is that abstracted infrastructure can bring Web2 players into Web3 games without forcing them to think about wallets at all.

Gala / GalaChain / Gala Games

Gala set out to build not just a game, but a full entertainment ecosystem spanning games, music, and film. At its core was GalaChain, a proprietary blockchain meant to host a portfolio of titles where players could own in-game assets and participate in governance through the GALA token.

Unlike Immutable’s focus on a few polished titles, Gala Games pursued a breadth strategy, announcing dozens of games across genres — RPGs, shooters, strategy, and casual sims. Its earliest breakout was Town Star, a farm-sim reminiscent of FarmVille, which briefly became one of the first high-profile play-to-earn games. The company also partnered with celebrity brands, such as Snoop Dogg for Gala Music. But execution lagged: many projects slipped on delivery timelines or failed to attract sustained user bases.

This breadth doubled as an experiment in asset models — land sales in Town Star, NFT characters in RPGs, and tokenized rewards in music and film. But it also stretched the ecosystem thin.

To improve usability, Gala developed GalaChain to reduce Ethereum fee dependence and offer a controlled environment. Yet adoption showed the same pattern as other Web3 gaming platforms: most players cared less about asset ownership than about gameplay or short-term rewards.

Beyond product delivery, Gala was clouded by controversies. Token schemes, questions about treasury management, and shareholder disputes (including public legal battles among co-founders) damaged its credibility. These scandals amplified community doubts, making Gala a case study in how fragile trust can be in Web3 projects, especially when governance and incentives lack clarity.

On average, many leading blockchain gaming projects have valuations in the $500-1,000 million range, with monthly active users typically in the 2-3 million band. By contrast, Supercell — the studio behind Clash of Clans, Brawl Stars, and other hits — reports ~200-300 million MAU across its portfolio, and its valuation has been estimated around US$20 billion.

Nexon / MapleStory / MapleStory Universe

MapleStory, launched by Nexon in 2003, is one of the most enduring MMORPGs in the world. By 2023 it still counted around 6–7 million monthly active users, supported by a cash-shop model that sustained the game for two decades and helped it surpass 250 million registered accounts over its lifetime.

In 2022 Nexon announced MapleStory Universe, a Web3 expansion of the IP. The project introduced MapleStory N, a blockchain-integrated version of the game where in-game items would be minted as NFTs. For its infrastructure, Nexon chose Polygon Supernets, a customized Ethereum scaling solution. This setup allowed MapleStory to bridge existing gameplay with tokenized assets, using NXPC as the ecosystem’s utility token for item issuance, trading, and community-driven content.

The rollout gave MapleStory a token economy with a market cap of roughly US$600 million (NXPC) at launch. On-chain activity spiked, with reports of 70,000+ daily active wallets engaging with MapleStory N features. However, the broader Web2 player base — millions of MAU on the legacy game — has not yet fully migrated to the blockchain version, meaning the Web3 economy sits alongside rather than replacing the original cash-shop model.

Has Blockchain Gaming Delivered on Its Promise So Far?

Today, most leading blockchain gaming projects are valued between $500 million and $1 billion, with monthly active users (MAU) typically in the 2–3 million range. By comparison, Supercell — publisher of Clash of Clans, Brawl Stars, and other Web2 hits — boasts 200–300 million MAU across its portfolio and a valuation in the $10–11 billion range. The scale gap remains immense.

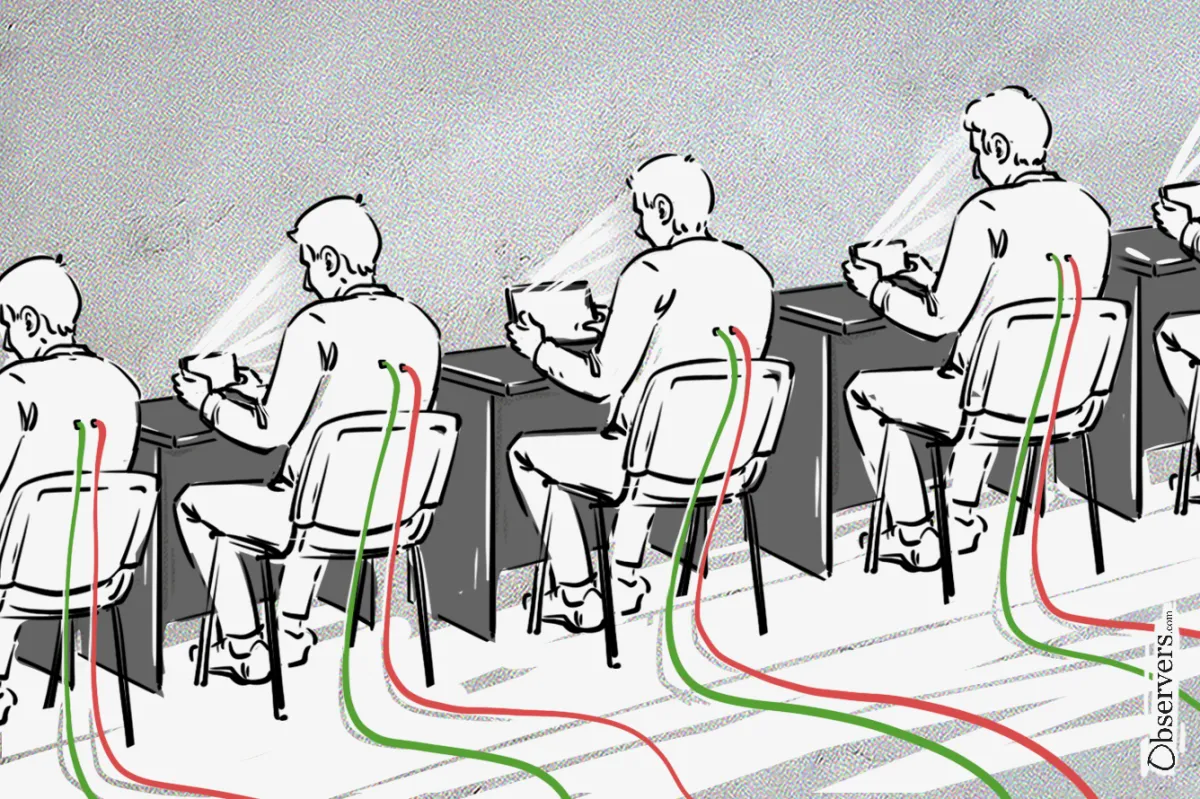

A key trend in blockchain gaming is the rise of “invisible blockchain”: embedded or account-abstraction wallets, gas fee abstraction, and fiat on-ramps that push crypto infrastructure into the background. Players interact with games, not chains. This reflects an important reality: the market has not demanded blockchain for its own sake.

Ultimately, users are more likely to trust established brands with proven track records of safeguarding value transfers, rewards allocation, and digital assets than experimental teams driven by short-term incentives and risk of slashing. And this logic is not unique to gaming. Airline miles, loyalty points, or digital IDs can all function perfectly well on a Web2 stack.

It is worth remembering that blockchain emerged as a response to problems in finance — arbitrary money creation and reversible transactions in markets where trillions of dollars and even state-level interests are at stake. In those contexts, the heavy overhead of blockchain systems is justified. Preserving the avatar of a preteen gamer, however, may not be.