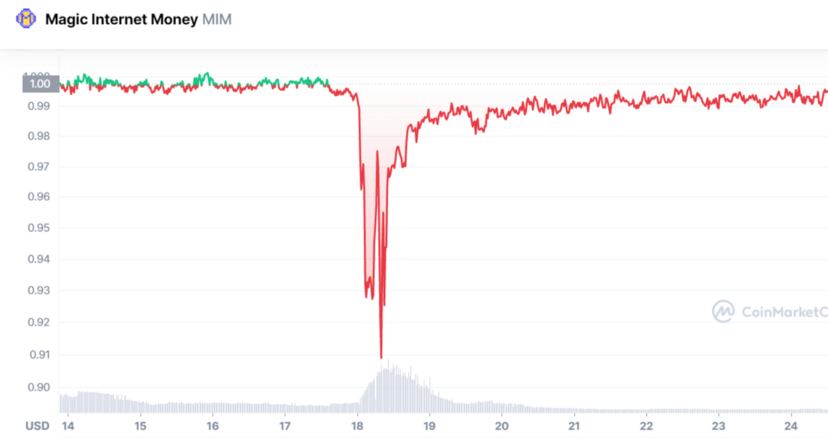

Now the crypto industry is watching stablecoins. News about the collapse of the ecosystem or reports about the loss of binding to the fiat currency is no longer able to surprise anyone who follows the news. In this regard, a sharp drop in MIM is called the domino effect, which is associated with the collapse of Terra.

Now stablecoins attract the attention of not only investors and other market players, but also regulators. Problems with stable coins, as we wrote earlier, led to the discussion of new legislation on their regulation in many countries.

Twitter user AutismCapital stated that Abracadabra has accumulated bad debts that amount to $12 million. An insider attributes this to the collapse of the Terra ecosystem.

Last month during the Terra blowup, $12M of bad debt was created by Abracadabra (the protocol behind MIM) because liquidations couldn't happen fast enough to cover the protocol's MIM liabilities. This news was swept under the rug.

— Autism Capital 🧩 (@AutismCapital) June 17, 2022

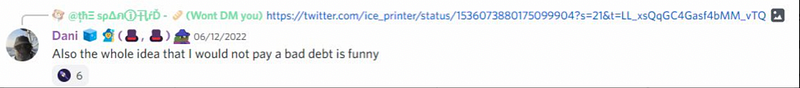

The founder of Abracadabra, Daniele Sestagalli, reacted immediately to the accusations. He said that the system is still solvent and there are enough funds to pay off piling debts.

“[The Abracadabra] Treasury has more money than the debt and $CRV are valuable for the protocol.”

In order to reassure, he invited everyone and investors to go to the address of the treasury, which contains assets worth $12 million. Autism Capital quickly commented on this statement. The user claimed that the debt was created five days ago, and shared a screenshot below showing his conversation about it in the Discord MIM group.

A sharp drop in MIM is called the domino effect, which is associated with the collapse of Terra. In this regard, let’s look at other projects that had a hard time after the collapse. For example, the Avalanche blockchain project, according to the founder, lost $60 million due to investments in Terra.

The credit platform DeFi Venus also had a difficult time, which also suffered losses. The high volatility of LUNA has led to a problem with the valuation of asset prices in the decentralized Chainlink oracle network that the project uses. The oracle settings did not allow displaying the cryptocurrency price below $0.1. This allowed the attackers to bring millions of tokens to the platform, using them as collateral. Because of this, Venus Protocol lost about $13.5 million.

Once again, we see the collapse of a successful stablecoin, followed by revelations and accusations from insiders. It is very good that the founders of Terra and MIM are not keeping silent, but are conducting a public discussion with their accusers. But will this have a positive impact on investor confidence and the performance of their ecosystems? We will observe.