Latest Articles

85 Articles

MoneyTech provides innovative blockchain solutions for financial services, focusing on improving efficiency and security in digital payments and lending systems.

MoneyTech provides innovative blockchain solutions for financial services, focusing on improving efficiency and security in digital payments and lending systems.

Circle’s first post-IPO results show USDC supply nearly doubled YoY to $61.3B, market share up to 26%, and revenue +53% to $658M. The $1.2B IPO boosted equity to $2.37B, funding new plays like the Circle Payments Network and Arc blockchain in a bid to challenge Tether’s dominance

Global Dollar’s stablecoin USDG is growing fast—thanks to a new model where partners like Robinhood, OKX, and Mastercard earn a share of reserve yields. With over 25 institutions onboard and market cap surpassing $329M, USDG is quietly building a powerful global distribution network

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

Alex Harutunian

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

Alex Harutunian

Circle’s first post-IPO results show USDC supply nearly doubled YoY to $61.3B, market share up to 26%, and revenue +53% to $658M. The $1.2B IPO boosted equity to $2.37B, funding new plays like the Circle Payments Network and Arc blockchain in a bid to challenge Tether’s dominance

Alex Harutunian

Global Dollar’s stablecoin USDG is growing fast—thanks to a new model where partners like Robinhood, OKX, and Mastercard earn a share of reserve yields. With over 25 institutions onboard and market cap surpassing $329M, USDG is quietly building a powerful global distribution network

Sasha Markevich

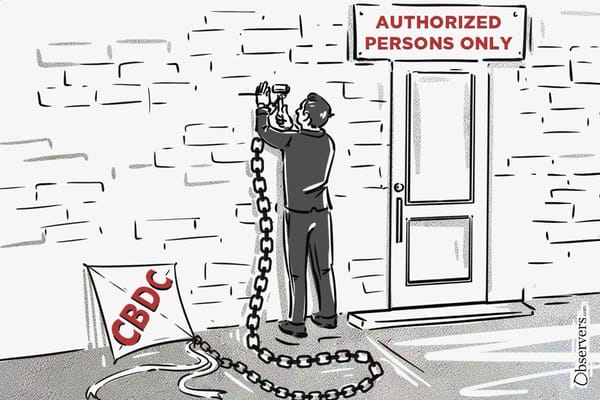

As central banks build digital currencies with tight control, they abandon the core innovation of blockchain—permissionless design. While CBDCs favor private ledgers, the U.S. turns to stablecoins running on public rails, balancing decentralization, oversight, and market-driven innovation.

Alex Harutunian

Cork Protocol offers a novel way to hedge depeg risks through tokenized derivatives like Depeg Swaps and Cover Tokens. The model drew attention across DeFi, though a recent $12M exploit revealed critical vulnerabilities in its implementation.

Alex Harutunian

Circle's IPO opens the door for public investors to benefit from stablecoin seigniorage for the first time. Unlike crypto miners or exchanges, Circle profits from monetary demand for USDC—a zero-interest asset backed by interest-bearing reserves—and now shares that upside through equity.

Alex Harutunian

The project is rapidly attracting attention, having already surpassed $300 million in TVL. Its innovative dual-token strategy and upcoming airdrop are drawing more users to the protocol.

Alexander Mardar

Tether’s omnichannel USDT0 rapidly expands across multiple chains. Built on LayerZero’s Omnichain Fungible Token standard and supported by Legacy Mesh, USDT0 unifies liquidity across blockchains. Unlike Circle’s Bridged USDC, it offers decentralized, flexible, and incentivized cross-chain support.

Alexander Mardar