Latest Articles

47 Articles

Explore the world of decentralized exchanges, where crypto trading occurs without intermediaries, ensuring greater transparency and efficiency.

Explore the world of decentralized exchanges, where crypto trading occurs without intermediaries, ensuring greater transparency and efficiency.

Curve Finance is launching Yield Basis with a $60M crvUSD credit line. The product aims to eliminate impermanent loss for liquidity providers, and at the same time transform CRV from a governance token into an income-generating asset with revenues shared back to holders

Hyperliquid is preparing to launch its own stablecoin, USDH, through a validator-led governance vote. With USDC currently dominating its ecosystem, USDH would reduce reliance on external issuers and capture reserve yield. Paxos, Frax, Ethena, and an Agora–MoonPay coalition are competing to deploy it

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

Alex Harutunian

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

Alex Harutunian

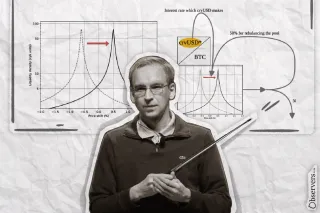

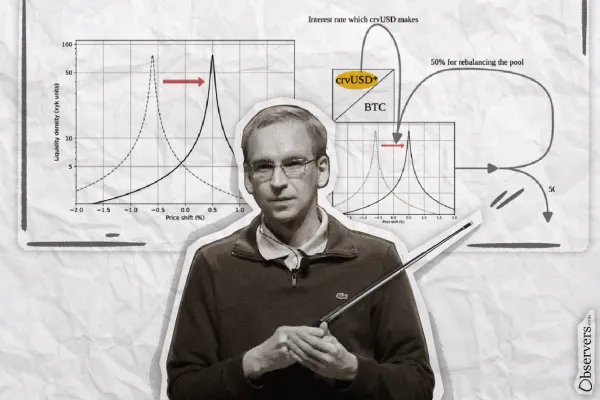

Curve Finance is launching Yield Basis with a $60M crvUSD credit line. The product aims to eliminate impermanent loss for liquidity providers, and at the same time transform CRV from a governance token into an income-generating asset with revenues shared back to holders

Alex Harutunian

Hyperliquid is preparing to launch its own stablecoin, USDH, through a validator-led governance vote. With USDC currently dominating its ecosystem, USDH would reduce reliance on external issuers and capture reserve yield. Paxos, Frax, Ethena, and an Agora–MoonPay coalition are competing to deploy it

Alex HarutunianUniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

Alex Harutunian

Decentralized exchanges just hit a record high, with DEX-to-CEX spot volumes reaching parity for the first time. The middle-tier altcoin sector, once central to CEX activity, is losing ground. Meanwhile, a new generation of CLOB-based DEXs is preparing to reshape the landscape of crypto trading.

Alexander Mardar

The increase in volume has been attributed to rising activity across the BNB ecosystem and the launch of PancakeSwap’s Version 4 ‘Infinity’ upgrade, which introduced multiple new pool types and gas-saving features.

Alexander Mardar

The auto-rebalancing mechanism in Fluid’s ETH/USDC pool failed under recent ETH volatility, resulting in heavy losses for liquidity providers.

Alexander Mardar

TONSWAP is a new DEX and launchpad planned on the TON blockchain, aiming to fix poor UX and low liquidity in TON DeFi. With Telegram integration, $100M projected funding, and a meme-savvy brand, it positions itself as the ecosystem’s go-to trading hub with seamless access and deep liquidity.

Alex Harutunian