In a white paper published last week, the Swiss Bankers Association (SBA) laid out its proposals for a Swiss-franc-pegged ‘Deposit Token’. The DT is envisioned as a purely digital form of currency, which can be enhanced with the programmability of smart contracts. The proposed token would be issued on a public blockchain to ensure interoperability and limit restrictions on access.

The paper was published as a response to the question of how banks can best support the Swiss economy when it comes to payments for digital assets and in an increasingly digitalized world. One of the main use cases suggested in the white paper is as a means of payment for tokenized assets, enabling instantaneous settlement on a single platform.

Looking further ahead, the SBA says that the Deposit Token has potential to be used in a Swiss franc DLT-based financial ecosystem, and for “payments of the future”, such as licensing micropayments, smart contract enabled ownership transfer, and payments through Web3 and Internet of Things. SBA included initiatives aiming to safeguard national sovereignty in payment services in the list of priorities for the Deposit Token:

If functionality and convenience cause a shift away from national currencies towards foreign ones (“dollarization”), this can lead to unwanted dependencies and drawbacks for monetary and economic policy

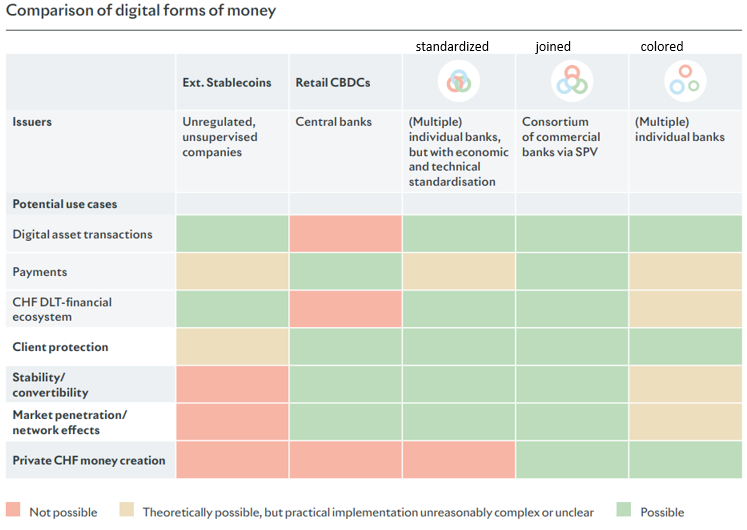

The association considered three potential approaches to the Deposit Token:

A “Coloured Token” would allow each individual bank to issue its own DT, based on its own preferred standards for technology and the required amount of underlying reserves. However, this approach was deemed to limit interoperability and have a high potential for risk, with consumers potentially favouring DTs from higher-rated institutions.

A “Standardised Token” would also be issued by individual banks, but would conform to a universal technical specification, and be “fully backed by secure and highly liquid reserves.”

But the approach favored by the SBA is that of a single “Joint Token”, issued solely by a special-purpose vehicle (SPV) owned by the participating banks, and either fully or partially backed by reserves. This would allow for functionality such as money creation via fractional reserve banking, reducing the need to charge for settlement services and enabling interest payments on tokens held with a bank.

In order to continue its development of the Deposit Token SBA is looking to resolve certain issues with the regulatory body FINMA. These include whether the token would be considered a security, and whether rules around identification of parties can be simplified to mirror those of cash transactions or the Travel Rule.

Meanwhile the two biggest Swiss banks, both members of the SBA, were making headlines of their own over the weekend. UBS has agreed to buy the beleaguered Credit Suisse for over $2 billion, after an $54 billion credit injection from the SNB last week failed to stop a free falling share price and ballooning customer withdrawals.