The Society for Worldwide Interbank Financial Telecommunication (Swift) is a messaging system that enables global banks and financial institutions to reliably communicate cross-border payment information to one another. It has been a trusted resource for 50 years, over which time it has become the industry default, and been upgraded to newer standards, such as ISO 20022 in 2004.

However, it has often faced criticism for inefficiency, as transfers can “pass through multiple banks before reaching their final destination, making them time-consuming, costly and lacking transparency on how much money will arrive at the other end,” according to a 2018 report in the Financial Times.

It has since made further innovations to its services, such as Global Payments Innovation and Swift Go (for low-value international payments), although take-up has been mixed. This is partly due to banks needing to upgrade back-end systems for full compatibility, and of course, because newer blockchain-based solutions are now available.

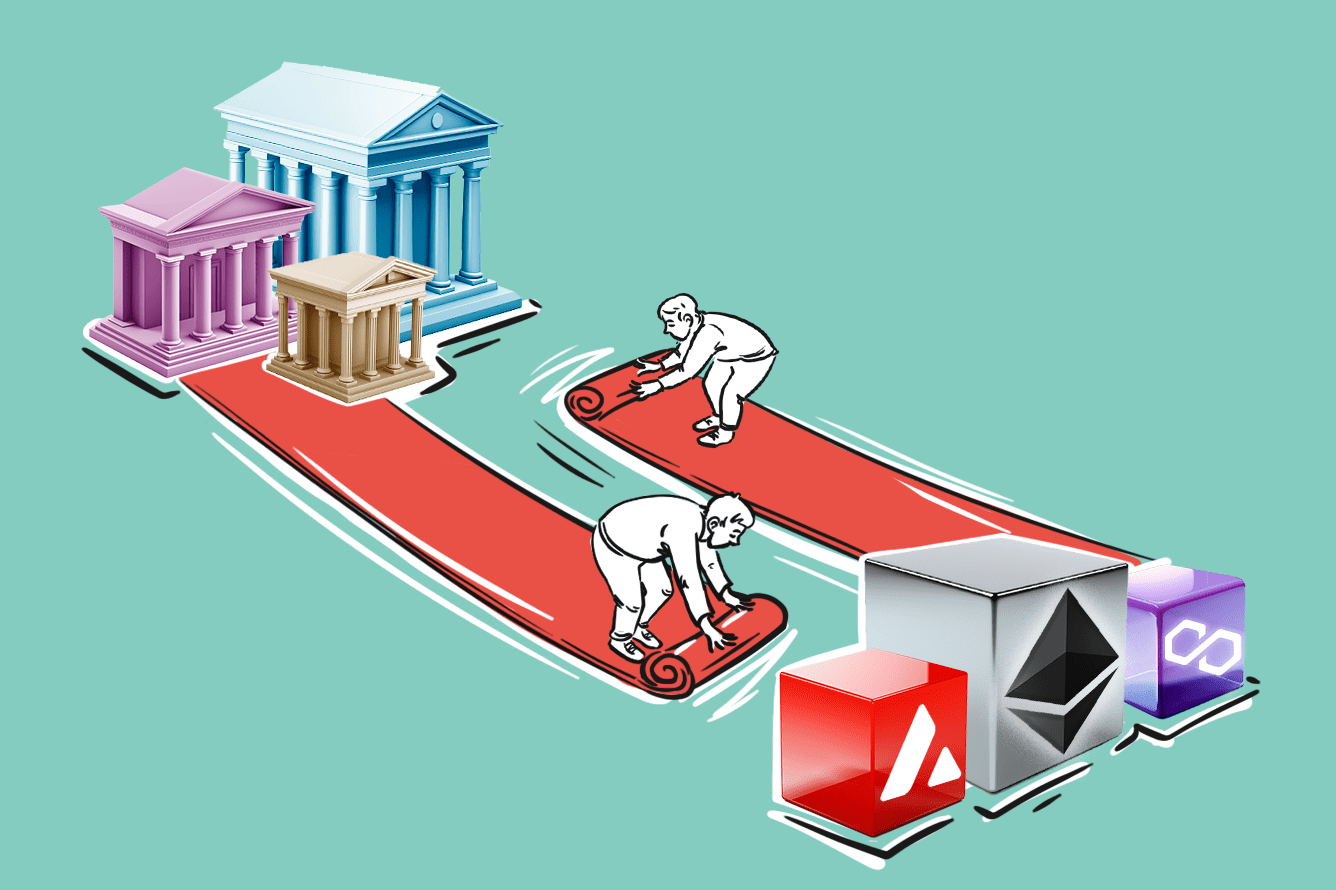

Not to be outdone, Swift has partnered with multiple global financial institutions to investigate tokenized assets held on blockchain, and whether the Swift service can be used as a trusted provider to connect banks to blockchains and facilitate the transfer of these assets. One of the key points of focus has been the fragmented nature of the blockchain space, and a report published last week addressed ways to overcome this.

The thrust of this has been an experimental solution leveraging Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This has been used to explore whether banks can use their existing bank-end Swift-enabled systems to interact with tokenized assets across both public and private blockchain platforms.

The project successfully achieved its aims, and gave valuable insights into aspects which require further investigation as the solution design is developed. According to Swift’s Chief Innovation Officer, Tom Zschach:

“Our experiments have demonstrated clearly that existing secure and trusted Swift infrastructure can provide that central point of connectivity, removing a huge hurdle in the development of tokenisation and unlocking its potential.”

Feedback gained from the project includes the need for an abstraction layer to manage blockchain complexity and nonce management to avoid replay attacks. It also identified that regulatory clarity is dearly needed in the sector, and the importance of data privacy, liability and recourse.

Future development will consider connections to public permissioned ledgers and various on- and off-chain Delivery versus Payment (DvP) options. Institutions taking part in the experiment included BNY Mellon, Citi, SIX Digital Exchange and BNP Paribas.