SushiSwap has voted on the so-called "Labs model" aimed at enhancing development speed and efficiency. Voting on the proposal, which began on April 3, concluded today with more than 62% voting "Yay" for restructuring SushiSwap's DAO and treasury.

However, the proposal unveiled on March 26 by the SushiSwap team has ignited a fierce debate within the community, flagging issues such as lack of transparency, power centralization, and unfair allocation of project resources. Crucially, the ability of the 'ruling party' to hold such an outsized share of the vote raised serious concerns about the viability of decentralization voting.

Sushi Labs vs Sushi DAO

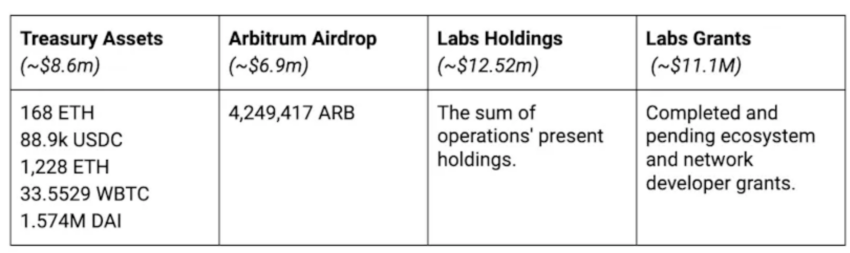

The proposal suggests creating "Sushi Labs" as a new entity with significant autonomy over project development and daily operations. This separate body would be granted a hefty financial package – a whopping 25 million SUSHI tokens, valued at roughly $38.5 million based on current market prices. Sushi Labs would receive a treasure trove of assets from the Sushi DAO treasury:

“We request that Sushi DAO award a grant of 25 million Sushi tokens to Sushi Labs, including assets from the Arbitrum airdrop, business development, and partner grants, Kanpai 2.0, Sushi 2.0, rewards, stablecoins, and ‘Sushi House’each address holdsfunds."

Titled "Evolving Sushi - Burū no Shinka [Signal]", the full text outlined a significant restructuring of the decentralized exchange (DEX)'s decentralized autonomous organization (DAO) and treasury.

This is not SushiSwap's first foray into utilizing treasury funds for ecosystem growth. In February 2023, the DEX launched Sushi Studios, a decentralized incubator that provides resources like funding and technical expertise to external developers and independently-funded projects. The DEX said the new platform aims to foster innovation without directly tapping into the DAO treasury. SushiSwap has not released any information on Sushi Studios since the launch. The community discussion thread was archived on March 6. It is uncertain whether the Sushi Studios framework is even still active.

SushiSwap's meteoric rise in August 2020 was almost immediately followed by controversy. The project's anonymous founder and former CEO, Chef Nomi, attempted to abruptly withdraw a large amount of SUSHI tokens, sparking fears of a "rug pull" and leading to a loss of community trust. Though Chef Nomi ultimately returned the funds, the incident eroded trust within the SushiSwap community from the get-go and cast a long shadow over the project's leadership and commitment to transparency.

Community members worry about Sushi Labs' potential power grab and argue that such a structure directly contradicts SushiSwap's core principle of decentralization. An opponent, identified as sushicitizens.eth, pledged a significant amount of SUSHI tokens (4.4 million or around $8 million at the time) against the proposal. Other members pointed out that the DEX neglected to announce the proposal on social media upon release.

The DAO Voting

The proposal utilized a Snapshot vote, a common method used in decentralized governance to determine voting power based on a specific point in time.

In the case of SushiSwap's proposal, a snapshot was taken to capture the SUSHI token holdings of all wallet addresses at a predefined time. The number of SUSHI tokens each address holds determines their voting power in the proposal.

The main issue is that the SushiSwap governance team (sushigov.eth) was top of the voting board, with 5.5 million SUSHI tokens cast in favor of the proposal. The ability to wield a large block of votes (about 73% for SushiSwap) swayed the vote and contradicted the DEX's ethos: decentralization.

On April 3, a vocal opponent to the proposal, Naïm Boubziz, noted on X that suspicious transactions could be seen in the lead-up to the Snapshot vote. He pointed to instances where new wallets seemingly added liquidity to SUSHI pools just before the Snapshot date, potentially inflating their voting power. These same wallets withdrew liquidity shortly after the snapshot.

Community members also pointed out that 4 million SUSHI tokens, representing a substantial portion of the 5.5 million currently supporting the proposal, originated from the DEX's multisig wallet. This concentration of voting power raises questions about SushiSwap's transparency and potential conflicts of interest.

#Sushsiwap : Lol .

— Naïm Boubziz (@BrutalTrade) April 8, 2024

Sushiswap voted for themselves with the Ops multisig wallet.

Does this seem clearer to you now? https://t.co/NHtOQOXtt9 pic.twitter.com/OlDPSJ0BfN

Boubziz's accusations of potential manipulation surrounding the Snapshot vote have significantly escalated tensions within the SushiSwap community. While the exact intent behind the observed liquidity activity remains unclear without a formal investigation, these allegations raise serious questions about the fairness and integrity of the entire voting process.

In an April 8 post, the Sushi's CEO, also known as "Head Chef," confirmed that he had asked the Sushi team to vote using the OPs multisig wallet "due to the threat of a hostile takeover." Grey said that "Humpy," a SUSHI whale, has been pushing for "an extortive governance attack attempt" for almost half a year.

While Jared Grey cites the potential threat of a hostile takeover by a community member to justify the Sushi team's vote using the multisig wallet, this action raises a critical question: Doesn't this undermine the very foundation of a DAO?

DAOs are built on the principle of distributed power and community-driven decision-making. By centralizing a significant voting block in the hands of the Sushi team, Grey's decisions contradict the ethos of decentralization that SushiSwap claims to uphold. Overall, this incident highlights the ongoing tension between ensuring decentralized governance and safeguarding against potential attacks on projects through their DAOs.