Happy Sunday, Observers!

The summit that leads from “asset light” to “asset heavy” feels more like a roller coaster than ever. With President Trump at the helm, calling and firing what sometimes feels like rather random shots, markets are losing it.

The White House’s announcement that it would establish a national crypto reserve of mainly U.S.-made tokens - Ripple, Solana, and Cardano - led to the fastest rise of crypto prices ever, which was followed, in a matter of hours, by the second largest price drop ever.

Experts in Web3 and Digital AssetsRebecca Denton

Experts in Web3 and Digital AssetsRebecca Denton

Trump’s government continued to release market-shifting news and updates all throughout the week, including the imposition of tariffs on two of U.S. largest trading partners and the official establishment of a Strategic Bitcoin Reserve with the funds provided by forfeiture and civil arrests.

Some proponents of the Reserve believe that Trump’s decision will force other economic institutions to introduce similar funds in their geographies.

This idea seems to stem more from the U.S.’ national myth of “leadership” than in reality, as several countries have rejected plans for a BTC reserve, with Switzerland being the latest.

On Friday, Trump hosted its first crypto summit in the White House for which key industry leaders were invited. Yet, despite it being the sort of event that less than a year ago would have featured only in the wildest dreams of the crypto community, now it failed to arouse anybody -when it ended, Bitcoin was trading at only $86,000 and crypto ETFs registered outflows of around $370 million.

Experts in Web3 and Digital AssetsRebecca Denton

Experts in Web3 and Digital AssetsRebecca Denton

🔥 Highlights Of The Week

- Gemini files for IPO with Goldman Sachs;

- Nasdaq to launch 24-hour stock trading operations;

- Reddit co-founder Alexis Ohanian joins effort to acquire TikTok US and transition it to blockchain.

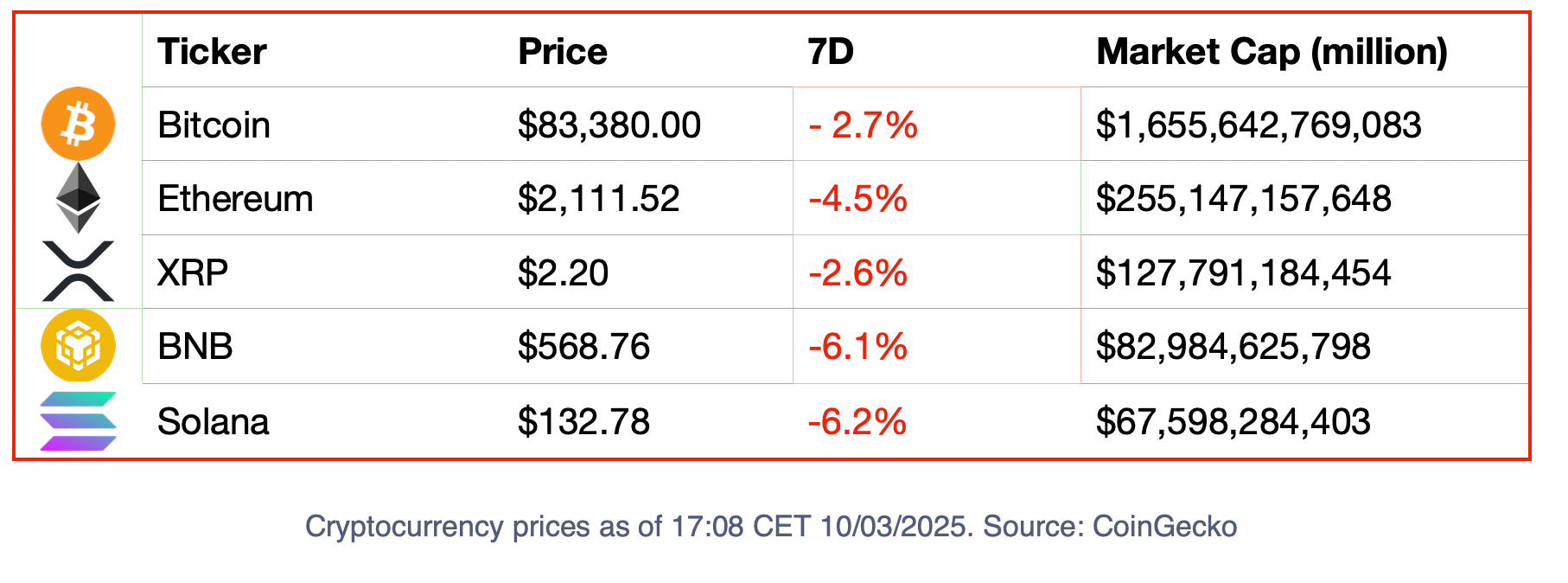

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- After three years, the U.S. Securities and Exchange Commission has closed its investigation on the NFT studio Yuga Labs. Since Trump began his tenure as president of the United States, the agency has been rapidly shifting its stance on crypto enforcement. Here is a list of all the lawsuits it has dropped recently.

😈 Crypto Naught And Sloppy

- Binance delists all stablecoins that aren’t compliant with the MiCA regulation in the European Union at the end of the month, including the world’s leading USD pegged token, USDT.

What's Popping With DeFi Lending Protocols?

Experts in Web3 and Digital AssetsAlexander Mardar

Experts in Web3 and Digital AssetsAlexander Mardar

The lending protocol Morpho is quickly becoming one of the most significant projects in DeFi. In the two years since its inception, it has amassed an active loan portfolio of over $2 billion.

Morpho’s success is largely due to its feature, which allows users to create custom lending markets, which leads to greater efficiencies in capital allocation.

Paul Frambot, the protocol’s CEO, explained that rather than operating as a bank, “Morpho is an infrastructure for banks.”

As Morpho rises, its biggest competitors are stepping up their game.

Aave has introduced a new proposal for its tokenomics that upgrades the Aave Safety Module to a new Umbrella safety protection system. This system will use Aave tokens and directly burn them to cover the bad debt, reducing selling pressure on the protocol’s token in the case of any adverse event.

Furthermore, the proposal plans to implement significant buybacks. For the first six months, a $1m/week buyback will be conducted, totaling $24 million.

Experts in Web3 and Digital AssetsAlexander Mardar

Experts in Web3 and Digital AssetsAlexander Mardar

Project Of The Week: Mass

Experts in Web3 and Digital AssetsAlexander Mardar

Experts in Web3 and Digital AssetsAlexander Mardar

Mass is the first consumer mobile app that allows users to engage with all corners of decentralized finance.

The project aims to abstract away all the complexity surrounding these matters to increase accessibility to finance and has created a “gas tank” feature that simplifies the payment of fees to different protocols.

On the app, users can trade stocks, crypto, and commodities. While tokenized stock trading is currently only available after KYC, spot and perpetual trading are accessible without KYC.

🔫 Post Of The Week

The crypto community embraced this week's chaos with a fair share of a sense of humour. Here are some of the hottest takes: