Following a cooling-off period, the meme-coin frenzy on Solana has reignited, propelling the price of SOL above $200 and stimulating growth in network activity. The phenomenon began last year, marking a pivotal driver for Solana’s growth this cycle. The allure of Solana for meme-coin traders largely stems from its significantly low transaction fees and user-friendly experience—qualities that have been increasingly scarce on Ethereum due to the rising ETH price.

DeFiLama reports that Solana’s on-chain trading volume has surged, hitting a record high of nearly $4 billion over the weekend, surpassing Ethereum’s recent figures.

Source: defillama.com

Currently, Raydium, a decentralized exchange on Solana, leads in trading volume across all platforms, even outperforming Uniswap V3, which has been a frontrunner in the decentralized exchange space for years. Other Solana exchanges, Orca and Jupiter, are also ranked in the top five across all exchanges.

Source: coingecko.com

A significant portion of this renewed activity can be attributed to pre-sales on Solana. Influencers on Twitter have been mobilizing funds to launch their meme-coins, some meeting with remarkable success.

The pre-sale craze began with the launch of a meme-coin called Book of Meme. Launched on March 14 with an initial value of about $4 million, Book of Meme soared by over 36,000%, achieving a peak market capitalization of $1.45 billion in under 56 hours. Its listing on Binance sparked debates over potential insider trading, prompting Binance to initiate an investigation and offer a bounty ranging from $100,000 to $5 million for reports of fraudulent behavior.

Over the past three days, Solana meme-coin projects have collectively raised over $100 million through presales, despite controversies surrounding this fundraising model. The journey has not been without its pitfalls; several projects have fallen victim to scams, and others have suffered losses due to mismanagement. A notable example is the meme-coin Slerf, whose founder inadvertently burned $10 million worth of funds raised from presale investors.

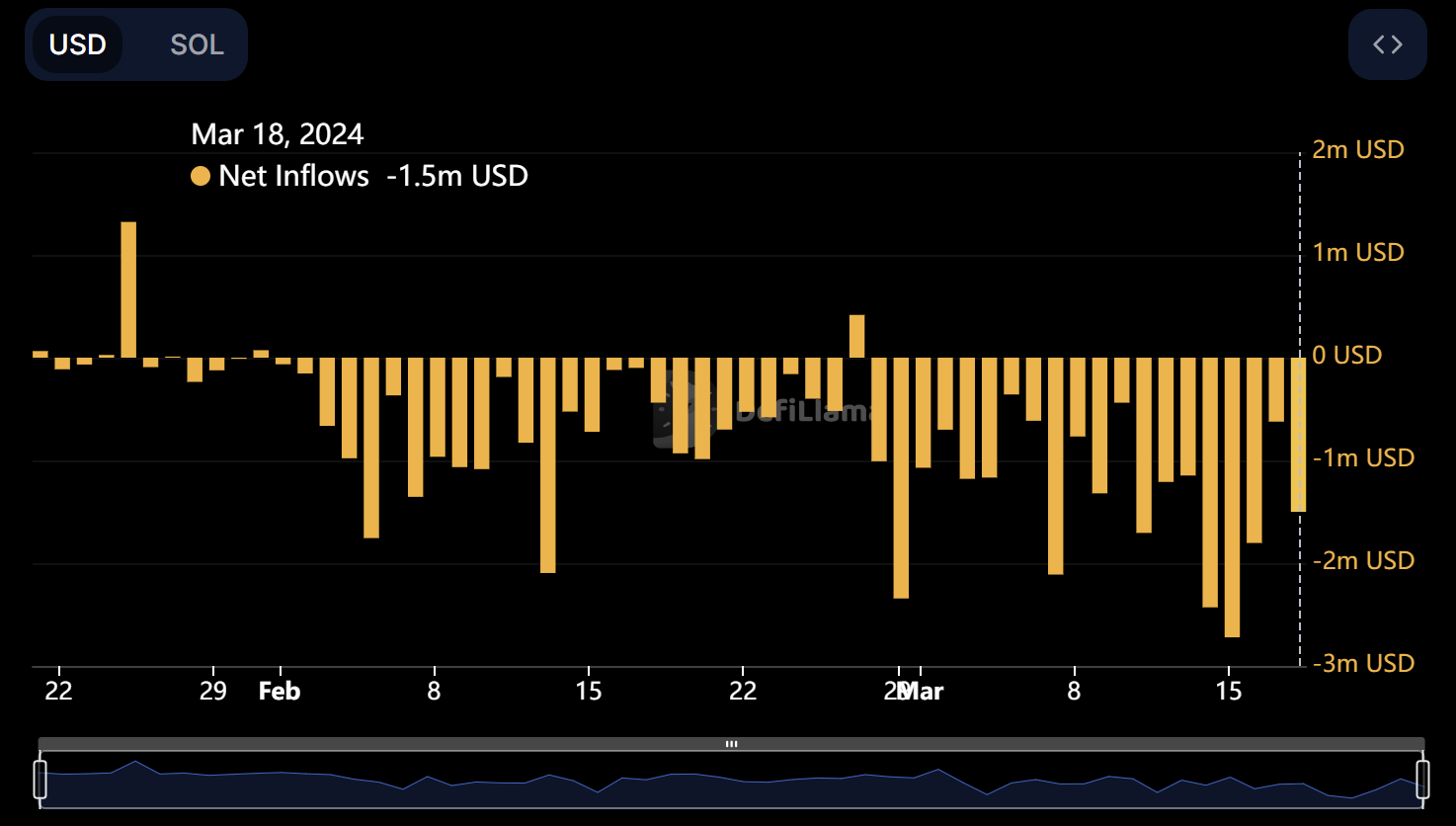

Whether this frenzy will sustain itself in the long term and positively impact Solana’s adoption is uncertain. One critical observation is that the current surge is predominantly driven by existing Solana traders, with a noticeable lack of new inflows. In fact, DeFiLama data suggests that Solana has been experiencing more outflows than inflows, casting doubt on the sustainability of this recent upsurge.

Still, this memecoin frenzy undeniably garners increased attention for the platform. This surge of interest has elevated Solana to the fourth-largest cryptocurrency by market capitalization, surpassing BNB, with its search popularity on Google Trends hitting unprecedented levels. As Solana ascends the rankings, its visibility significantly increases, which is in itself an important factor in crypto.