Singaporean Court Blocks Sale of a Bored Ape NFT, Sets Precedent for Digital Assets Being Protected as Property

Singapore courts blocked a Bored Ape NFT from sale, in one of the first cases of its kind that could have broad ramifications for digital assets.

The NFT, from the famed Bored Ape Yacht Club series, shouldn’t be sold as there is a pending resolution of an ownership dispute after it was foreclosed on as collateral for a loan. It means that the law does recognize non-fungible tokens as a form of property to which court injunctions can be attached, and this NFT case is a consistent application of that same principle.

“It is the first decision in a commercial dispute where NFTs are recognized as valuable property worth protecting,” said Shaun Leong, lead counsel for the case and equity partner of Withersworldwide. “So more than merely strings of numbers and codes imprinted on a blockchain, the implication is that NFT is a digital asset and people who invest in it have rights that can be protected.”

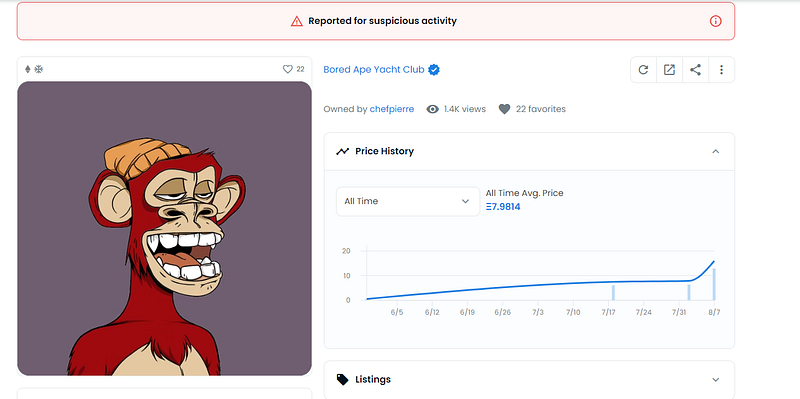

The claimant is a Singaporean citizen, an active dealer in crypto and digital assets, according to the case filing, and a frequent borrower on NFTfi, a platform that allows people to use NFTs as collateral for crypto loans. The only thing we know about the defendant is the username chefpierre.eth but the identity and physical location are unknown. He is known as a frequent trader on the platform.

The particular BAYC NFT, №2162, was very valuable for the claimant, and he had no intention to ever part with or sell it. However, he used the NFT as collateral to borrow crypto because “due to its rarity and high value” he could get larger loans, the filing said.

In mid-April the claimant asked for to refinance a loan for which the NFT in question was being used as collateral. After some back-and-forth, chefpierre.eth gave a short time frame in which the loan could be repaid. The claimant was unable to pay, and chefpierre.eth foreclosed on the NFT. The claimant is alleging “unjust enrichment” in the case.

This is the first court case that sets precedent for protecting digital assets as legal property. However, NFT buyers should be vigilant about the rights and control they give to third parties over an NFT. In this case, the fact that the borrower does not know the ‘real life’ identity of the lender creates a significant complexity for the borrower’s legal proceedings.

This is likely to be just one of many developments regarding rights in the NFT and metaverse space. The next step in series of challenges may revolve around the ownership of virtual land. NFT issuers and key NFT marketplaces, like Opensea, may be increasingly encouraged to have an open registry of NFTs where the ownership of a specific NFT is formally disputed in courts of law.