Early Effects of the Shapella Upgrade

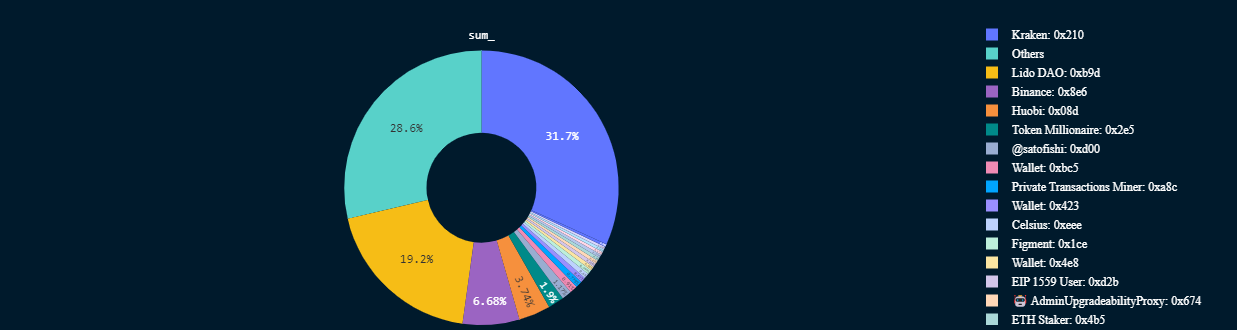

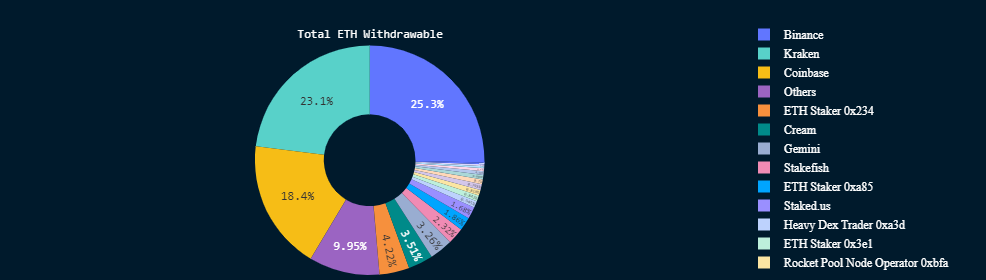

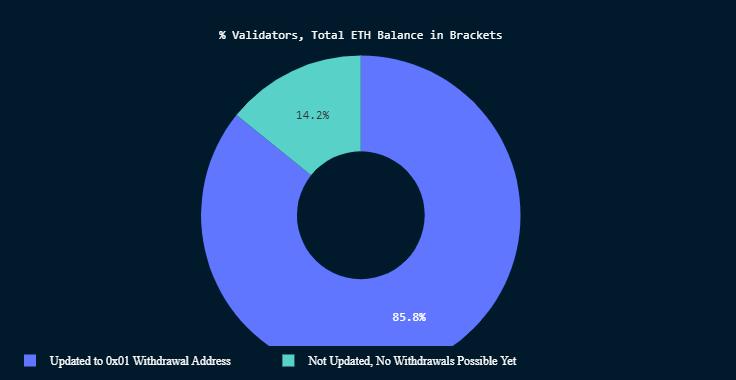

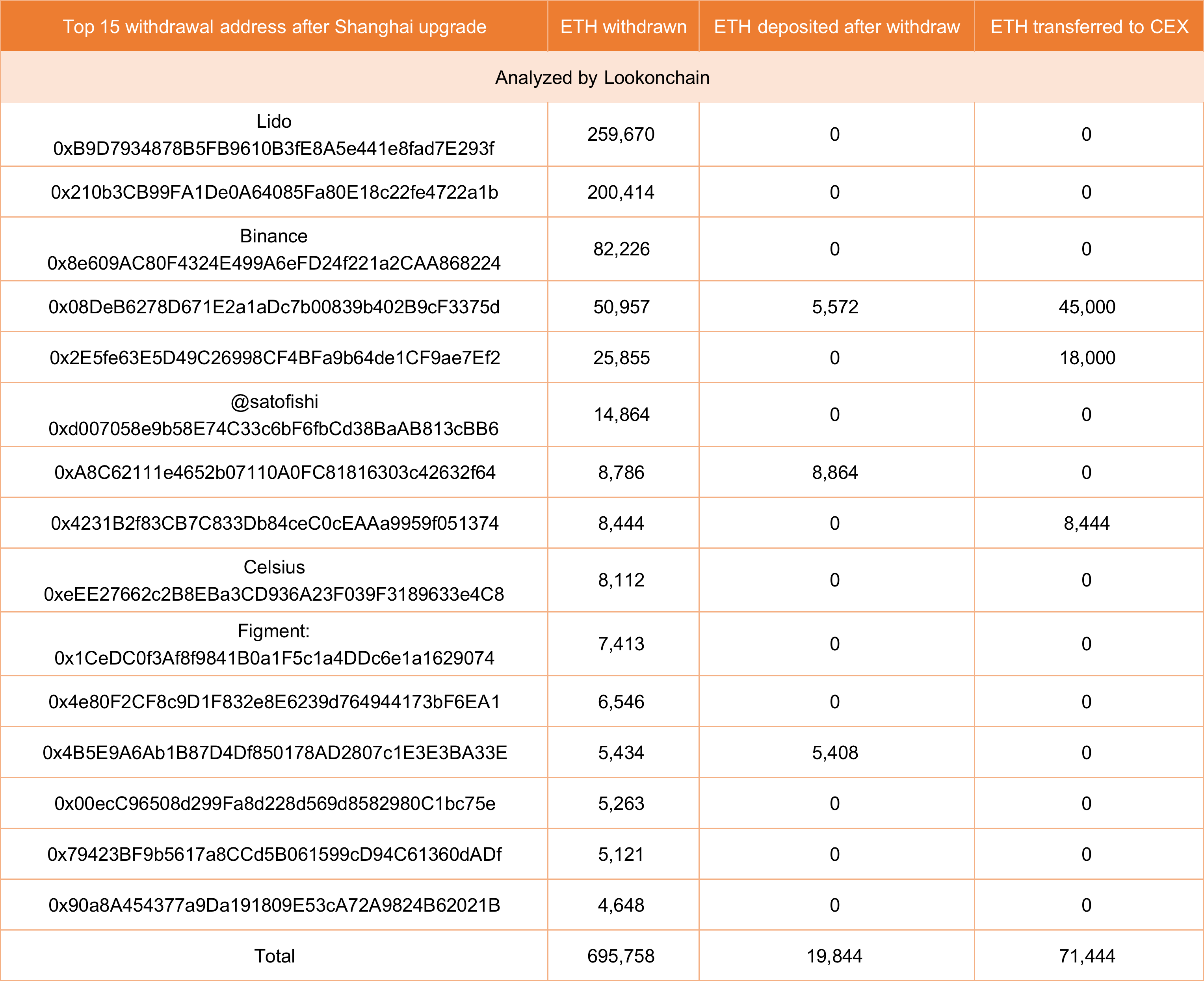

It has been more than a week now since Ethereum successfully launched the Shapella upgrade and the option to withdraw staked ETH became available. The amount of ETH withdrawn so far exceeds one million, or about 5% of the ETH that was initially locked.