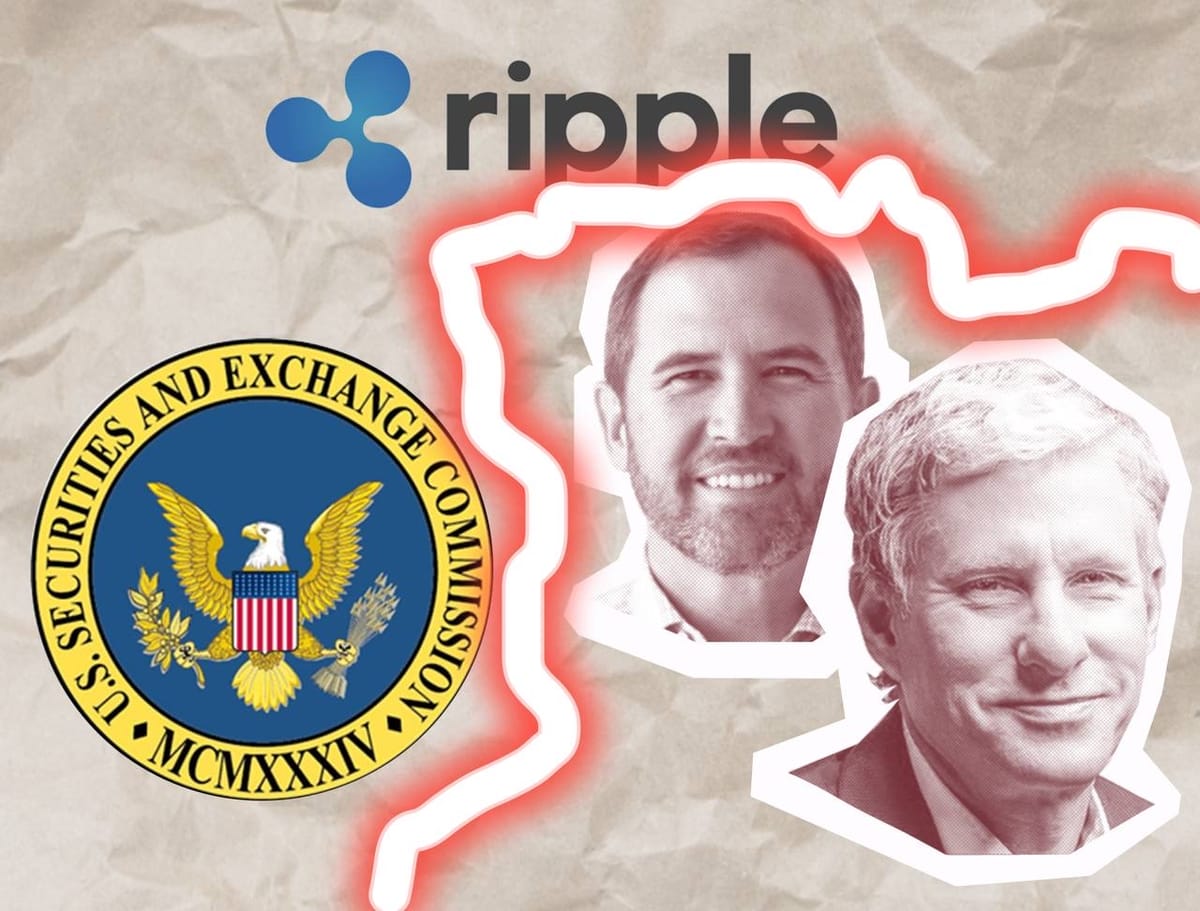

On October 19, the United States Securities and Exchange Committee (SEC) asked a judge to dismiss its previous charges against Ripple founders Christian Larsen and Bradley Garlinghouse.

The digital payment network said that the decision was a "stunning capitulation by the government," echoing the sentiment of an optimistic crypto community.

While Ripple's XRP token enjoyed a surge of interest after the news came out (its price jumping by almost 9%), blockchain video-sharing platform LBRY was taking its last breath and Thor Technologies was hit with a million-dollar fine, both also courtesy of the SEC.

The Case Against Ripple

Ripple Labs Inc. has been in a legal battle with the SEC since 2020, when the market regulator pressed charges against the crypto payment network and its founders for allegedly raising money by selling XRP tokens without registering them as a security.

As one of the first significant crypto assets accused of being an unregistered security, the case brought much media attention and support to the project. The eventual outcome of the process is expected to define the future of crypto legislation in the U.S., making both sides fight hard.

Lately, the SEC has been on a losing streak. In July, a judge ruled that XRP "is not necessarily a security on its face," a ruling that the Commission tried to appeal but failed.

The case that the SEC has now asked to be dismissed is against Ripple's founders. The charges against the crypto platform itself, which will likely set the legal terms for the whole market, still stands to be fought over.

To Fight or Not To Fight

The winds may be changing in SEC's favor, however. The day after the dismissal of the case against Ripple's founders, a judge in California ruled the Commission victorious over Thor Technologies, which it took to court for illegally selling $2.6 million in crypto asset securities - Thor tokens.

The case was settled in a default judgment, meaning Thor's co-founders didn't confront the Commission about the accusations.

Blockchain-based video-sharing company LBRY Inc. put up a fight in its case against the SEC, but eventually got dragged down. The company powering Odysee had its day in court, amassing significant legal fees.

In a surprising announcement in September, it proclaimed its intentions to appeal the court's ruling that it had indeed sold unregistered securities. Unfortunately, increasing debt didn't give it enough time to fulfil this promise. On October 19, the company told its community it was shutting down. "It wasn't a happy ending, but it was a happy journey," wrote former CEO Jeremy Kauffman.

Like LBRY, several blockchain projects have seen their demise at the hands of the SEC. Ripple is on a winning streak and has the support of a community fed up with legal uncertainty. Will its case be strong enough to bring an end to the Commision's crypto crusade?