SEC has approved amendments to hedge fund reporting requirements. Among increased scrutiny, the regulator requires disclosure to crypto exposure.

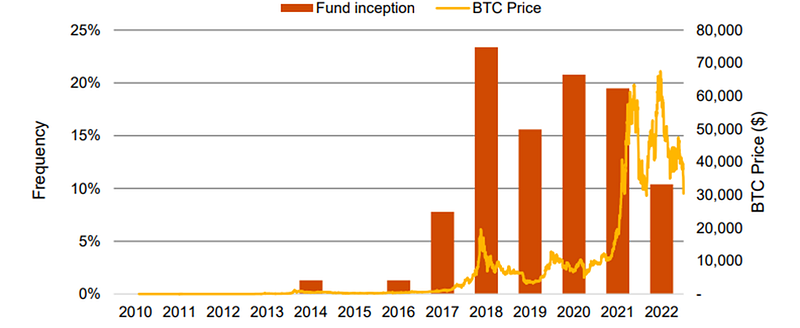

Recent PWC study showed that more than 300 crypto hedge funds have been established with total assets with managed values of above $4 billion. This makes it around 4% of approximately 8,000 hedge funds in existence and under 0.1% by value from nearly 4500 billion assets under management of hedge funds globally.

Most of them employ a standard for these types of funds, market neutral (profit from both on market ups and downs) and long/short (profit from both undervalued and overvalued) strategies.

Hedge funds originated in the early last century with the development of capital and financial markets. Unlike investments in shares and funds, hedge fund investment implies trading strategies that maximize the return on a portfolio such as leverage, shorting and arbitrage. Hedge fund managers are incentivized to always provide positive returns, with all-weather aggressive investment techniques. In contrast conservative mutual fund managers are appraised for their conservative, market aligned performance. Due to this, regulators restrict marketing of these types of investments only to institutional investors and High Net Worth Individuals. (Traditionally, the latter were also the main clients and beneficiaries of hedge funds.) At the same time, because of limited public exposure, hedge funds also enjoyed relatively low reporting and disclosure requirements.

It looks like SEC and other regulatory agencies in U.S. are changing their views on hedge funds systemic risks. The lessons of 2007–2009 financial crisis, 2020 US Treasury turmoil and finally, the GameStop story showed that liquidity needs of hedge funds can indirectly affect large public and national financial interest and hedge funds do possess systemic risks. A series of recent bankruptcies and project runs in crypto led regulators to evaluate hedge fund stability from this angle too.

The new regulation came in the form of an amendment to the Private Fund (PF) reporting form. SEC decreased the reporting threshold for hedge funds from $2 billion to $500 million, added disclosures on advisors and complex structures. The category “cash and cash equivalents” is now redefined to exclude treasury bills and crypto assets that must be reported separately. SEC paper also refers to definitions adopted previously:

In connection with these proposed amendments, we propose to define the term “digital asset” as an asset that is issued and/or transferred using distributed ledger or blockchain technology (“distributed ledger technology”), including, but not limited to, so-called “virtual currencies,” “coins,” and “tokens.” These types of assets also are commonly referred to as “crypto assets.” We view these terms as synonymous.

Overall, there has been little commentary from the crypto community on the proposal. Normally such initiatives are welcomed because they also add legitimization much needed for a utopian crypto industry.