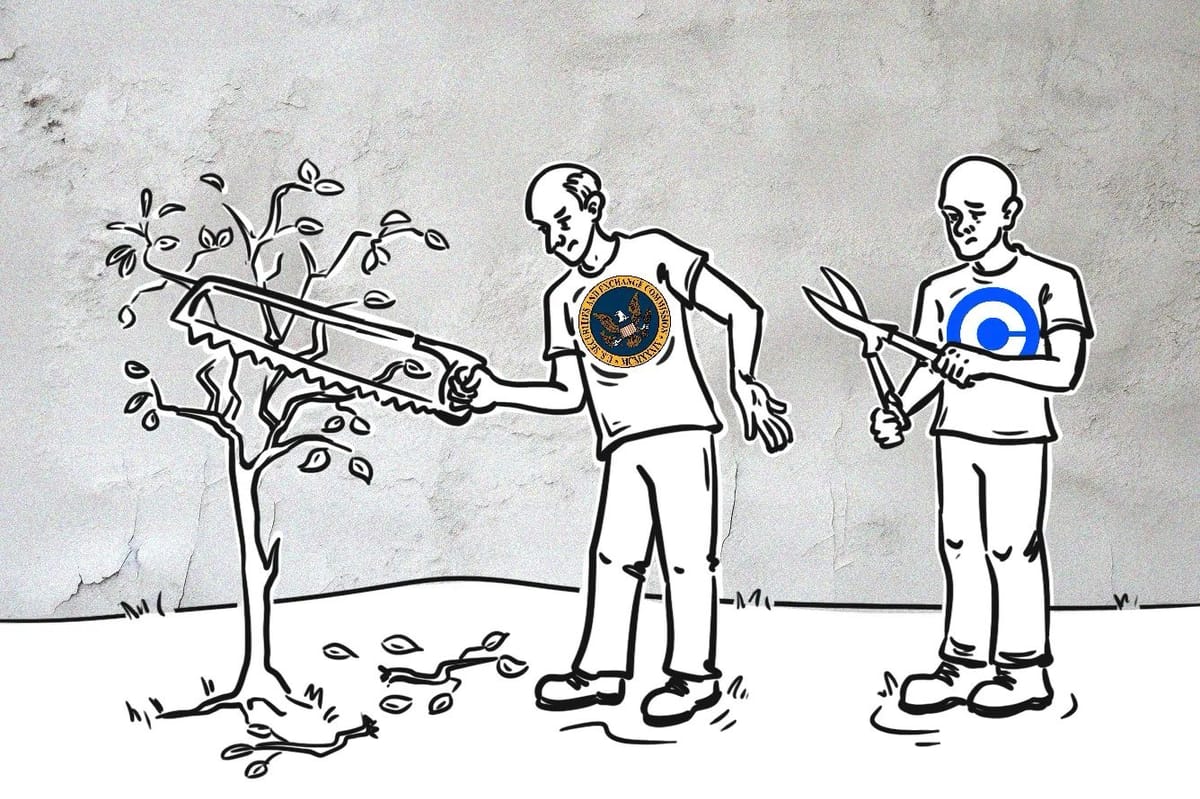

On December 15, the U.S. Securities and Exchange Commission (SEC) provided its long-awaited response to major cryptocurrency exchange Coinbase’s 2022 request for proper crypto regulation: and the answer is “NO.”

“The Commission concludes that the requested rulemaking is currently unwarranted and denies the Petition. The requested regulatory action would significantly constrain the Commission’s choices regarding competing priorities, and the Commission declines to undertake it at this time.”

In its response, the SEC stated that the initial Petition “generally addresses the classification of crypto assets as securities” and disagreed that applying existing securities statutes and regulations to crypto assets is unworkable.

In a statement issued alongside the refusal, SEC Chair Gary Gensler expressed his support for the Commission’s decision and highlighted three reasons behind that support:

“First, existing laws and regulations apply to the crypto securities markets. Second, the SEC addresses the crypto securities markets through rulemaking as well. Third, it is important to maintain Commission discretion in setting its own rulemaking priorities… I look forward to working with crypto projects and intermediaries that wish to comply with the law.”

Paul Grewal, Coinbase’s Chief Legal Officer, said the company would fight further and is already challenging the “SEC's arbitrary and capricious denial” in Third Circuit. He also expressed gratitude towards two Commissioners: Hester Peirce and Mark Uyeda. They disagreed with the decision to deny the request, saying that they hope that "interested persons continue to posit specific rule changes, guidance, and exemptions that would form a useful basis for the crypto industry to continue its development within the United States."

Grewal also reminded users on X about the ongoing argument between the SEC and CFTC concerning the classification of cryptocurrencies and the SEC Chair’s inconsistent perspective on cryptocurrencies. Notably, Grewal is not the only one who disagrees with Gensler’s position. Many X users supported the exchange, saying that the authorities want to preserve optionality and ambiguity to stay in power and extract as much money from companies as they want. John Deaton, a lawyer and blockchain enthusiast, went further and accused Gensler of "gaslighting the American people." He recalled Gensler asserting at his confirmation hearing that crypto lies beyond the SEC’s and the CFTC’s purview due to its unique nature, and falls into a regulatory gap. Deaton believes that Gensler "has done a 180 for political reasons."

Coinbase initially filed its petition with the SEC in July 2022, requesting that the regulator “propose and adopt rules to govern the regulation of securities that are offered and traded via digitally native methods, including potential rules to identify which digital assets are securities.”

With no response forthcoming, this April the exchange filed a lawsuit against the SEC, aiming to force the agency to finally provide an answer. In May, the SEC was legally obliged to provide a legal basis for why it has not responded to the petition. In this, the SEC alleged that Coinbase has no right to mandamus, which orders a government agency to fulfil certain duties, adding that it needs “time to weigh whether or not to initiate a rulemaking proceeding about such topics in the first instance.”

The Commission's latest response might be unsatisfactory for the exchange, but at least now Coinbase has a legal basis that allows it to proceed with its further pursuit of the regulator.