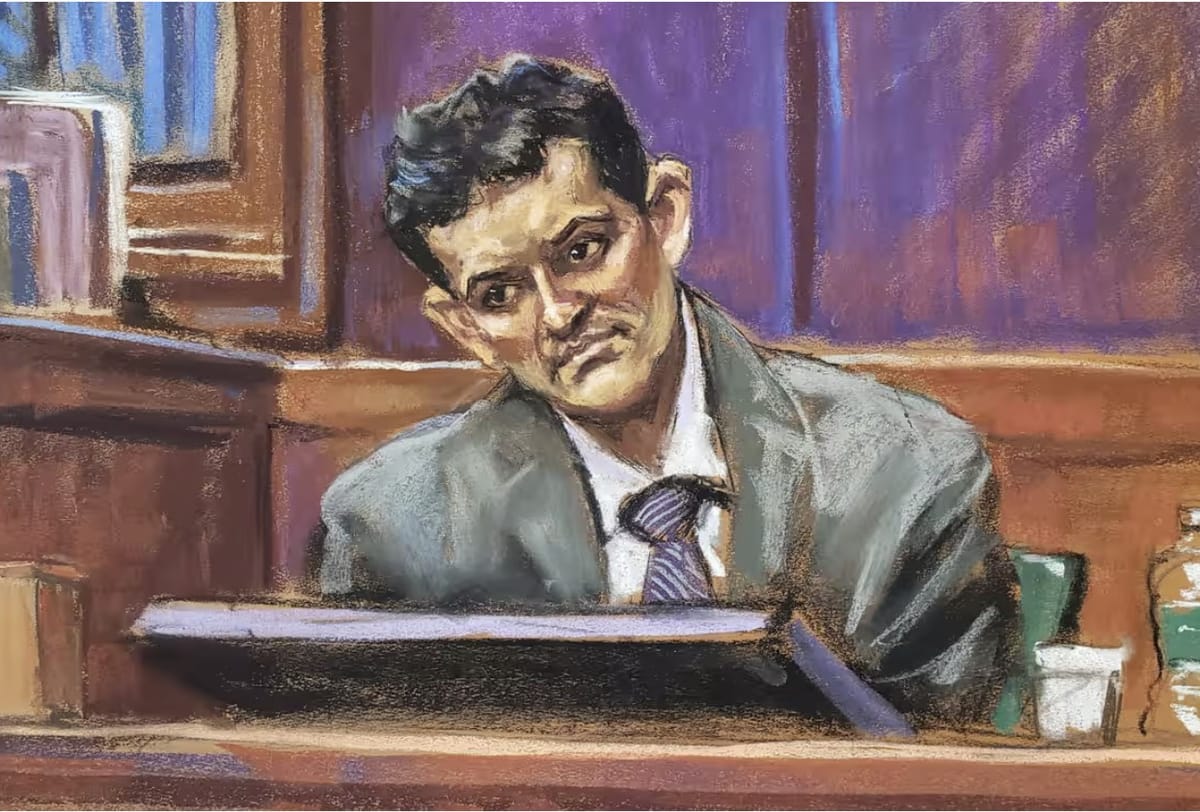

This week we saw the final stages of the former FTX CEO Sam Bankman-Fried's high-profile trial. TL;DR - he was found guilty on all seven counts. For those with a slightly longer attention span, here are the details:

Bankman-Fried's testimony this week hasn’t represented him as a particularly nice guy. The Assistant U.S. Prosecutor drew the jury’s attention to the fact that he used to be rather rude to the authorities; while publicly supporting blockchain regulation to protect customers, he admitted to privately saying “fuck regulators.” He also admitted that helping to draft crypto regulation included benefits such as seizing market share from competitor exchange Binance. Bankman-Fried was also quite harsh on users of Crypto Twitter, calling them "dumb motherfuckers."

Best moment of this morning’s SBF trial.

— Teddy Schleifer (@teddyschleifer) October 30, 2023

Prosecutor: You called people on Crypto Twitter “dumb motherfuckers.”

SBF: No, only “a specific subset of them.”

Bankman-Fried testified that he believed spending $8 billion in customer deposits “was folded into risk management,” but admitted that he wasn’t paying as much attention as he should have been at FTX. The exchange’s close ties with the Bahamian Prime Minister were also brought up in the discussion, although Bankman-Fried denied it.

The defence’s closing statement was focused on proving that Bankman-Fried “made tough and sometimes bad decisions but was not trying to defraud anyone.” His lawyer, Mark Cohen said that the government has tried to turn "Sam" into “some sort of villain, some sort of monster” while he was just “doing the best he can under very, very difficult circumstances.”

The prosecution delivered its closing arguments, saying that if the jury believes even one of the three cooperators, the defendant is guilty. It outlined that the defendant was the only person who had the control over FTX to give Alameda secret access and access to Alameda to spend the money.

“This is not about complicated issues of crypto. It’s about deceit. It’s about lies. It’s about stealing. It’s about greed… He was lying to the public and he repeated the same lies on the witness stand… He knew the money was coming from the customers. But he spent it anyway,” – said Assistant United States Attorney Nicolas Roos in the closing statement.

The jury reached its verdict on November 2. Bankman-Fried was found guilty of two counts of wire fraud, two counts of wire fraud conspiracy, one count of securities fraud, one count of commodities fraud conspiracy and one count of money laundering conspiracy.

“We respect the jury’s decision. But we are very disappointed with the result. Mr. Bankman-Fried maintains his innocence and will continue to vigorously fight the charges against him,” – said defense attorney Mark Cohen.

Sentencing is scheduled for March 28, 2024, and Bankman-Fried could face up to 115 years in prison, although Judge Kaplan is the one who will have the final say on the matter. The post-trial motions are scheduled for December 11. Judge Kaplan has also told the prosecutors to inform him in February if they intend to proceed with the second potential trial regarding an alleged Chinese bribe and campaign finance violations.

While it may still be too early to say a final goodbye to Sam Bankman-Fried and (particularly) FTX just yet, many people will be pleased with the eventual outcome of this trial. We will continue to Observe events leading up to sentencing, the ongoing FTX bankruptcy proceedings, and of course on the "vigorous fight" promised by the defence.