Hinman Speech Deadline

An essential turning point in the U.S. Securities and Exchange Commission (SEC) vs Ripple case revolves around the internal discussions held within the agency regarding the widely-discussed "Hinman speech."

On May 19, James Filan, a pro-XRP defense attorney and former federal prosecutor, said in a tweet that the SEC and Ripple Labs have filed a joint letter to obtain a one-week extension, until June 13, 2023, to submit publicly accessible versions of cross-motions for summary judgment, along with related exhibits, which include the Hinman materials.

The Hinman Speech, delivered in 2018 by former SEC official William Hinman, holds significant importance in Ripple's lawsuit and more generally in the crypto industry. In the speech, Hinman expressed his view that transactions and sales of Ethereum (ETH) should not be considered securities transactions, distinguishing it from other cryptocurrencies. This statement had far-reaching implications, as it provided a level of clarity and regulatory guidance for the market. Critics have raised concerns about potential bias and preferential treatment, leading to a demand, made months ago, for internal transcripts and discussions surrounding the speech to shed light on the SEC's decision-making process and its impact on different cryptocurrencies.

SEC Removes Hinman's Biography Amid Controversy

Recently, the SEC removed Bill Hinman's biography from its website, just eight days before being required to provide unredacted copies of his emails. Hinman's revised bio now only includes basic details of his previous role at the SEC. In his previous role, Hinman's biography highlighted his responsibility for offering "interpretive assistance to companies concerning SEC rules" and providing recommendations to the Commission regarding both new and existing rules.

Hinman's departure from the Commission coincided with the SEC's lawsuit against Ripple for the unregistered sale of XRP, back in December 2020. This suggests that the SEC may have been aware of the speech and was merely trying to "damage control" any future implication of Hinman's declaration.

No Mention of XRP in Coinbase and Binance Lawsuits

Within a 24-hour period earlier this week, the SEC filed two lawsuits against two prominent players in the crypto exchange industry, namely Binance and Coinbase. Although the details differ, both lawsuits share a common core allegation: the exchanges are selling unregistered securities, including digital assets like BNB, BUSD, SOL, MATIC, ADA, and others. To everyone's surprise, both lawsuits overlooked mentioning Ripple's XRP, despite the ongoing legal battle between Ripple and the SEC for the same reason.

In recent years, the SEC has been actively cracking down on the digital asset industry, leading to heightened demands for regulatory action. The collapse of FTX, a major competitor to Binance, further intensified the need for aggressive enforcement under existing laws. SEC Chairman Gary Gensler emphasized the importance of maintaining trust in the markets and preventing harm to investors, setting the stage for upcoming developments.

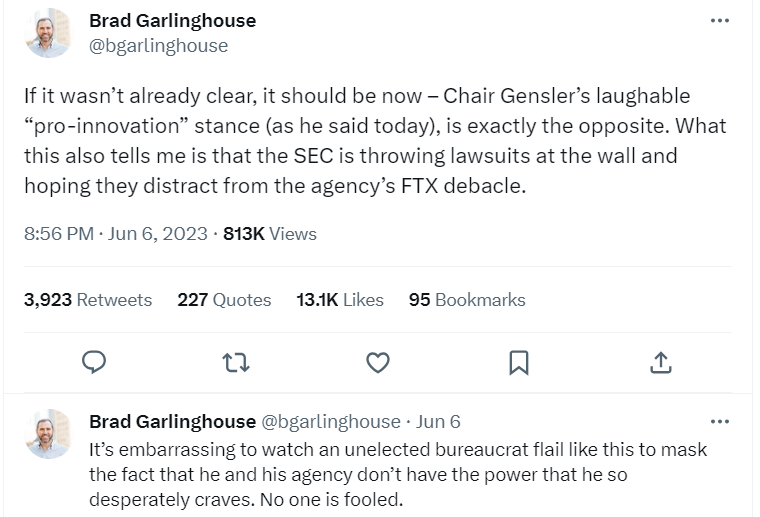

Ripple's CEO Brad Garlinghouse, who has been openly critical of the regulator in the past, decided to express his opinion on the matter and suggested that the regulator's actions are an attempt to make up for their failure to prevent the FTX crash last year. Furthermore, Ripple's CEO accused Gensler and the SEC of exceeding their authority, claiming that they lack the power they desperately want.

According to Garlinghouse, the lawsuit will reach a resolution "within weeks, not months." Although Ripple says it anticipates a decision on summary judgment in 2023, as stated in their recent quarterly report, the final timeline will ultimately be determined by the court.

"The Future of Digital Assets" Hearings

As the cryptocurrency industry eagerly anticipates the June 13 disclosure of the contentious documents, an upcoming hearing holds significant importance. It has the potential to impact not only the outcome of the Ripple-SEC lawsuit but also the future of crypto assets going forward. The House Financial Services Committee announced it will hold "The Future of Digital Assets: Providing Clarity for the Digital Asset Ecosystem" on June 13. This hearing aims to shed light on the regulatory landscape in light of recent lawsuits and tackle issues of innovation, competition, investor protection, and market stability.

The House of Representatives Committee on Agriculture in the US Congress held "The Future of Digital Assets: Providing Clarity for Digital Asset Spot Markets" on June 6. It featured various speakers, including Coinbase CLO Paul Grewal.

"While the upcoming June 13 HFSC hearing is an important one for crypto, the one being held next week by the House Committee on Agriculture is equally so. Congressman Glenn Thompson has been a steadfast supporter of the call for clarity in this space." - Susan Friedman, Senior Director of Global Policy at Ripple.

Updated Timeline

The most recent developments of the lawsuit can be found here.

- May 16: Judge Torres rejected the SEC's motion to keep the Hinman speech sealed.

- May 19, 2023: Reports that the SEC and Ripple filed a joint letter requesting a one-week extension, until June 13, 2023, to submit the Hinman speech.

- June 5: A tweet reveals that the SEC has removed Hinman's biography from its website.

- June 6: The House of Representatives Committee on Agriculture in the US Congress held a hearing on digital assets.

- June 13: The Hinman documents are expected to become available.

The House Financial Services Committee will hold an hearing on the future of digital assets.