The stablecoin market is quickly moving toward mainstream use and, according to some predictions, could grow to be worth trillions of dollars. Right now, a few big players dominate the space, but that is starting to change as new projects are entering the market.

One of the latest to attract attention is Resolv, a stablecoin protocol that uses both ETH and BTC as backing. It runs on a delta-neutral strategy, reducing risk from price movements by balancing long and short positions. In one way, it is similar in design to Ethena’s USDe stablecoin, but Resolv brings its own take to the table.

Here is how it works: Resolv buys ETH or BTC on the spot market and at the same time opens a short position on futures contracts for the same asset. This creates a neutral position that doesn’t gain or lose much if prices go up or down. That position is used as collateral to issue a stablecoin.

Historical data shows this approach can offer steady returns, since shorts usually earn a positive funding yield. For example, simulations show a median annual return of 8.4% on ETH, with most results falling between 7% and 10% per year. On top of that, the protocol earns additional yield from staking assets like ETH. All of this yield is shared with stablecoin holders.

USR and RLP Stablecoins

Resolv uses a two-token system: USR and RLP. USR is a stablecoin backed by ETH, BTC, and other stablecoins. It can be minted or redeemed at a 1:1 ratio with liquid collateral and is designed to hold a stable value of $1. USR doesn’t earn yield by itself, but users can stake it to get stUSR, which does.

One thing that makes USR different is that it is overcollateralized. That means, beyond the full backing provided by users minting USR, there is an extra layer of protection in the form of the second token, RLP. RLP acts like insurance. It adds more than 100% extra collateral to back USR and helps protect it from market swings or other risks. In return, RLP holders earn a larger share of profits from the protocol. RLP doesn’t aim to stay at $1—it can go up or down depending on demand and market conditions.

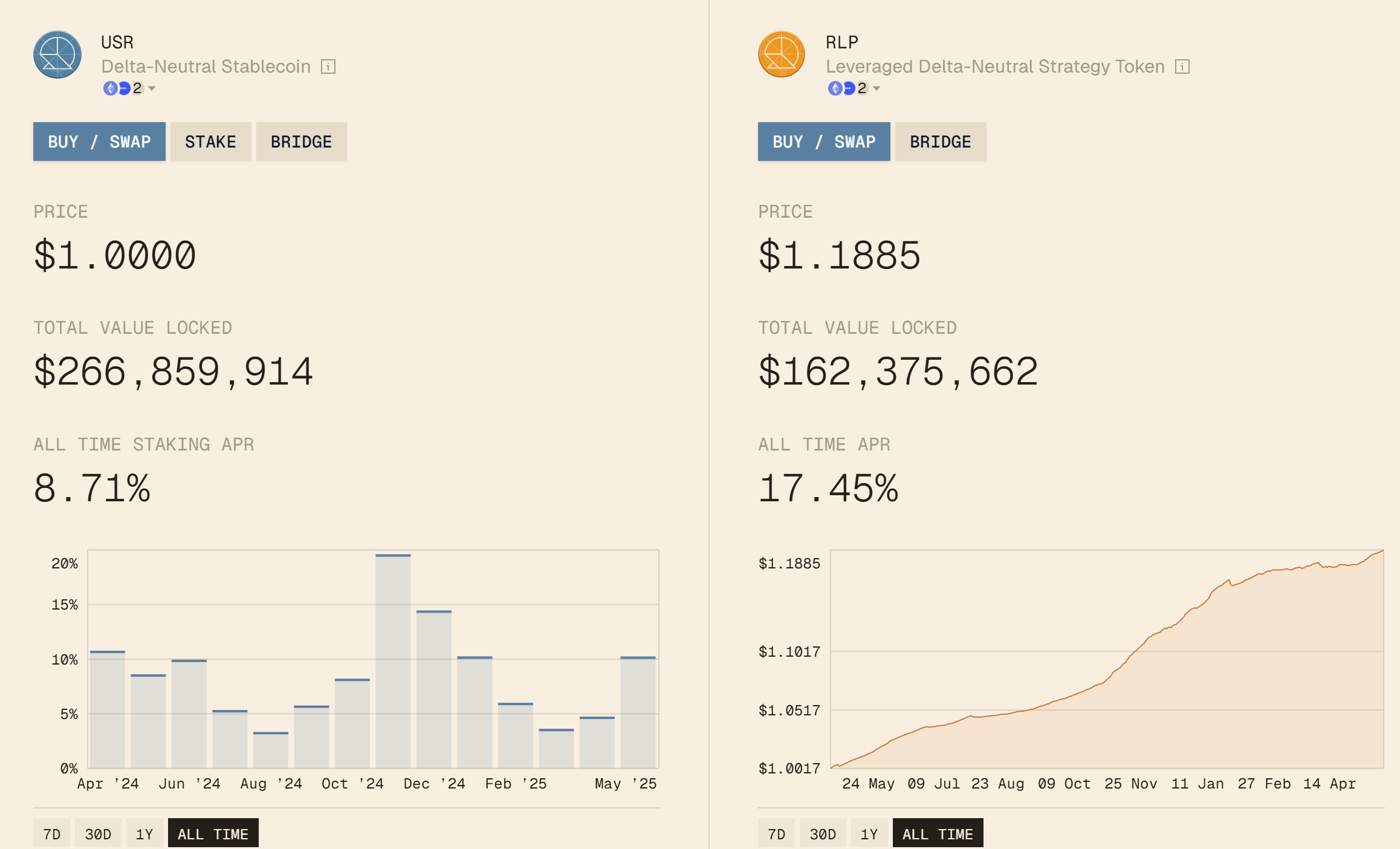

As of now, the protocol holds over $300 million in TVL. Around $273 million of that is in USR and $112 million in RLP.

The returns are also different for the two tokens. USR currently has an all-time average return of 8.71%, while RLP offers about 17.45%. The higher return for RLP is because it carries more risk, such as counterparty risk, extended periods of negative funding rates, and other associated risks.

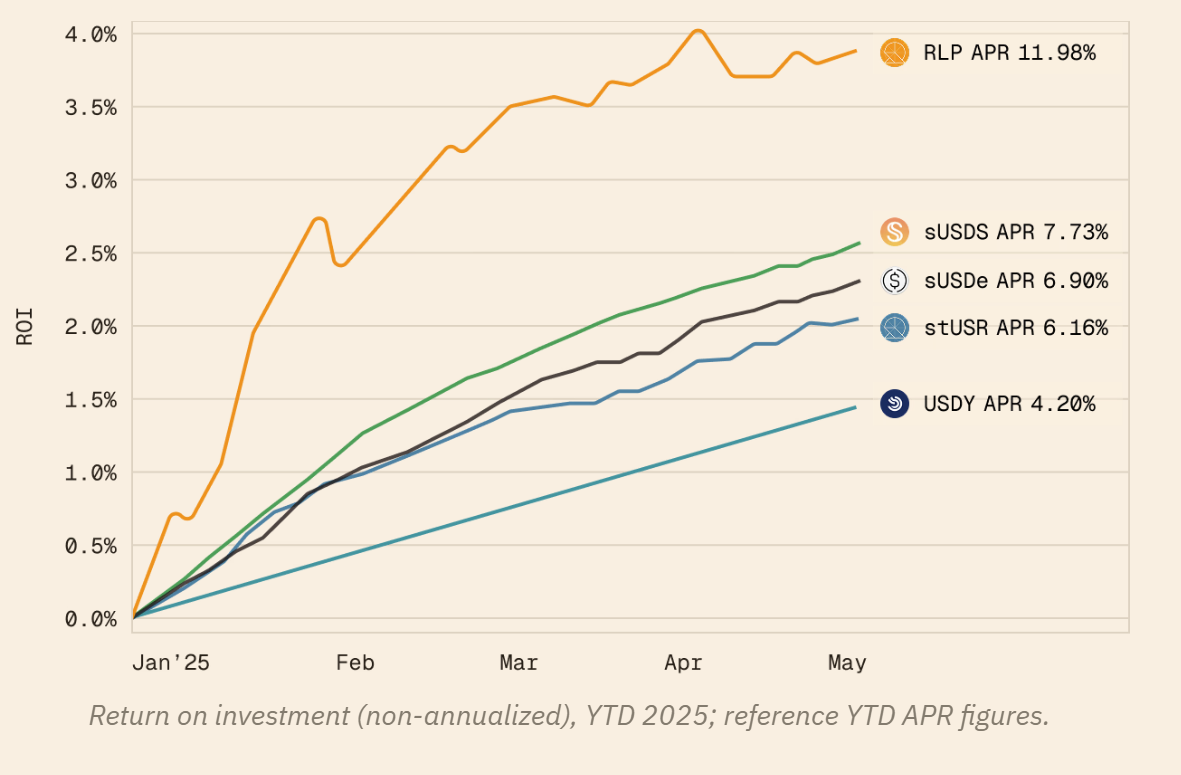

When it comes to yield, RLP has outperformed both USR and other stablecoins like Ethena’s sUSD and USDe since its launch.

Resolv’s collateral is made up of about 43.6% Ether, 36.0% Bitcoin, and 20.4% stablecoins. The protocol operates mostly on Binance’s centralized futures exchange, as well as Hyperliquid, a decentralized platform.

RESOLV Governance Token

While the initial whitepaper of Resolv focused primarily on the mechanics of the USR stablecoin and its delta-neutral hedging strategy, the introduction of the $RESOLV governance token was a subsequent development. The token is designed to facilitate community participation in protocol decisions, including governance votings, rewarding active community members, and funding protocol development services such as bug bounty audits.

Eligible users can sign up for an airdrop and claim their tokens until May 25, 2025.