OKX, the world's third-largest cryptocurrency exchange by trading volume, discontinued support for USDT trading pairs in the European Economic Area, according to a customer support email shared on social media. Deposits and withdrawals in USDT, over-the-counter transactions, as well as a trading pair of the Tether euro-denominated coin reportedly still remain available.

Breaking: @Tether_to $USDT pairs have been removed by @okx in the EU 👀

— MartyParty (@martypartymusic) March 18, 2024

Only $EUR and $USDC @circle pairs now allowed. Huge news. pic.twitter.com/E1HNHRaLkB

To sweeten the pill, the exchange promised to launch over 30 new euro spot trading pairs, and stressed USDC remains available for trading. OKX's official commentaries are not particularly convincing, given the dominance of USDT on centralized exchanges:

“This year our focus is to expand euro pair liquidity and become the preferred venue for euro to crypto spot trading. We evaluated this decision and delisting the current USDT pairs only impacts a small subset of our user base,” - wrote the OKX spokesperson, expanding somewhat on the vague “regulatory requirements” referred to in the customer support email.

Tether, the issuer of the world’s largest stablecoin, hasn’t officially commented on the situation, but CEO, Paolo Ardoino, did suggest that "[OKX] wants to concentrate on the euro to prepare for MiCA [regulation]"

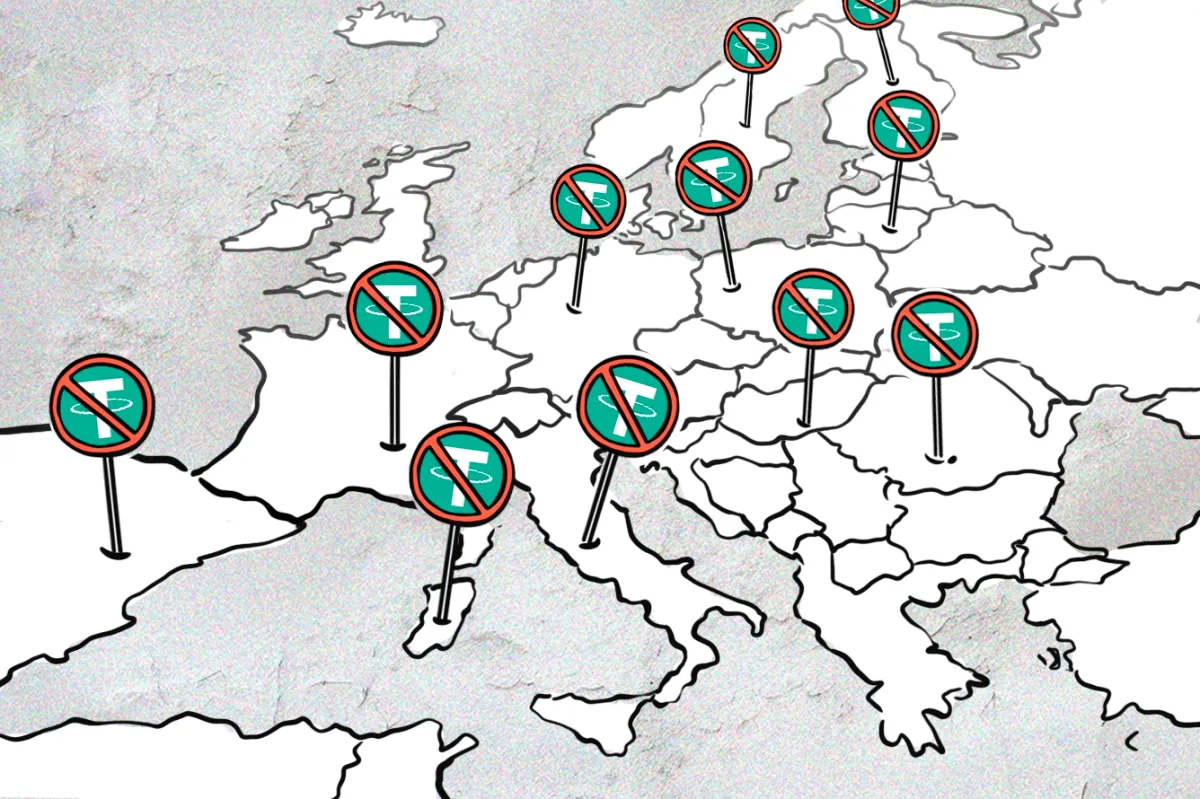

Most observers agree with Ardoino in that the exchange delisted USDT to comply with the Markets in Crypto-Assets (MiCA) regulatory framework, which enters into force on December 30 this year. Stablecoin-related rules, which make up the most significant part of MiCA, are expected to be introduced ahead of the comprehensive framework in the second quarter of 2024.

The framework is already in the implementation stage: last week the European Banking Authority published the final draft of technical standards on complaints handling for issuers of asset-referenced tokens.

According to MiCA, only Electronic Money Institutions (EMI's) and credit institutions licensed in the EU can legally issue fiat-backed stablecoins. Tether hasn’t publicly announced if they are applying for an EMI license, but Paolo Ardoino told Criptovaluta that they are working with EU regulators on such an application. Its main rival, Circle, has already applied for registration in France.

Additionally, MiCA limits the use of EMTs as a “means of exchange” at 1mln transactions or EUR 200mln per day if those are denominated in a currency other than the euro. At its current volumes, Tether would break that threshold in 30 minutes. EU regulation is a significant threat to the existing stablecoin issuers because their leading tokens are denominated in USD.

This USDT delisting by OKX might be the first harbinger of the regulatory restrictions for the stablecoins in the region. Experts discuss two possible scenarios: regulations will be ineffective due to lack of enforcement mechanism or, if the EU is successful at enforcing MiCA, then a significant rise in euro-pegged stablecoins is expected. The estimated share of Central, Northern, and Western Europe in the total crypto trading market is more than 20%, so the latter won't go unnoticed for the USD domination in crypto.

As for OKX, its bet on MiCA compliance squares nicely with its expansion strategy in the EU. OKX secured a license to operate in France in December 2023, following the incorporation of OKX France in April of the same year. We will observe how this will affect OKX's overall positions in crypto exchange charts.