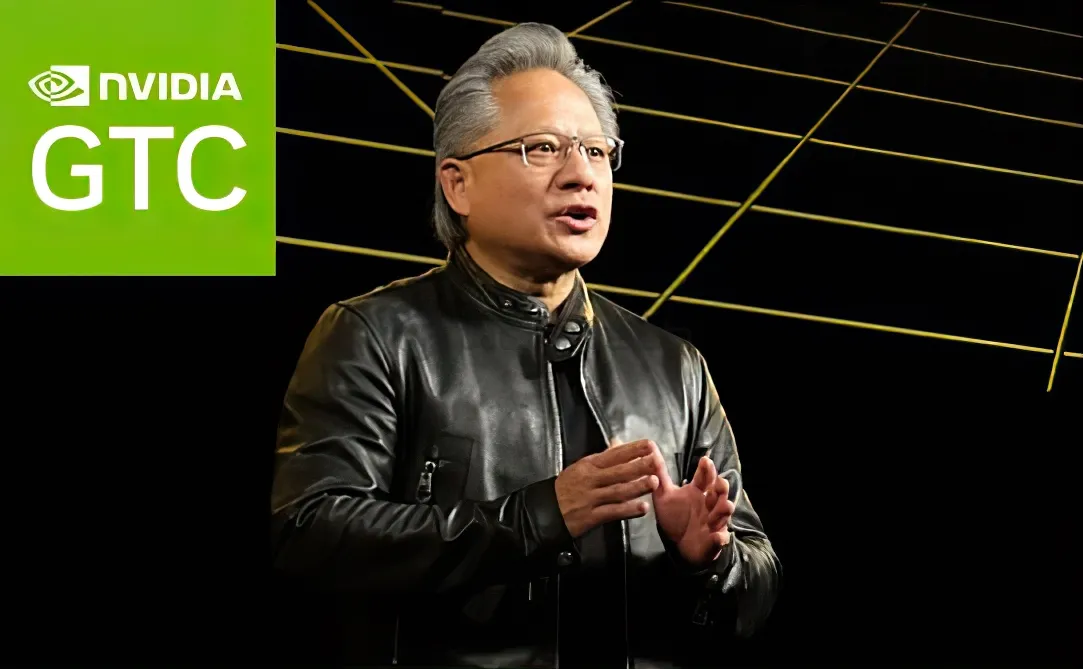

This Monday, Nvidia’s CEO Jensen Huang took centre stage at the McEnery Convention Center in San Jose, California, to present Blackwell, a new super powerful graphics processing unit (GPU), to an audience of around 16,000 people.

Huang's keynote speech was part of Nvidia’s annual GTC conference, arguably the most important artificial intelligence gathering of the year. The chip designer and software company has become one of the most impressive front-runners of the AI race, which kicked off in late 2022 with the launch of OpenAI’s ChatGTP.

As the producer of some of the most powerful graphics processing units (GPUs) available, Nvidia has seen the demand for its product rise exponentially. In May 2023, the company reached a market capitalization of $1 trillion. Less than one year later, it passed the $2 trillion mark, making Nvidia the 3rd largest enterprise in the world after Microsoft and Apple.

Blackwell - named after David Blackwell, the first African-American to be admitted into the National Academy of Sciences for his work in statistics and mathematics, was designed to enable "organizations everywhere to build and run real-time generative AI on trillion-parameter large language models at up to 25x less cost and energy consumption than its predecessor.”

Hopper, the former line of Nvidia’s processors, is a highly capable GPU model which has been crucial for the development of large language models (LLM) all around the world, allowing Nvidia to dominate over 80% of the AI chip market.

This groundbreaking news ought to have prompted a price rise in all products related to the sector, including AI tokens, just as we saw in February when OpenAI unveiled the prompt-to-video tool Sora. In the 24 hours following OpenAI's announcement, the price of all cryptocurrencies supporting AI-based projects rose by an average of 8%, with some, like Worldcoin, posting double-digits. This Monday, however, the opposite happened. Instead of going up, virtually all AI tokens are registering losses, and the sector’s market cap has fallen by more than 10% to $64.23 billion at the time of writing.

Amongst them, the price of ARKM fell 12,8%, that of FET dropped 14.5%, SingularityNET’s token price declined 15.5%, and RNDR is currently trading at $11.16 after having peaked at $13.53 on late Sunday night. Bittensor’s token is one of the few that contradicts the downtrend and is selling at 2% higher than yesterday.

One of the most surprising falls is NEAR. Earlier this month, it was disclosed that its CEO, Illia Polosukhin, would participate in a panel at Nvidia’s conference. Coupled with the news of the upcoming release of a new AI tool, Near Tasks, the token’s price surged 60% during the past weeks. But today, NEAR is trading at $6.84, less 19% than 24 hours ago.

The sector may be cooling down after token prices continued to surge for a long time following Sora’s launch. It's also possible that while OpenAI has a direct bridge towards crypto via its CEO Sam Altman’s parallel proof-of-personhood project Worldcoin, it might be harder for investors to connect the future of Nvidia with crypto projects.

Or, is this simply investors’ letting go after holding their breath during a long and intense period of anticipation? Nvidia’s stock price is also oddly contradictory. Despite rising to $920 when markets opened on Monday morning, the company’s stocks were selling at $884 at the close of the market.