Circle has announced that native USDC and the upgraded Cross-Chain Transfer Protocol (CCTP V2) will be deployed on the Hyperliquid blockchain. This step will allow Hyperliquid users to access fully-reserved USDC directly on-chain, without relying on bridged or wrapped tokens.

Circle has been steadily expanding native USDC and CCTP across multiple ecosystems in 2025. CEO Jeremy Allaire outlined this roadmap earlier in the year, emphasizing that Circle’s goal is to make USDC natively available everywhere developers and institutions build.

Over the course of 2025, Circle added support for a growing list of chains, including Sonic, Plume, XDC Network, World Chain, Sei, and Hyperliquid is now joining that lineup — a significant move given its rapid rise in trading volume and liquidity.

With $2.2 billion in Total Value Locked (TVL), Hyperliquid is processing up to $30 billion in daily derivatives volume, solidifying itself as one of the fastest-growing DeFi-native ecosystems. This meteoric rise reflects its dominance in decentralized perpetuals (perps)—commanding over 80% market share—and powering hundreds of billions in monthly derivatives volume.

The choice to deploy native USDC on Hyperliquid highlights the chain’s emergence as an institutional-grade DeFi hub.

At the same time, the move fits squarely into Circle’s broader strategy to position USDC as the default stablecoin for decentralized finance — trusted, redeemable, and seamlessly transferable across chains.

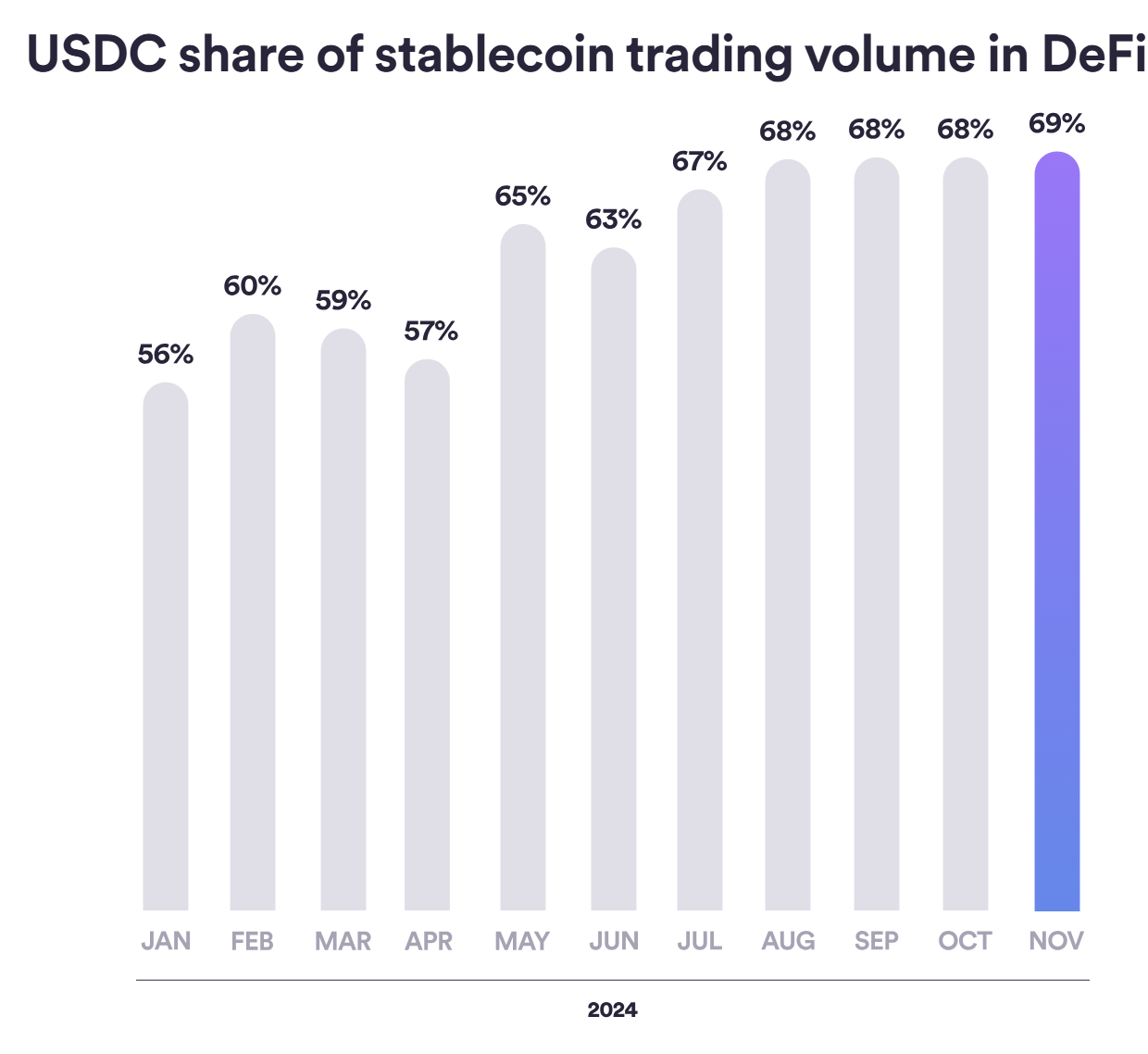

Today, stablecoins account for nearly 70% of all DeFi liquidity pools, with USDC representing over 40% of that share, making it the backbone of lending markets, collateral systems, and DEX trading pairs.

By contrast, Tether's USDT holds a smaller footprint in DeFi (≈15–20% of liquidity) but dominates centralized exchange pairs.