With Bitcoin surging past $120,000, Strategy (formerly Microstrategy), the largest corporate holder of the cryptocurrency, is sitting on almost $30 billion in unrealized gains. This staggering windfall has reignited questions around how such profits are managed on a corporate balance sheet — from dividend strategies and bond issuance to tax implications and long-term sustainability.

Saylor’s Vision: From Proactive Intelligence to Bitcoin Treasury

MicroStrategy was founded in 1989 by Michael Saylor as a business intelligence and software company. One of its early trademarks was “Proactive Intelligence”—Saylor’s vision for delivering real-time insights by integrating data analytics directly into business operations. Remarkably, MicroStrategy became one of the most high-profile casualties of the 2000 dot-com crash, with its stock heavily overvalued amid the “everything will be internet” euphoria of the era.

After the crash, the company continued to operate quietly for decades, focusing on enterprise analytics solutions for large corporations. In the pre-Bitcoin era, MicroStrategy’s annual revenues hovered between $400–600 million, a modest scale compared to tech giants like Microsoft, which posted over $110 billion in revenue by 2018. Despite its early ambitions and initial public offering in 1998, MicroStrategy remained a niche player in the broader software landscape.

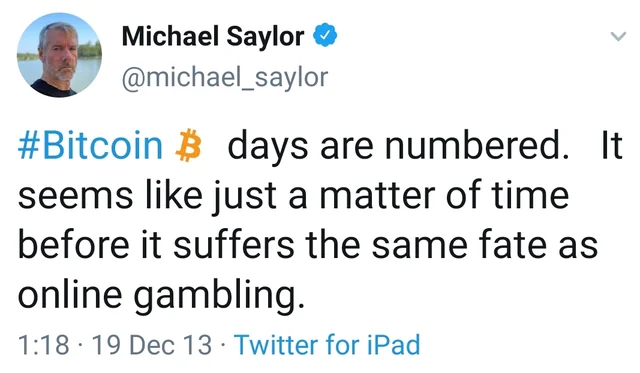

That changed dramatically when Michael Saylor — initially skeptical about Bitcoin — caught the wave of the emerging digital asset industry and transformed MicroStrategy into one of its most prominent players. In 2020, the company made headlines by converting its corporate cash reserves into Bitcoin. What began as a treasury move quickly escalated: MicroStrategy started borrowing to buy more Bitcoin, and later, issuing stock to fund even larger purchases.

At one point, the company attempted to align this new strategy with its software roots by branding itself as a “Bitcoin Development Company,” but the concept was short-lived. Over time, Bitcoin accumulation became its defining mission. In 2024, MicroStrategy formally rebranded itself as a Bitcoin treasury company, signaling that Bitcoin was no longer just an asset on the balance sheet — it was the company’s core purpose. By 2025, it had simplified its name to “Strategy,” underscoring the sheer scale and singular focus of its Bitcoin play, with purchase rounds now measured in billions.

Accumulating Bitcoin: A Corporate DCA Strategy

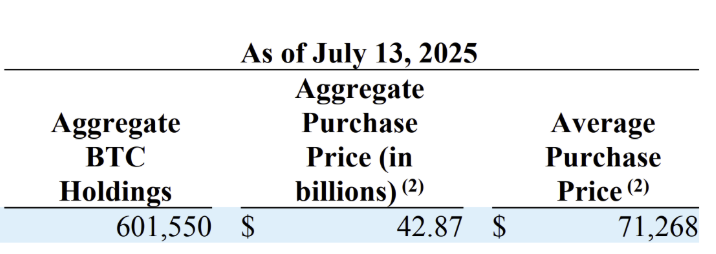

Since 2020, MicroStrategy has steadily acquired Bitcoin using a mix of direct cash purchases, convertible and straight bond issuances, and equity offerings. As of July 2025, the company holds 601,550 BTC at an average purchase price of $71,268 per coin — translating to almost $30 billion in unrealized gains at current market prices.

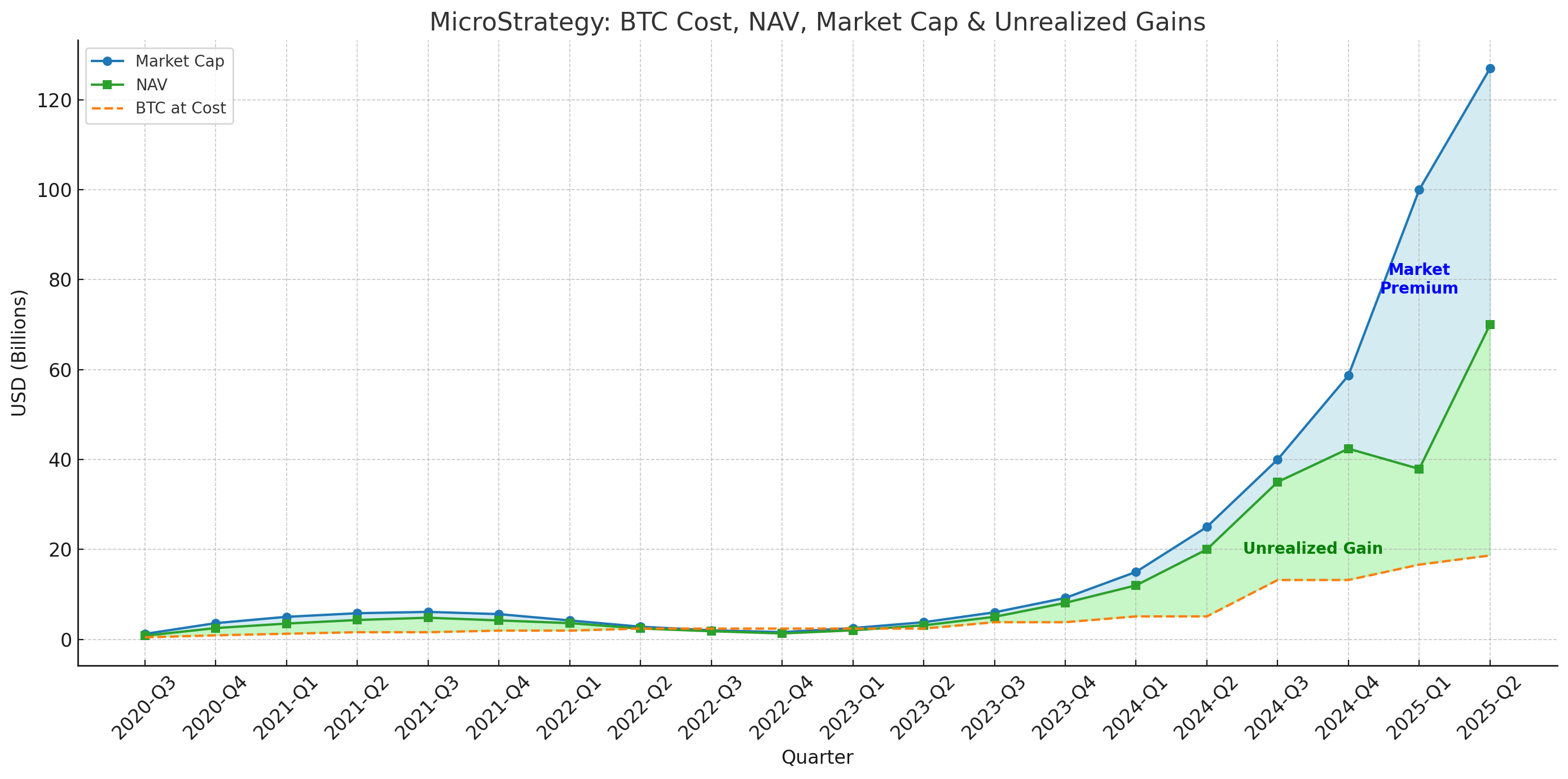

Besides, $30 billion gain on bitcoin price, the company managed to put another $60 billion market premium on top of its holdings by selling shares above Net Asset Value (NAV)

While this looks like an excellent strike into the digital asset market and expectations of further gains, the questions arise about the its compatibility with the corporate business form and long term sustainability.

Strategy's current operations resemble more a Bitcoin fund than corporate structure. Nevertheless the share price fundamentals should take into account the basic company parameters such as company's structure, expected cash flows and management.

Market Premium Or Dummium

For reasons that puzzle many observers, investors often choose to buy Strategy’s stock instead of simply buying Bitcoin — and they’re willing to pay a substantial premium for it. At times, the company’s market capitalization has been double the value of its Bitcoin holdings.

Some analysts attempt to justify this by attributing the premium to Strategy’s unique operational performance. But what they actually point to is not business activity in the traditional sense — rather, they cite the company’s capital structure, which allows its securities to be used in delta-neutral or gamma trading strategies. According to this view, Strategy’s true function is to serve as a leveraged vehicle for Bitcoin exposure, where traders profit from volatility in the underlying asset, so-called gamma trading, and are largely indifferent to the company’s stock price or fundamentals.

Beyond these trading mechanics, other theories for the premium exist: some cite institutional constraints on direct Bitcoin exposure, or investor loyalty to Michael Saylor’s vision. But these explanations rest on assumptions of passive or poorly governed capital, which is unlikely to hold in performance-driven markets.

Could the premium reflect expectations about future utility — perhaps that Strategy’s massive Bitcoin holdings will be monetized in new ways? Possibly. But intensive insider selling from Strategy’s management suggests otherwise.

In the absence of operational revenue or a utility thesis, the remaining explanation is a pure bet on the indefinite rise of Bitcoin’s price. The premium may narrow over time, but so long as Bitcoin appreciates, shareholders may still come out ahead.

Unrealized Gains Realized In Taxes

Beyond the market premium, another looming bubble in Strategy’s financials is its unrealized gain on Bitcoin holdings. Unlike the premium investors assign to Strategy's stock, unrealized gains pose a more tangible risk: they may soon trigger real-world cash outflows due to taxation, even if the Bitcoin remains untouched.

Starting in 2026, the U.S. will begin enforcing the Corporate Alternative Minimum Tax (CAMT), introduced under the Inflation Reduction Act. The rule applies a 15% minimum tax on adjusted financial statement income (AFSI) for corporations averaging over $1 billion in profits. Critically, AFSI includes unrealized capital gains from assets marked to market — which applies directly to Strategy’s Bitcoin holdings under GAAP rules.

If these interpretations hold, Strategy would owe taxes on its Bitcoin gains each year, regardless of whether it sells any BTC — a scenario that turns a paper gain into a real cash burden.

Given that Strategy generates minimal operating revenue and its entire business model revolves around Bitcoin accumulation, it has no ready cash flow to cover such a tax bill. That sets up a direct clash between its financial structure and the realities of the new tax code.

At the CAMT’s 15% rate, Strategy’s tax liability on the current $30 billion in unrealized gains would be approximately $4.5 billion. To cover that bill, the company would likely need to sell roughly 37,000 BTC at the current price, or just over 6% of its total holdings.

While this may seem modest in percentage terms, it would represent a symbolic reversal for a company that has spent years branding itself as a Bitcoin vault — not a seller. A forced sale would not only alter Strategy’s balance sheet but could also rattle investor confidence and exert downward pressure on the market at large.

Bitcoin Dotcom

Strategy stands at the intersection of corporate finance and crypto speculation. Just as MicroStrategy became a poster child of the dotcom bubble in the early 2000s — driven by inflated expectations, speculative momentum, and the bold vision of Michael Saylor — a similar dynamic is unfolding today, this time with Bitcoin at its core.

The ingredients are familiar: high hopes from an innovation-hungry crowd, leveraged bets by traders, and the cult-like charisma of Saylor himself. Whether this ends in another burst or a long-term transformation remains to be seen. But the pattern is undeniable — and worth watching.

Added to our Watch List.