In December 2023, a former LDO holder filed a class-action lawsuit against Lido DAO, claiming the organization is responsible for their investment losses due to the token's price decrease. The plaintiff also alleges that Lido's structure concentrates decision-making power in the hands of a small number of investors. Andrew Samuels states that 64% of LDO tokens are held with the founders and early investors, giving them disproportionate governance within Lido DAO. According to Samuels, regular investors' ability to influence the project's direction is negligible.

On Monday, a proposal on the Lido DAO forum titled 'Activate Lido Protocol Governance with Revenue Share Staking' reignited a debate within the Lido community. Submitted by user Lidosaviour, the proposal aims to introduce a new staking module for the native LDO token, offering holders a share of Lido's protocol revenue in exchange for staking their tokens, similar to Uniswap's recent update and the Frax Finance proposal a few days ago. However, this is not a new development for Lido; another user submitted a similar proposal last year with mixed feedback from the community.

Lidosaviour argues that staking would benefit LDO holders by directly linking token holding to protocol revenue. This could potentially lead to enhanced token value through increased demand and boosted governance participation through increased voting weight for staked tokens. This LDO staking module would allow users to commit their holdings to a smart contract for a predetermined period. In return, a portion of Lido's protocol revenue (with a proposed range of 20-50%) would be redirected towards stakers through a buyback and distribution program, potentially occurring weekly. Additionally, vested rewards could be implemented to incentivize long-term participation.

While acknowledging the potential value of increased token utility through staking, Hasu, strategic advisor at Lido, noted "several flawed assumptions" in the proposal:

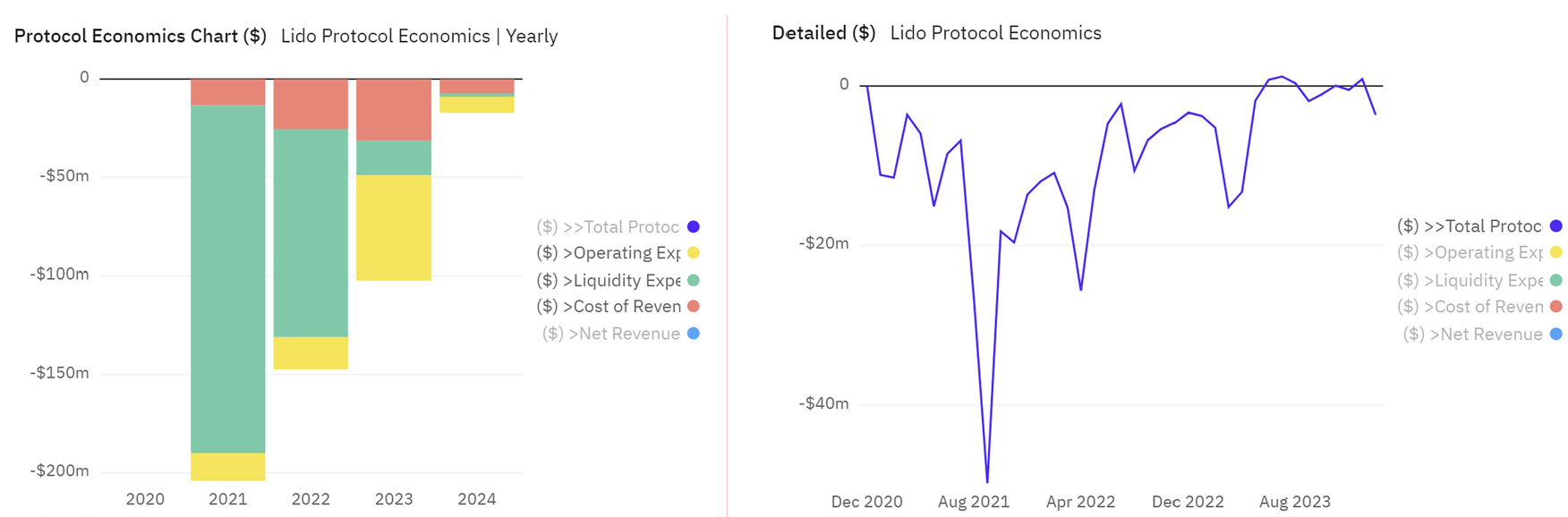

- The proposal's calculations are based on overstated figures. Lido's treasury is $130 million, not ~$500 million, and the LDO token should be discounted as assets entirely, as per a 2021 post by Hasu on DeFi treasuries.

- Lido's annual costs are significantly higher than suggested. Actual costs were $100 million in 2023 and are projected to be $50-60 million in 2024, not $16 million.

- Currently, Lido has no surplus available for distribution.

- Implementing the proposed revenue-sharing model (20-50%) would have severe consequences, including:

- Treasury depletion: Even without the share distribution, Lido's treasury is limited. A 50% drop in ETH price would further reduce both treasury and revenue, leaving Lido with less than two years of runway.

- Addressing the resulting shortfall would be difficult: Increasing revenue is a long-term solution and wouldn't address immediate needs, reducing costs by cutting strategic initiatives would be detrimental to Lido's long-term competitiveness, and issuing more LDO to compensate would be self-defeating and potentially harm token value.

The Steakhouse team, Lido's financial management provider since 2022, has published a detailed response rejecting the current proposal for LDO staking. While acknowledging the potential merit of the idea in the long term, they outline several key reasons why they believe it is not the right time for implementation.

Their primary concern lies in the immaturity of the involved markets. They argue that the specific blockchain subsectors relevant to Lido, including Ethereum staking and liquid staking solutions, are still under development. Additionally, Lido's position within these markets is rapidly evolving. Given this dynamic landscape, the Steakhouse team believes redirecting DAO surplus towards token buybacks is unjustified.

Instead of focusing solely on LDO token holder benefits, the finance team proposes a broader vision for the future: They see Lido transforming into a thriving marketplace that caters to various stakeholders, including node operators, stakers and developers contributing through the Staking Router. This marketplace, they argue, would foster healthy competition and ultimately benefit all participants in the Lido ecosystem.

The proposal suggests using LDO as a last-resort insurance mechanism to safeguard the protocol in case of unforeseen events. However, the Steakhouse team strongly objects to this approach. LDO is unsuitable for this role due to potential inefficiencies and its reflexive nature, and using LDO in this way could put the entire protocol at risk, Steakhouse said. Citing the example of stAAVE, a similar insurance token, the team argues that it has not been adequately tested under stress and is unlikely to function effectively in critical situations. Furthermore, Steakhouse emphasized the importance of using established assets like stETH and ETH for collateral purposes, as they believe these offer greater stability and reliability compared to LDO.

Beyond these arguments, the Steakhouse team also addressed factual inaccuracies in the original proposal, such as the outdated budget figures pointed out by Hasu. The team shared their commitment to active communication and transparency, highlighting a community call on March 13 to discuss the latest approved budget plan. They concluded: "We appreciate your continued participation in governance but respectfully disagree with the premise and will vote to reject the motion." We will keep an eye on any updates regarding the debate surrounding Lido's governance and the ongoing lawsuit.