On June 1 the Hong Kong Securities and Futures Commission (SFC) implemented a new crypto-friendly licensing and regulatory regime, in a bid to establish the city-state as a global hub for the digital assets industry. One of the new rules aimed at protecting retail investors is that a token must be included on at least two indices for it to be retail-tradable.

N.B. While this may not seem all that ‘crypto-friendly’ it is a vast improvement on previous proposals, which would have limited crypto trading to professional investors only.

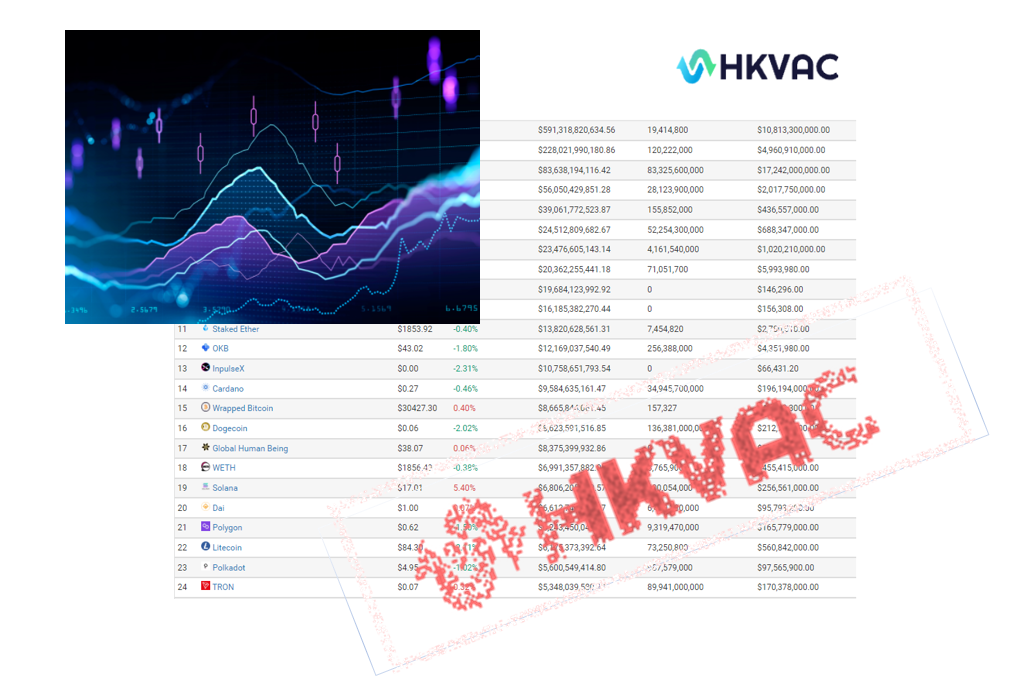

So if the people want to trade crypto tokens… and the SFC demands crypto token indices… why not just make up some indices? Which is exactly what rating agency, the Hong Kong Virtual Asset Consortium (HKVAC), has done, by launching its ‘Cryptocurrency Large Market Cap Index’.

HKVAC claims that this index gives an accurate representation of the value of the 30 biggest digital assets by market cap, although there are some eligibility rules for inclusion. Firstly, the exclusions, which include bitcoin and ether, along with stablecoins, otherwise pegged coins and privacy coins.

Tokens must also meet market cap and liquidity requirements to be included on the index, with a median market cap of no less than $10 million and a median daily traded volume of at least $100,000 over the previous three-month period.

Eligible tokens are then ranked based on their median market cap over a seven-day period and the top 30 are included in the index, with a weighting factor in proportion to their market cap, giving a dollar value for the index.

HKVAC is supported by Hong Kong legislator Johnny Ng, and major exchanges such as Huobi and KuCoin, so this index should gain the official seal of approval. The rating agency also has a second ‘Cryptocurrency Risk Rating Based Index’ coming soon, which will list what it describes as ‘lower-risk’ cryptocurrencies.

There have allegedly been some complaints from the Hong Kong crypto community that the reference value is not high, as the token list includes platform tokens, some privacy tokens (reportedly including Monero, despite the eligibility rules), and a number of tokens deemed securities by the U.S. SEC.

However, this rather seems to be missing the point. Creating this index means that tokens such as BNB, MATIC, ADA, LTC, DOGE, ATOM, XRP, VET and TRX (i.e. key tokens that retail investors may wish to trade) are at least halfway to fulfilling the criteria set by the SFC to make them retail-tradable.

Industry figures came out in support of the move, including Binance’s Changpeng Zhao (CZ) and Tron’s Justin Sun, both of whose tokens are ‘coincidentally’ included in the new index.

HK moving forward. pic.twitter.com/BY4Bg6qHOu

— CZ 🔶 Binance (@cz_binance) June 27, 2023

It will be interesting to Observe which tokens are included in the upcoming ‘Risk Rating Based Index’, although arguably many of the same high market cap tokens may be considered lower-risk. Including a token on both may essentially rubber-stamp it for approval as retail-tradable.

Touché authorities.