Polygon and GSR are building a new blockchain called Katana. It is tailored for DeFi and built on a modified version of the OP Stack, with a connection to Polygon’s zero-knowledge Agglayer. The idea is simple: create a chain that is better at holding liquidity and generating real yield.

The project's motto: "a DeFi chain forged to bring dead bags to life..."

To make that possible, the team has introduced a number of economic design choices that aim to bring capital and users into the ecosystem.

The team behind Katana believes that one of the biggest issues facing many Layer 2 networks and blockchains today is the lack of meaningful liquidity. A lot of crypto assets just end up sitting idle after they are moved on-chain. There is so much going on — too many protocols, too many tokens — and everything is kind of fighting for attention. That spreads liquidity thin and makes the markets feel inefficient. This leads to short-term rewards that attract temporary capital, which tends to exit quickly, leaving assets unused and yields unsustainable.

One Activity – One Application

Katana is trying to avoid fragmentation by concentrating liquidity into a small group of core applications and assets. Unlike many other networks that support multiple versions of the same DeFi protocols, Katana will feature a single option for each key DeFi function. This structure avoids fragmentation and helps concentrate both users and capital.

For example, instead of having several trading platforms or lending protocols, there will be just one of each, used by the entire network. This approach is designed to make markets more efficient and deepen liquidity around each core application.

Several partners have already been announced as part of the network’s initial lineup. Morpho will be the lending and borrowing protocol, Sushi will serve as the main platform for spot trading, and Vertex will handle perpetual futures trading.

Alongside these applications, Katana will also support a set of native assets. Agora will manage the AUSD stablecoin, Bitvault will issue BTC-backed stablecoins that generate yield, and Ether.fi will provide access to restaked ETH assets. Each of these core apps and assets will operate without direct competitors on the chain, which should help centralize activity and create stronger liquidity.

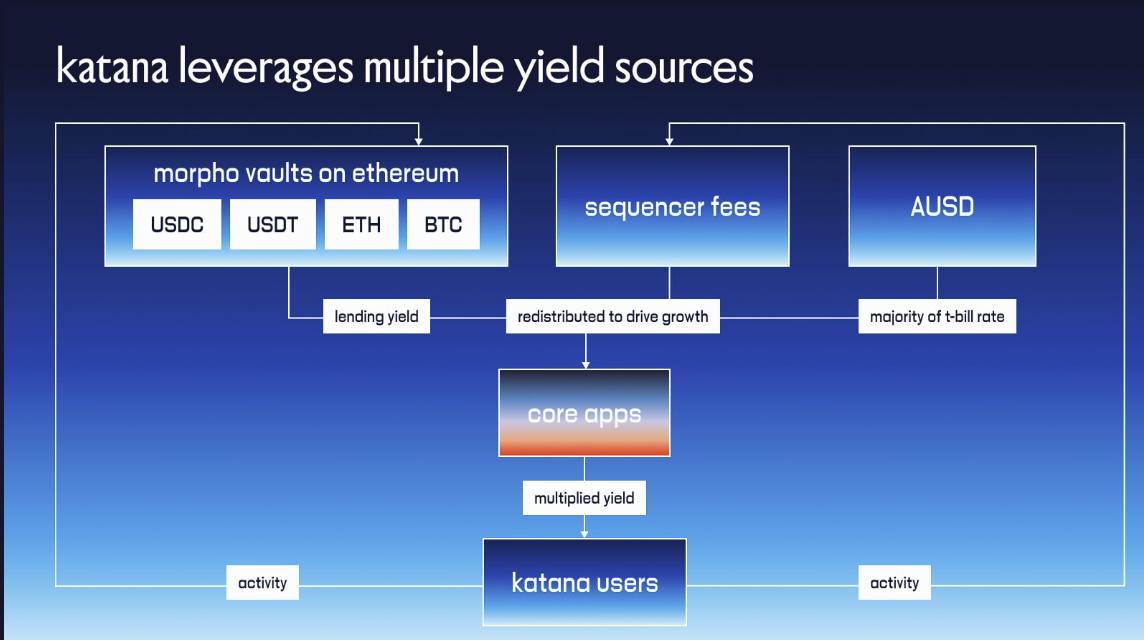

In addition to concentrating liquidity, Katana is promising multiple yield options. Assets bridged into the chain will continue earning yield on Ethereum through VaultBridge, and that yield will be directed back into the Katana ecosystem. Extra returns will come from Morpho vaults on Ethereum, and even the AUSD stablecoin is built to generate yield.

On Katana, all the yield flows back into the main apps and gets shared with users. It creates a kind of feedback loop — as more people join the network, yields go up, liquidity gets deeper, and the whole system gets stronger.

Katana is also planning to retain its earnings. All net sequencer fees, along with a portion of the revenue from core applications, are redirected toward building what the team calls chain-owned liquidity. This pool of liquidity is managed by the Katana Foundation and will be used to stabilize chain activity during periods of volatility. When markets become chaotic, chain-owned liquidity is meant to help smooth things out and reduce sharp swings in rates.

KAT Token

The project will introduce its own native token called KAT, and here also they don't want to follow the typical playbook. KAT will not be used for governance or as a gas token.

Ethereum will remain the gas token for the network. Protocol-level decisions are not given to the KAT holders either. Instead, KAT holders will be responsible for helping direct how incentives flow across the chain.

In this way, KAT functions more like a coordination tool than a traditional utility or governance token.

Over time, holders may take on additional responsibilities, including helping to secure the network in a decentralized manner and earning fees for doing so. However, that functionality is not yet live.

An important detail of the project's tokenomics is that the project does not have any venture capital investors. There are no special token unlocks that benefit insiders ahead of regular users. The majority of the token supply will go directly to users and the ecosystem.

"Pre-deposits" are already open, and early participants will receive rewards through a lootbox-style system ahead of the network’s official launch. The public mainnet is expected to go live in late June 2025, and all deposited assets will become available at that time.

The Katana project introduces several novel ideas and clearly reflects thoughtful marketing and positioning by its team. Unlike many recent launches, the innovation here isn’t in flashy tokenomics but in how the chain is structured to concentrate liquidity and align incentives. Its conservative stance on retained earnings and limited governance powers suggests a pragmatic, protocol-first approach—though it does raise questions about how much decentralization is being sacrificed. Whether Katana becomes an outlier or sets a new precedent in DeFi remains to be Observed.